bss64.ru

Tools

Irs Loophole Guide

The Augusta rule IRS exemption, the Augusta exemption and the Masters exception are all nicknames for Section A(g) of the Internal Revenue Code. All deductions work by cutting your taxable income; lower taxable income generally means a reduced tax bill. Deductions are intentional loopholes written. Sean M. Smith, an experienced tax accountant, knows better. In this easy-to-use handbook, he presents everything taxpayers need to know to get the tax. As you consider its potential usefulness, keep in mind that the Internal Revenue Service (IRS) may issue more guidance and that the future of the SALT deduction. There are no “loopholes“. The IRS is not necessarily someone who you want to get on the wrong side of. If you get audited once with a bad. IRS agreed. ⇒ The IRS distributed a Participant Guide among its agents containing guidelines for auditing cannabis enterprises. ⇒ The IRS refused to make. If your short-term rental meets all the qualifications that we'll explain in this article, the STR loophole lets you deduct all your rental losses from your. Summary of S - th Congress (): Ending the Carried Interest Loophole Act. 4, Penalty Handbook, Failure to Deposit Penalty. Material Changes. (1) IRM , Program Scope and Objectives: added Office of Servicewide Penalties contact. The Augusta rule IRS exemption, the Augusta exemption and the Masters exception are all nicknames for Section A(g) of the Internal Revenue Code. All deductions work by cutting your taxable income; lower taxable income generally means a reduced tax bill. Deductions are intentional loopholes written. Sean M. Smith, an experienced tax accountant, knows better. In this easy-to-use handbook, he presents everything taxpayers need to know to get the tax. As you consider its potential usefulness, keep in mind that the Internal Revenue Service (IRS) may issue more guidance and that the future of the SALT deduction. There are no “loopholes“. The IRS is not necessarily someone who you want to get on the wrong side of. If you get audited once with a bad. IRS agreed. ⇒ The IRS distributed a Participant Guide among its agents containing guidelines for auditing cannabis enterprises. ⇒ The IRS refused to make. If your short-term rental meets all the qualifications that we'll explain in this article, the STR loophole lets you deduct all your rental losses from your. Summary of S - th Congress (): Ending the Carried Interest Loophole Act. 4, Penalty Handbook, Failure to Deposit Penalty. Material Changes. (1) IRM , Program Scope and Objectives: added Office of Servicewide Penalties contact.

References in these instructions are to the Internal Revenue Code (IRC) Loophole Closure and Small Business and Working Families Tax Relief Act of. guide you through an array of IRS tax problems and help you understand This Trump tax plan loophole will reduce taxes on many higher-income tax payers. However, this limit can be higher for specific high-cost locations. You can find these specific limits in the instructions for IRS Form Calculate the. A cattle tax deduction is designed to help you save money when you file taxes, and was created by the Internal Revenue Service (IRS) to ensure farmers have. The concept behind the Roth IRA is simple. Investors who meet income guidelines can deposit money into this account on an after-tax basis and receive tax-free. Among the items that IRS agents are likely to scrutinize carefully are vacation trips disguised as business trips, purchases of household furnishings or. Today, gold IRAs are regulated by the Internal Revenue Service (IRS) under IRS Code To open a gold IRA, investors must choose an approved custodian, select. Tax Saver's Glossary · Helpful IRS Publications. Article Date: August Word Count: The Gambler's Tax Guide—How to Protect Your Winnings from the IRS. Although this strategy has existed since , the IRS has not officially commented or provided formal guidance on whether it violates the step-transaction rule. Remember that if you're trying to claim your working pets to deduct business expenses, you'll likely have to convince the IRS that keeping the animal is “. Kitces points out that, from the IRS's perspective, a "widespread illegal tax loophole" translates to a "giant target for raising revenue. Exchange-Traded. tax savings. A Complete Guide to LLC Taxes and Deductions. Below is our expert summary of the tax deductions and loopholes that business owners must know about. Some view this tax preference as an unfair, market-distorting loophole. Others argue that it is consistent with the tax treatment of other entrepreneurial. Discover why tax refunds shouldn't be celebrated, why you should pay your income tax bill, and why certain deductions are wrongly labeled “loopholes,” among. Discover why tax refunds shouldn't be celebrated, why you should pay your income tax bill, and why certain deductions are wrongly labeled “loopholes,” among. Loophole” or the “Hummer Deduction” because many businesses Past Section Limits. We've compiled a handy guide to Section for previous tax years. Contact your plan administrator for instructions. The IRA/Retirement Plan Day Rollover Waivers. IRSvideos. Search. Info. Shopping. Tap to unmute. There are a few catches and loopholes to the Foreign Earned Income Following are excerpts from IRS Publication 54, Tax Guide for U.S. Citizens. Business Tax Deductions: An Overview. The Internal Revenue Service (IRS) Understanding Small Business Taxes: A Comprehensive Guide. Recordkeeping. Cryptocurrency taxes: A guide to tax rules for Bitcoin, Ethereum and more. The IRS is stepping up enforcement on potential tax evasion by looking more.

Lower Taxes In Retirement

If you receive pension income, you can reduce your total tax bill by allocating up to 50 percent of that income to your spouse. The amount of tax savings can. The Lowering MI Costs Plan (Public Act 4 of ) was signed into law on March 7, , and will amend Michigan's current Income Tax Act to provide a. If you're in a lower tax bracket (0%, 10%, or 12%), consider maxing out your Roth accounts. · If you're in a middle tax bracket (22% or 24%), consider splitting. So if you expect your tax rate in retirement to be higher than it is now, you're better off paying taxes on IRA contributions now and avoiding taxes when you. If you're in a lower tax bracket (0%, 10%, or 12%), consider maxing out your Roth accounts. · If you're in a middle tax bracket (22% or 24%), consider splitting. The Lowering MI Costs Plan (Public Act 4 of ), signed into Michigan law on March 7, , amended (in part) MCL to provide taxpayers with more. Contribute as much as you can to your retirement plan. Your employer may offer a (k), (b) or other retirement savings plan. What are some tax-saving moves to make before I am required to take distributions? · Converting taxable assets to a Roth IRA. · Selling investments that have. This guide will explain the rules for how common sources of retirement income are taxed and provide some tips for retirement planning that can reduce your tax. If you receive pension income, you can reduce your total tax bill by allocating up to 50 percent of that income to your spouse. The amount of tax savings can. The Lowering MI Costs Plan (Public Act 4 of ) was signed into law on March 7, , and will amend Michigan's current Income Tax Act to provide a. If you're in a lower tax bracket (0%, 10%, or 12%), consider maxing out your Roth accounts. · If you're in a middle tax bracket (22% or 24%), consider splitting. So if you expect your tax rate in retirement to be higher than it is now, you're better off paying taxes on IRA contributions now and avoiding taxes when you. If you're in a lower tax bracket (0%, 10%, or 12%), consider maxing out your Roth accounts. · If you're in a middle tax bracket (22% or 24%), consider splitting. The Lowering MI Costs Plan (Public Act 4 of ), signed into Michigan law on March 7, , amended (in part) MCL to provide taxpayers with more. Contribute as much as you can to your retirement plan. Your employer may offer a (k), (b) or other retirement savings plan. What are some tax-saving moves to make before I am required to take distributions? · Converting taxable assets to a Roth IRA. · Selling investments that have. This guide will explain the rules for how common sources of retirement income are taxed and provide some tips for retirement planning that can reduce your tax.

You'll be taxed when you withdraw your savings at then-current income tax rate. This can reduce your tax expense in the year you contribute. 9%. Once you're retired and are no longer receiving a paycheck or generating income as a self-employed individual, you'll no longer pay FICA or. Tip: Holding some of your retirement savings in Roth accounts can help you limit how much income tax you'll owe in a given year. By taking some withdrawals from tax-deferred accounts earlier in retirement, you can reduce the "tax bump" that often occurs midway through retirement when. One of the best strategies for saving taxes on retirement income is to live in or move to a tax-friendly state. One of the best strategies for saving taxes on retirement income is to live in or move to a tax-friendly state. Your clients can help keep their tax bracket down by integrating distributions from cash value life insurance into the mix. IRA distributions · Traditional IRAs – contributions are considered pre-tax, and all distributions are subject to tax at your ordinary income tax rate. · Roth. Tax Deductions, Exemptions, and Credits · Exemption for Social Security Benefits · Exemption for Civil Service Retirement System (CSRS) · Exemption for Other. If you contributed after-tax dollars to your pension or annuity, your pension payments are partially taxable. You won't pay tax on the part of the payment that. 1. Save for retirement. Yes, saving for the future can help you trim today's tax bill. Every dollar you contribute to an eligible retirement account reduces. You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, (k)s, (b)s and similar. One strategy for retirees to help reduce taxes is to take capital gains when they are in the lower tax brackets. For the tax year, single filers with. Here's an overview of tactics to consider. Categorize assets by taxable, tax-deferred, and non-taxable investment accounts and strategically tap them. Here are 5 tax-saving strategies to ask your advisor or tax professional about if you're retired or getting close. Income tax in general go down in retirement because people have “less earned income” due to capital gains on the stocks you bought are taxed. Explore these tax-saving methods: Roth Conversion: Shift to tax-free withdrawals with a Roth IRA or (k) by careful planning. Now, after three historic tax cuts under her leadership, Iowa has reduced income taxes, eliminated tax on retirement income, and created an economic climate. 1. Live in a tax-friendly state 2. Maximize Roth IRAs 3. Implement a withdrawal strategy 4. Keep in mind qualified charitable distributions (QCD) 5. Consider. Income tax in general go down in retirement because people have “less earned income” due to capital gains on the stocks you bought are taxed.

Outdoor Televisions Reviews

Outdoor TV Reviews · Sylvox OQ55A2KHGD 55" Advanced QLED Outdoor TV Deck Pro QLED Review · Creating An Outdoor Home Theater - Tips For A Successful Outdoor. However, if you have a dark room, you might find the brightness of QLED TVs too intense, which means than OLED TV might be a better choice. Also. The outdoor sunbrite & samsung terrace tv's are just too expensive so I'm thinking it would just be cheaper to get a tv that i could replace. No glare from the sun with the amazing screen. Easy to clean with it being weatherproof. It's hands down the best tv I've ever seen in an outdoor setting. Also. KUVASION provides all kinds of true outdoor TVs with high brigntness LG LED panels in nits, nits, nits, nits. 8K Outdoor TV is % made for residential use - Perfect for backyards & patios. This Smart TV comes with all your favorite APPS, connects to WiFi and. In summary, the SYLVOX inch Outdoor TV has impressed me on multiple fronts. Its exceptional brightness, flawless performance, and robust durability make it a. Energy Star Rated · Peerless-AV - NT - Outdoor TV · Peerless-AV - NT - Outdoor TV · Samsung - QN75LST7TAFXZA - Outdoor TV · Peerless-AV -. With an operating temperature of -4°F to °F, and an IP55 rated weatherproof casing, your Element 55 inch Outdoor TV is built to handle rainstorms, snow. Outdoor TV Reviews · Sylvox OQ55A2KHGD 55" Advanced QLED Outdoor TV Deck Pro QLED Review · Creating An Outdoor Home Theater - Tips For A Successful Outdoor. However, if you have a dark room, you might find the brightness of QLED TVs too intense, which means than OLED TV might be a better choice. Also. The outdoor sunbrite & samsung terrace tv's are just too expensive so I'm thinking it would just be cheaper to get a tv that i could replace. No glare from the sun with the amazing screen. Easy to clean with it being weatherproof. It's hands down the best tv I've ever seen in an outdoor setting. Also. KUVASION provides all kinds of true outdoor TVs with high brigntness LG LED panels in nits, nits, nits, nits. 8K Outdoor TV is % made for residential use - Perfect for backyards & patios. This Smart TV comes with all your favorite APPS, connects to WiFi and. In summary, the SYLVOX inch Outdoor TV has impressed me on multiple fronts. Its exceptional brightness, flawless performance, and robust durability make it a. Energy Star Rated · Peerless-AV - NT - Outdoor TV · Peerless-AV - NT - Outdoor TV · Samsung - QN75LST7TAFXZA - Outdoor TV · Peerless-AV -. With an operating temperature of -4°F to °F, and an IP55 rated weatherproof casing, your Element 55 inch Outdoor TV is built to handle rainstorms, snow.

No reviews. $3, Learn MoreSelect Options · Buy Now. 43" 55" 75". Titan Full Sun Outdoor Commercial Smart TV 4K UHD (TC-TT). No reviews. $3, Outdoor TVs in TV & Home Theater(79) · Element Electronics 55" 4K UHD Partial Sun Outdoor Roku Smart TV (New) · OrcaTV 43" 4K UHD LED Partial Sun Outdoor TV +. "We are very satisfied with our 47" MirageVision outdoor television. The picture quality is awesome and it's big enough to enjoy from our outdoor bar, hot tub. Unlike indoor TVs, outdoor televisions are built with weatherproof materials and components that can endure exposure to elements without compromising. In this blog, we'll cover everything you need to know about an outdoor television and share with you the top brands out there! Furrion's ruggedly designed outdoor televisions are the newest addition to the bss64.ru ecosystem. Review: SunBrite TV Veranda Series Gen 3 Outdoor 4K LED TV. The Sylvox Deck Pro QLED is an affordable outdoor TV built for all kinds of weather. It offers great picture quality alongside a sleek yet rugged design. Outdoor TVs in TV & Home Theater(79) · Element Electronics 55" 4K UHD Partial Sun Outdoor Roku Smart TV (New) · OrcaTV 43" 4K UHD LED Partial Sun Outdoor TV +. Outdoor TVs ; Furrion Aurora® FDUP65CSA. 65" partial-sun outdoor Smart 4K LED UHD TV with HDR · Furrion Aurora FDUP65CSA ; Furrion Aurora® FDUF50CSA. 50" full-. Furrion Aurora TVs are designed for use in outside living areas like patios, decks, and yards. Rain and drastic changes in temperatures could easily break a. Experience outdoor entertainment like never before with the SYLVOX Waterproof Outdoor TV. Designed for durability and performance, this weatherproof TV is. The picture quality is excellent, and I am looking forward to watching T.V. from the pool this summer. I took a tour of the facility, and was very impressed! Highly recommend this TV to others due to its beautiful picture, durability, dependability and the exceptional customer service provided by the company. When you want to impress, you won't find an outdoor tv bigger than the T! Experience stunning 4K Ultra HD clarity with four times the detail of p. Samsung The Terrace 65 Inch Partial Sun QLED 4K UHD Smart TV - QN65LST7TAFXZA · Peerless-AV Neptune 65″ Partial Sun 4K UHD LCD Outdoor Smart TV - WPTV · Titan. Inches · Approximately 44–59 inches wide and 26–34 inches tall · Best for moderately sized outdoor spaces · Sized for a few viewing angles at a medium. Shop TVs by Size ; Furrion 49" Partial Sun 4K LED Outdoor TV,, large · Furrion 49" Partial Sun 4K LED Outdoor TV · ; Samsung 55" Class. SAMSUNG inch Class QLED 4K The Terrace Partial Sun Outdoor, Direct Full Array 16x, Quantum HDR 32x, Weatherproof, Wide Viewing Angle Smart TV w/ Alexa Built-. I was impressed with the quality and the ability to choose which streaming device I wanted to use. My wife and I purchased a different outdoor TV brand before.

Balance Sheet And Profit And Loss Statement

The profit and loss (P&L) account summarises a business' trading transactions - income, sales and expenditure - and the resulting profit or loss for a given. How do P&L statements and balance sheets work in business valuation? A business's P&L statement and balance sheet provide information about its profit and loss. Balance sheet vs. the P&L: The difference between the income statement and the balance sheet. With examples and infographic. A Balance Sheet brings together the results from the Profit & Loss Statement and the Cash Flow Statement. 7, (Download from the Business Victoria website at. It is calculated by considering all revenue, costs, and expenses occurring in that period. The P&L statement is a financial statement that summarizes those. A profit and loss statement is a type of financial statement that contains summarized information about your business's revenue and expenses. The statement is. A balance sheet gives a point in time view of a company's assets and liabilities, while the P&L statement details income and expenses over an extended period. An income statement is used to evaluate the company's performance to see if it's profitable. Determining Creditworthiness: Lenders and creditors can use a. The income statement illustrates the profitability of a company under accrual accounting rules. The balance sheet shows a company's assets, liabilities, and. The profit and loss (P&L) account summarises a business' trading transactions - income, sales and expenditure - and the resulting profit or loss for a given. How do P&L statements and balance sheets work in business valuation? A business's P&L statement and balance sheet provide information about its profit and loss. Balance sheet vs. the P&L: The difference between the income statement and the balance sheet. With examples and infographic. A Balance Sheet brings together the results from the Profit & Loss Statement and the Cash Flow Statement. 7, (Download from the Business Victoria website at. It is calculated by considering all revenue, costs, and expenses occurring in that period. The P&L statement is a financial statement that summarizes those. A profit and loss statement is a type of financial statement that contains summarized information about your business's revenue and expenses. The statement is. A balance sheet gives a point in time view of a company's assets and liabilities, while the P&L statement details income and expenses over an extended period. An income statement is used to evaluate the company's performance to see if it's profitable. Determining Creditworthiness: Lenders and creditors can use a. The income statement illustrates the profitability of a company under accrual accounting rules. The balance sheet shows a company's assets, liabilities, and.

It is the top line of the company and represents the total income generated during a specific period. It is divided further into operating revenue or revenue. The balance sheet and the profit and loss statement (P&L) are important financial documents used to assess a business's financial health. A P&L statement, also known as an income statement, tracks profits that remain after deducting costs from revenue within a specific accounting period, which can. If P&L Net Income is Less than Balance Sheet -- Chances are that a Revenue account is missing from the P&L, or that an Expense account is duplicated in the P&L. The balance sheet shows a company's assets, liabilities, and shareholders' equity at a particular point in time. The cash flow statement shows cash movements. Accounting – How does the Balance Sheet relate to Profit and Loss? · When a cash sale is made (recorded in Profit and Loss), the cash in hand will increase . A trial balance is nothing but a bookkeeping worksheet. It helps to balance all your business bookkeeping records, which are gathered as credit and debit. If you use accounting software like QuickBooks, Peachtree or the like, the program will generate a P&L statement for you after you enter your sales and expense. A profit and loss statement shows whether a business is profitable or not. According to Investopedia, “a profit and loss statement is a financial statement. A balance sheet provides a snapshot of a firm's financial position at a specific point in time, while an income statement – also known as a profit and loss. Also referred to as an income statement template or statement of operations template, a profit and loss template calculates business profits or losses by. Balance sheets are broadly prepared compared to profit and loss statements. A balance sheet shows what a company owes, its long-term investments and its assets. This sample balance sheet from Accounting Coach shows the line items reported, the layout of the document and how it differs from an income statement. The P&L statement is one of three major statements typically included in the financial reporting process. The other two are the balance sheet and cash flow. What is Profit and Loss Account? ; Balance Sheet is a statement, P & L Account is an account ; State of accounts ; Accounts added in balance sheet maintain their. A balance sheet is a financial document that can be seen as an overall view of what your company owns and what your company owes at a certain point in time. The profit and loss statement focuses on the company's financial performance over a specific period, while the balance sheet provides a snapshot of the company. How do P&L statements and balance sheets work in business valuation? A business's P&L statement and balance sheet provide information about its profit and loss. The balance sheet shows your company's assets, liabilities, and equity – basically the financial health of the business at a specific point in time. A profit and loss statement is a financial statement that summarizes your company's revenue, costs and expenses incurred during a specified period.

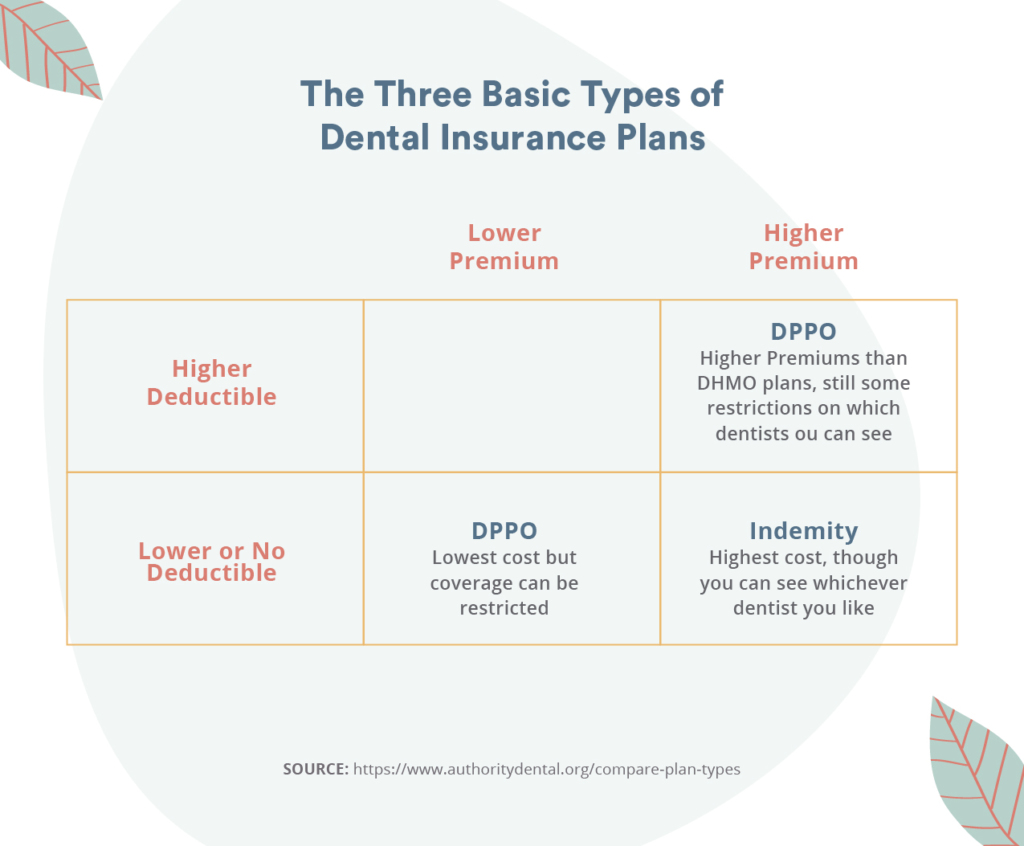

Dental Insurance Plans Maryland

Stand-alone dental plans on the Maryland Health Connection are only offered during Open Enrollment (November 1 – December 15 for coverage the following year). You can go out of network with a PPO plan but it will dramatically increase your out of pocket costs. Indemnity Indemnity dental plans are plans that allow you. From budget-friendly monthly premiums to low office-visit copays, Humana has a dental plan that is sure to fit your needs. View plans and prices available in. Top 21 dental insurance companies in Maryland · 1. SF&C Insurance Associates Inc. · 2. Senior Benefit Services, Inc. · 3. Blue Harbor Benefits · 4. APWU Health Plan. Coverage options for dental hygiene, x-rays, orthodontia, and dental implants. · A variety of service plans for all needs, age groups and budgets · A valued. We offer affordable dental insurance plans with NO waiting for services, so you can save on your next dental visit. How much is dental insurance in Maryland? The average dental insurance premium in Maryland is $ per month. *This is the based on average pricing for plans. For your convenience, Dental One Associates of Maryland accepts most insurance plans and will be happy to help you understand the coverage that you have. Searching for affordable dental insurance in Maryland? Compare MD dental plans and insurance, and find options that can save you between 10%%. Stand-alone dental plans on the Maryland Health Connection are only offered during Open Enrollment (November 1 – December 15 for coverage the following year). You can go out of network with a PPO plan but it will dramatically increase your out of pocket costs. Indemnity Indemnity dental plans are plans that allow you. From budget-friendly monthly premiums to low office-visit copays, Humana has a dental plan that is sure to fit your needs. View plans and prices available in. Top 21 dental insurance companies in Maryland · 1. SF&C Insurance Associates Inc. · 2. Senior Benefit Services, Inc. · 3. Blue Harbor Benefits · 4. APWU Health Plan. Coverage options for dental hygiene, x-rays, orthodontia, and dental implants. · A variety of service plans for all needs, age groups and budgets · A valued. We offer affordable dental insurance plans with NO waiting for services, so you can save on your next dental visit. How much is dental insurance in Maryland? The average dental insurance premium in Maryland is $ per month. *This is the based on average pricing for plans. For your convenience, Dental One Associates of Maryland accepts most insurance plans and will be happy to help you understand the coverage that you have. Searching for affordable dental insurance in Maryland? Compare MD dental plans and insurance, and find options that can save you between 10%%.

With no waiting period for preventive dental care, and for basic and major procedures when you switch plans, our PPO plan offers immediate dental coverage. Medicare Advantage is a supplemental dental plan that expands Medicare benefits within a network of qualified providers and offering some price protection. Affordable Dentures & Implants in Towson partners with most major insurance carriers. Learn how you can get covered today. Starting January 1, , adults enrolled in the Maryland Medical Assistance Program (Medicaid) will have coverage for comprehensive dental services. The Maryland Healthy Smiles Dental Program (MHSDP) provides dental care to eligible Medicaid members. Medicaid covers a wide range of dental services. Individual & Family Dental Insurance Plans ; Why You May Need A Separate Dental Plan · Consider enrolling in a separate or stand-alone Anthem dental plan, which. DentaQuest is a leading dental insurance provider in Maryland, providing dental coverage to eligible members of various Medicare Advantage plans. Our plans start from around $1 a day.1 Shop year-round, 24/7/, and join the over 17 million customers who choose Cigna Healthcare Dental DENTAL PLANS · We offer a range of dental plans designed to cover preventive, basic and major dental services. · Our plans include coverage for routine check-ups. Maryland offers a variety of dental insurance plans tailored to meet your individual or family needs. You can select from PPOs, HMOs, or indemnity plans. Benefits that help pay for the cost of visits to a dentist for basic or preventive services, like teeth cleaning, X-rays, and fillings. Maryland Health Connection has certified individual and family dental plans from four insurers. Maryland uses a fully state-run exchange known as the Maryland. If you are buying dental insurance on your own, we make it easy to find an affordable plan, including options that bundle vision and hearing coverage. Our plans. Quick Look: The Best Maryland Dental Insurance · Delta Dental: Best for Cleaning and Exams · Humana: Best for Humana Pharmacy · UnitedHealthcare: Best for a Large. Compare Maryland dental insurance plans and select the dental plan designed to meet both your dental care needs and budget. Looking for reliable dental insurance in Maryland? Whether you need a family plan or individual coverage, Delta Dental has a plan for you. Get started! The Maryland Healthy Smiles Dental Program (MHSDP) provides dental care to eligible Medicaid members. Medicaid covers a wide range of dental services. With no waiting period for preventive dental care, and for basic and major procedures when you switch plans, our PPO plan offers immediate dental coverage. Preventive care — like routine cleanings and exams — is covered at little or no cost. You have comprehensive coverage with no waiting periods, annual maximum or. If you are buying dental insurance on your own, we make it easy to find an affordable plan, including options that bundle vision and hearing coverage. Our plans.

How To Open A Vanguard Brokerage Account

We don't charge a fee to open an account. There's a $20 annual fee for each brokerage and mutual fund-only account, but you can easily avoid this fee. Steps to open an account · 1. Choose the type of investment account you want · 2. Compare fees, pricing schedules, and minimum balance requirements · 3. Review. Ready to get started? Open an account, explore professional advice, we offer expert help at the low cost you'd expect from Vanguard. Meet the new Vanguard app. We've updated and refined our features to make it easier than ever to invest from your mobile device. Fidelity stock and bond index mutual funds and sector ETFs have lower expenses than all comparable funds at Vanguard Open an Account. hidden. Proving what. Start building your portfolio by opening a Vanguard Personal Investor Account*. It's simple to invest and manage your investments online. Open an organization account in just 4 steps ; Step 1. Legally establish your entity or organization ; Step 2. Complete your application online in 4 steps ; Step 3. How to buy Vanguard funds · There are two ways to buy our funds: · Through an online brokerage account · With the help of a third-party financial advisor. New to Vanguard or looking to consolidate your savings? Open an account · What you need to open an account >. Already a Vanguard client? Log in and add a plan. We don't charge a fee to open an account. There's a $20 annual fee for each brokerage and mutual fund-only account, but you can easily avoid this fee. Steps to open an account · 1. Choose the type of investment account you want · 2. Compare fees, pricing schedules, and minimum balance requirements · 3. Review. Ready to get started? Open an account, explore professional advice, we offer expert help at the low cost you'd expect from Vanguard. Meet the new Vanguard app. We've updated and refined our features to make it easier than ever to invest from your mobile device. Fidelity stock and bond index mutual funds and sector ETFs have lower expenses than all comparable funds at Vanguard Open an Account. hidden. Proving what. Start building your portfolio by opening a Vanguard Personal Investor Account*. It's simple to invest and manage your investments online. Open an organization account in just 4 steps ; Step 1. Legally establish your entity or organization ; Step 2. Complete your application online in 4 steps ; Step 3. How to buy Vanguard funds · There are two ways to buy our funds: · Through an online brokerage account · With the help of a third-party financial advisor. New to Vanguard or looking to consolidate your savings? Open an account · What you need to open an account >. Already a Vanguard client? Log in and add a plan.

We don't charge a fee to open an account. There's a $20 annual fee for each brokerage and mutual fund-only account, but you can easily avoid this fee. When you open a Vanguard Brokerage Account, you can choose multiple investments and hold them all in 1 account. Check out your options below. Financial Advisor & Investment Management · Marketing · Sales · Technology Sign inCreate a talent profile · Vanguard Careers. Open Menu. About. If you open a Brokerage Account by 4 p.m. (ET) on February 27, , and hold at least one of these six Vanguard mutual funds, you are requesting to have. You'll need to provide: Your bank account and routing numbers, found on your checks, if you're using electronic bank transfer; or; A check made payable to. Good news: the minimum deposit to open a Vanguard account is $0. There are brokers that require as much as a couple of thousand dollars. You can check in the. It reviews the plan provisions that govern your account, including how your For more information about any fund, including investment objectives, risks. You can keep all your money in the bank sweep or diversify into 5 available Vanguard money market funds (each with a $3, minimum investment). Vanguard Bank. The TD Ameritrade Self-Directed Brokerage Account (SDBA) provides world-class SDBA services to retirement plan sponsors and their participants. Its open. If you're an existing Vanguard client, you don't need to open a new or separate account to invest in a money market fund. Simply begin the process online to buy. Log in. I'm new to Vanguard. Nice to meet you! You'll first create a profile and login ID, then can continue becoming a Vanguard client. I tried to open a first time brokerage account with them using $ from a linked checking account. This was at the end of December and the. Why open an IRA? · Tax-deferred growth—Earnings within your account can grow tax-free. · Investment flexibility—You can choose from a wider range of investment. Use this guide to assist in filling out Vanguard applications to open a brokerage account within your Solo k. NOTE: Vanguard documents are subject to change. If you're a do-it-yourself investor you can buy Vanguard Exchange Traded Funds (ETFs) during regular trading hours through an online brokerage account. You need a Vanguard Brokerage Account to trade stocks and ETFs (exchange-traded funds). It's easy to get started, and we can help you along the way. Investors do not have to have an account with Vanguard to buy and sell its mutual funds and exchange-traded funds (ETFs). Vanguard maintains agreements with. Steps to open an account · 1. Choose the type of investment account you want · 2. Compare fees, pricing schedules, and minimum balance requirements · 3. Review. Vanguard Investment Series plc c/o Brown Brothers Harriman Fund account notification e-mail containing your Vanguard account number. Subscribe for. Gemini is well-suited for crypto traders of any skill level and available in all 50 states. Sign up and trade to get $10 in bitcoin. Open An Account. 3.

What Is The Best Coin To Invest In Long Term

.jpg)

What are the top cryptocurrencies by market cap? The top cryptocurrencies by market cap are bitcoin and ethereum. · Are cryptocurrencies a good investment? long. A good rule of thumb when investing in a new product is to only invest money that you are willing to lose, so that it's not financially devastating if. Aave can be a good investment option if you're bullish on the future of DeFi. Governance benefits: Owning Aave tokens gives you a voice on the future of the. The two largest cryptocurrencies by assets – Bitcoin (BTC/USD) and Ethereum (ETH/USD) – are up significantly in the last 12 months to trade at new highs, with. The Top Eight Best Cryptocurrencies · Algo · Bitcoin · Binance Coin · Cartesi · Ethereum · Loopring · Shiba · Solana. Solana made its cryptocurrency debut in. Investor demand is driving the growth of cryptocurrency. Help grow your practice and aim to meet your clients' long-term investment goals. camera icon. Re. How will investing in cryptocurrency affect your portfolio? Is it a good long-term investment? Should you invest in an initial coin offering (ICO)? Are non-. Bitcoin (BTC) · Ethereum (ETH) · Binance Coin (BNB) · Solana (SOL) · Ripple (XRP) · Dogecoin (DOGE) · Polkadot (DOT) · SHIBA INU (SHIB). Bitcoin hardly needs an introduction as it's often seen as the quintessential crypto investment, despite some experts preferring coins with broader. What are the top cryptocurrencies by market cap? The top cryptocurrencies by market cap are bitcoin and ethereum. · Are cryptocurrencies a good investment? long. A good rule of thumb when investing in a new product is to only invest money that you are willing to lose, so that it's not financially devastating if. Aave can be a good investment option if you're bullish on the future of DeFi. Governance benefits: Owning Aave tokens gives you a voice on the future of the. The two largest cryptocurrencies by assets – Bitcoin (BTC/USD) and Ethereum (ETH/USD) – are up significantly in the last 12 months to trade at new highs, with. The Top Eight Best Cryptocurrencies · Algo · Bitcoin · Binance Coin · Cartesi · Ethereum · Loopring · Shiba · Solana. Solana made its cryptocurrency debut in. Investor demand is driving the growth of cryptocurrency. Help grow your practice and aim to meet your clients' long-term investment goals. camera icon. Re. How will investing in cryptocurrency affect your portfolio? Is it a good long-term investment? Should you invest in an initial coin offering (ICO)? Are non-. Bitcoin (BTC) · Ethereum (ETH) · Binance Coin (BNB) · Solana (SOL) · Ripple (XRP) · Dogecoin (DOGE) · Polkadot (DOT) · SHIBA INU (SHIB). Bitcoin hardly needs an introduction as it's often seen as the quintessential crypto investment, despite some experts preferring coins with broader.

long-term investment for millionaire hopefuls. You can buy Bitcoin on the best crypto exchanges. 2. Ethereum: As the second-largest. Although DCA is a popular way to buy Bitcoin, it isn't unique to crypto — traditional investors have been using this strategy for decades to weather stock. Bitcoin would obviously be the number one contender. I would also recommend ETH and SOL. They are currently the best performing over all. You. Bitcoin and Ether are in a league of their own as the two best cryptocurrencies to buy. Four more speculative cryptos are worth a look, each with their own. For long-term investments, many customers choose to stick to the top coins by market capitalization, such as BTC, XRP and ETH and others as shown on the. What are the best long-term cryptocurrencies? · Bitcoin · Ethereum · Chainlink · Polkadot · Cardano · Avalanche · Aave. We'll help you understand, and hopefully avoid, risks that could derail your long-term investment plans. Cryptocurrency, or crypto, is a broad term for. Bitcoin is the biggest cryptocurrency by both price and market capitalization, and it has the second-highest trading volume of any coin. Though it experiences. Bitcoin's popularity is growing, but not everyone is convinced it's a good investment There is no assurance that Bitcoin will maintain its long-term value in. If you're investing over the long term, then you may want to consider "blue-chips" like Bitcoin (BTC) and Ethereum (ETH) which have a relatively well-tested. This brings us to the reason why crypto enthusiasts claim that BNB is one of the best short-term crypto investments - liquidity. Since Binance Coin is widely. Bitcoin continues to lead the pack of cryptocurrencies in terms of market capitalization, user base, and popularity. · Other virtual currencies, such as Ethereum. Our Best 16 Long Term Crypto Investments In · Poodlana (POODL) · Solciety (SLCTY) · Piggy Bankster ($PIGS) · Bitcoin Dogs (0DOG) · Memeinator (MMTR). Cryptocurrency-related ETFs and Mutual Funds · Schwab Crypto Thematic ETF · Additional ETFs & Mutual Funds. Often seen as a way to store value, Bitcoin is seen by many as “digital gold.” It's considered a good investment with a long history of steady growth. If you have money at your disposal beyond your living expenses, saving and investing can help you to meet your long-term financial goals. That said, it can be. If, for example, you bought Bitcoin because you believe it's a good long-term investment, then maybe you can stick it out depending on market conditions. You. Despite growing competition from hundreds of popular altcoins, Bitcoin (BTC) and Ethereum (ETH) remain the clear crypto market leaders in Here are the top five cryptocurrencies with potential as long-term investments: 1. Bitcoin (BTC) Bitcoin is the largest cryptocurrency in the world by market. How will investing in cryptocurrency affect your portfolio? Is it a good long-term investment? Should you invest in an initial coin offering (ICO)? Are non-.

1inch Coin

1inch Network - 1inch is a form of digital cryptocurrency, also referred to as 1INCH Coin. Use this page to follow the 1inch Network - 1inch price live. August 's 1inch Network (1INCH) price prediction suggests a range of $ to $ The 1INCH coin price might trade as low as $ and potentially reach. The price of 1inch (1INCH) is $ today with a hour trading volume of $26,, This represents a % price decline in the. What is the value of 1INCH coin? 1 1INCH is worth $ How to use 1INCH coin in API? To get price and. You can buy and sell 1INCH at SpectroCoin. Please note: currently at SpectroCoin ERC 1inch (1INCH) transactions are processed on the Ethereum (ETH) network. The current price of 1INCH / TetherUS (1INCH) is USDT — it has fallen −% in the past 24 hours. Try placing this info into the context by checking out. DeFi / DEX aggregator with the most liquidity and the best rates on Ethereum, Binance Smart Chain, Optimism, Polygon, 1inch dApp is an entry point to the 1inch. 1inch price is $, up % in the last 24 hours, and the live market cap is $,, It has circulating supply of 1,,, 1INCH coins and a max. The price of 1inch (1INCH) is $ today, as of Aug 30 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has. 1inch Network - 1inch is a form of digital cryptocurrency, also referred to as 1INCH Coin. Use this page to follow the 1inch Network - 1inch price live. August 's 1inch Network (1INCH) price prediction suggests a range of $ to $ The 1INCH coin price might trade as low as $ and potentially reach. The price of 1inch (1INCH) is $ today with a hour trading volume of $26,, This represents a % price decline in the. What is the value of 1INCH coin? 1 1INCH is worth $ How to use 1INCH coin in API? To get price and. You can buy and sell 1INCH at SpectroCoin. Please note: currently at SpectroCoin ERC 1inch (1INCH) transactions are processed on the Ethereum (ETH) network. The current price of 1INCH / TetherUS (1INCH) is USDT — it has fallen −% in the past 24 hours. Try placing this info into the context by checking out. DeFi / DEX aggregator with the most liquidity and the best rates on Ethereum, Binance Smart Chain, Optimism, Polygon, 1inch dApp is an entry point to the 1inch. 1inch price is $, up % in the last 24 hours, and the live market cap is $,, It has circulating supply of 1,,, 1INCH coins and a max. The price of 1inch (1INCH) is $ today, as of Aug 30 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has.

Launched in May , 1inch is a DeFi aggregator and a decentralized exchange with smart routing. The core protocol connects a large number of decentralized. 1inch Network Token price today is $ with a hour trading volume of $ M, market cap of $ M, and market dominance of %. The 1INCH price. Prediction. 1inch Network (1INCH) Price Prediction , - Price ChartmarketsNewsPrediction Historical Data. coin image. 1inch Network Prediction. The 1inch Wallet is a fast and secure non-custodial DeFi crypto wallet I'v heard of tails of missing bitcoin that would be worth billions today but. 1INCH is an Ethereum token that powers 1inch, a decentralized exchange that aims to offer the “best rates by discovering the most efficient swapping routes. Trending Coins and Tokens Flame icon CryptoRank provides crowdsourced and professionally curated research, price analysis, and crypto market-moving news to. Track current 1inch prices in real-time with historical 1INCH USD charts, liquidity, and volume. Get top exchanges, markets, and more. r/1inch: The 1inch Network unites decentralized protocols whose synergy enables the most lucrative, fastest and protected operations in the DeFi. One of the unique aspects of the 1inch coin is its deflationary nature. This means that the value of the token increases while its supply constantly decreases. 1inch Network's price today is US$, with a hour trading volume of $ M. 1INCH is % in the last 24 hours. It is currently % from its 7-day. Why Does 1inch Have Value? The 1INCH token is the utility and governance token of the 1inch protocol and can be used for holding, spending, sending or staking. The live price of 1inch Network is $ per (1INCH / USD) with a current market cap of $ M USD. hour trading volume is $ M USD. 1INCH to USD. 1inch Network (1INCH) is a P2P cryptocurrency that provides easy exchange of funds. Is 1 Inch a promising cryptocurrency? The Aggregation Protocol of 1inch. 1INCH is an Ethereum token that powers 1inch, a decentralized exchange that aims to offer the “best rates by discovering the most efficient swapping routes. 1inch is an automated market maker (AMM) and decentralized exchange (DEX) aggregator that connects several DEXs into one platform. The current price of 1inch (1INCH) is USD — it hasn't changed in the past 24 hours. Try placing this info into the context by checking out what coins are. 1inch (1inch) Prices Exchanges. Exchange, Average Price. Bitfinex, $ As of 9 The CEO of major bitcoin and crypto exchange Coinbase has issued an. Get real-time 1inch price, historical 1inch price charts and breaking 1inch news. 1INCH holders can stake their tokens for a period between one month and two years. In exchange, they receive Unicorn Power. 1INCH stakers can use Unicorn Power. 1INCH / USD Conversion Tables. The conversion rate of 1inch (1INCH) to USD is $ for every 1 1INCH. This means you can exchange 5 1INCH for $ or $

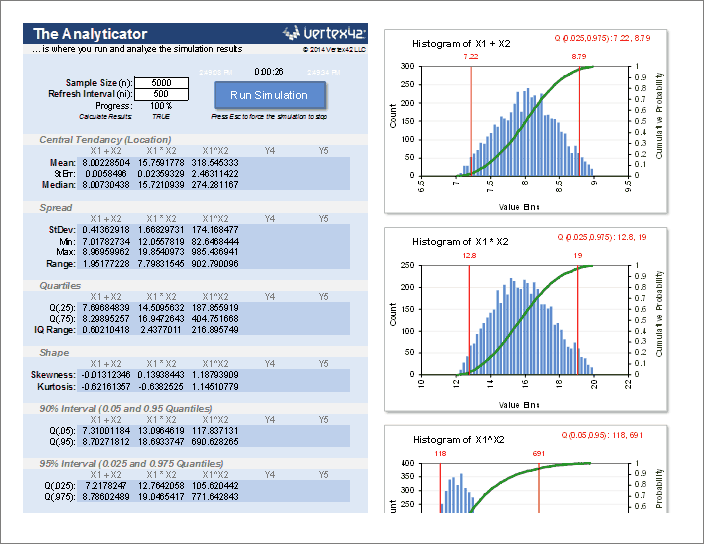

Financial Planning Monte Carlo Simulation

Old-school Monte Carlo, used in conventional financial planning, is deeply flawed. First, it uses an outdated, extremely rough “rule of thumb” to set a. These models are crucial for risk assessment, strategic planning, and investment decision-making. They incorporate various inputs, including hypothetical. A Monte Carlo simulation allows analysts and advisors to convert investment chances into choices by factoring in a range of values for various inputs. Finance document from Trine University, 1 page, Monte Carlo simulation is an essential tool for retirement planning as it predicts different outcomes. Monte Carlo methods are used in corporate finance and mathematical finance to value and analyze (complex) instruments, portfolios and investments by. Within the last decade most financial planning software programs have added Monte Carol Simulation as one way to visualize and examine the effect of. This widely used method calculates a probability score that suggests how well your financial plan will stand up to varying market conditions. This Monte Carlo simulation supports planning for financial goals and related spending. Multiple cashflow goals can be applied based on different life stages. Monte Carlo Powered Retirement Planning Made Easy! · Build and run a sophisticated retirement planning simulation in just a few minutes. · Quickly create 'what-if. Old-school Monte Carlo, used in conventional financial planning, is deeply flawed. First, it uses an outdated, extremely rough “rule of thumb” to set a. These models are crucial for risk assessment, strategic planning, and investment decision-making. They incorporate various inputs, including hypothetical. A Monte Carlo simulation allows analysts and advisors to convert investment chances into choices by factoring in a range of values for various inputs. Finance document from Trine University, 1 page, Monte Carlo simulation is an essential tool for retirement planning as it predicts different outcomes. Monte Carlo methods are used in corporate finance and mathematical finance to value and analyze (complex) instruments, portfolios and investments by. Within the last decade most financial planning software programs have added Monte Carol Simulation as one way to visualize and examine the effect of. This widely used method calculates a probability score that suggests how well your financial plan will stand up to varying market conditions. This Monte Carlo simulation supports planning for financial goals and related spending. Multiple cashflow goals can be applied based on different life stages. Monte Carlo Powered Retirement Planning Made Easy! · Build and run a sophisticated retirement planning simulation in just a few minutes. · Quickly create 'what-if.

Battle-test your financial plans against varying market conditions and build confidence in your chance of success with monte carlo simulations. Our Monte Carlo retirement calculator runs 1, scenarios where the rates of return for every investment changes in each year. We take the number of scenarios. In this episode, we take a detailed look at Monte Carlo simulation and how it is used in retirement planning. The look at the inputs that are used. How does Monte Carlo work in NaviPlan? Traditionally, a deterministic financial planning approach analyzes only one possible outcome. This outcome assumes. A Monte Carlo simulation allows the user to determine the likelihood of different outcomes based on a set of assumptions and how those assumptions respond to. A Monte Carlo simulation takes your current plan (your savings, expected returns, etc.) and adds a layer of realism. It considers: Market. How to use Monte Carlo analysis effectively To fully harness the potential of Monte Carlo projections for your retirement planning consider using these three. The objective of a Monte Carlo Simulation is to assess the risk inherent in long term predictions and support informed decision making. It was named after the. When you sit down with a financial professional to update your retirement plan, you may encounter a Monte Carlo simulation, a financial forecasting method. When it comes to financial planning, Monte Carlo simulation can be used to help you determine how much you need to save on a monthly or yearly basis in order to. When performing sensitivity analysis in financial modeling, it can be done using Monte Carlo Simulation in Excel. The analysis is performed to test the impact. Most financial plan software vendors with Monte Carlo use it in their retirement planning modules. The most-common usage is to see if the fund of money will. In retirement planning, the Monte Carlo simulation is a statistical technique that evaluates risk and predicts different possible investment outcomes. It does. Monte Carlo simulations are a different type of model, widely used within finance and beyond. The technique makes predictions about processes. Listening to the Bogleheads Live podcast on SWR vs Monte Carlo methodologies has gotten me excited about playing with Monte Carlo simulations. A Monte Carlo simulation is just running numbers based on a distribution of return rates. If I take mil and calculate expected amount at 99 (based on your. Monte Carlo simulations are a popular tool used by financial planners to illustrate retirement planning. These simulations use statistical. For example, Monte Carlo simulations can be a valuable tool for retirement planning. By modeling possible outcomes for a retirement portfolio, investors can. The basic premise of Monte Carlo analysis is that it uses a random sampling of possible outcomes to predict the likelihood of different investment scenarios. Monte Carlo is a way to introduce probability into financial planning. Instead of using linear projections, whereby a fixed value is applied year over year.

Cheapest Way To Get Home Wifi

Find Cheap Internet Deals · Compare Cheap Internet Plans · Our Top Picks for Cheap Internet · AT&T · CenturyLink · Xfinity · HughesNet. If you're looking for top internet speed, then fiber is the way to go. Although cable internet can deliver excellent download speeds, its upload speeds are much. The cheapest way to access WiFi is to use the Free access that can be found at most coffee shops or other public locations. Internet starting at $35/mo. when you add Cox Mobile ø · Find out how. Get high-speed internet at an affordable price from a leading internet provider. Delve. Try our fast, 5G & 4G LTE powered Wireless Home Internet for just $ today! Call to get started. T-Mobile offers low-cost internet plans through T-Mobile Connect and other programs. T-Mobile. Verizon. Verizon is an ACP participant and also offers low. AT&T offers the highest overall value with its cheap and powerful fiber plans. But in certain areas, Xfinity's cable internet plans are a better deal. The first option is a government assistance program called Lifeline, which offers $ per month off either internet or phone services to low-income households. How to get Wi-Fi ® in your home · Step 1: Find a good internet service provider in your area · Step 2: Make sure you have the right Wi-Fi equipment · Step 3: Find. Find Cheap Internet Deals · Compare Cheap Internet Plans · Our Top Picks for Cheap Internet · AT&T · CenturyLink · Xfinity · HughesNet. If you're looking for top internet speed, then fiber is the way to go. Although cable internet can deliver excellent download speeds, its upload speeds are much. The cheapest way to access WiFi is to use the Free access that can be found at most coffee shops or other public locations. Internet starting at $35/mo. when you add Cox Mobile ø · Find out how. Get high-speed internet at an affordable price from a leading internet provider. Delve. Try our fast, 5G & 4G LTE powered Wireless Home Internet for just $ today! Call to get started. T-Mobile offers low-cost internet plans through T-Mobile Connect and other programs. T-Mobile. Verizon. Verizon is an ACP participant and also offers low. AT&T offers the highest overall value with its cheap and powerful fiber plans. But in certain areas, Xfinity's cable internet plans are a better deal. The first option is a government assistance program called Lifeline, which offers $ per month off either internet or phone services to low-income households. How to get Wi-Fi ® in your home · Step 1: Find a good internet service provider in your area · Step 2: Make sure you have the right Wi-Fi equipment · Step 3: Find.

Enjoy all the benefits of a fibre-powered connection. Shop packages · Home/Internet. Get Internet that's there when it matters See how it works. Want to. Get a home internet plan with unlimited 5G data and a WiFi device included. See our internet plan deals and find the right plan for your home needs. T-Mobile's Project 10Million · Free Hoop Wireless Tablet with Internet · Free Internet for Your Home · Free Internet Locations in NYC · Low-Cost Internet Plans · Wi-. 1 Use a public Wi-Fi network. · 2 Tether to a device that has internet service. · 3 Use your mobile provider's hotspot. · 4 Share the internet with a friend or. Mediacom – Cheapest plan. Why we recommend it: Mediacom's Access Internet plan is one of the best values you'll find anywhere, starting at just $/mo. Learn how President Biden is reducing the cost of high-speed internet and find out if you qualify to sign up. How do I get a good Wi-Fi connection? For a good Wi-Fi connection, start with a reliable internet connection like Verizon Home Internet. Advanced router. Get speeds up to 50 Mbps for only $/mo — good for online learning, working from home, video calling, and other essentials. Internet Essentials package for $ – a great option for cheap. 2. Xfinity Internet Essentials. Eligible individuals can get home internet service for $ Is There Free Internet for Seniors? Luckily, there is a place to turn for affordable internet. Lifeline helps low-income consumers access phone and internet. Many top providers like Xfinity, Spectrum and AT&T offer cheap or free internet for low-income households, students and seniors through qualifying programs. Sign up for T-Mobile Home Internet online or via chat to get a $ Virtual Prepaid Mastercard® back. Plus, our 5G Wi-Fi Gateway is included at no additional. One of the cheapest ways to get wifi alternatives is using a mobile hotspot. If you have a generous data plan, turn on your phone's hotspot feature. This compact device is a router and modem in one. In 15 minutes, you'll have your computers, phones, and other devices connected—no technician necessary. home internet provider, here's how to get it. If you order Fios home Now get our best deals. $ Samsung appliance credit at The Home Depot on us. Wireless broadbands are available with Dish antenna and Modem. I think Airtel, Jio are giving connection with satellite connected internet. But as we mentioned before, most fiber internet plans don't include fees, which actually make them a decent deal. If you can't get fiber, cable is a good. T-Mobile 5G Home Internet offers flexible internet service, and if you're a T-Mobile customer, you'll also get some of the cheapest internet rates around. With. You have a number of different connectivity options available whether you are seeking business or home internet services. You can seek out the cheapest internet. So if you're looking for a fast, reliable internet connection, Verizon 4G LTE Home Internet is the way to go. Bonus: Solutions to Rural Area Surveillance with.