bss64.ru

Prices

Flag In C++

Bit flags are a programming technique to represent multiple boolean values or multiple states into a single integer. ILE C/C++ Compiler Reference. FLAG. Specifies the level of messages that are to be displayed in the listing. Only the first-level text of the message is. The most common ones: O1, -O2, -O3 and -Ofast. These are some of the most commonly used compiler flags when one begins with compiler. CheckRemoteDebuggerPresent() checks if a debugger (in a different process on the same machine) is attached to the current process. C/C++ Code. BOOL. How do I use flag variables to produce output for a program designed to search an array for a string provided via user input? Ask Question. Preprocessor debugging flags · #define one or more debugging flags (preferably in a header file), you can test a flag using an · #ifdef statement and. I understand the definition, which is that flags signify that the program will due something when the flag is entered, but how do I actually. This flag is enabled by default for -std=c++ -fchar8_t ¶; -fno-char8_t. Enable support for char8_t as adopted for C++ Flag UnlimitTrussLengthDM referenced from Lua isn't ; Creatoriom (Creatoriom) September 1, , am #1 · 7 Likes. VokiDoki_YT (Voki) September 1, Bit flags are a programming technique to represent multiple boolean values or multiple states into a single integer. ILE C/C++ Compiler Reference. FLAG. Specifies the level of messages that are to be displayed in the listing. Only the first-level text of the message is. The most common ones: O1, -O2, -O3 and -Ofast. These are some of the most commonly used compiler flags when one begins with compiler. CheckRemoteDebuggerPresent() checks if a debugger (in a different process on the same machine) is attached to the current process. C/C++ Code. BOOL. How do I use flag variables to produce output for a program designed to search an array for a string provided via user input? Ask Question. Preprocessor debugging flags · #define one or more debugging flags (preferably in a header file), you can test a flag using an · #ifdef statement and. I understand the definition, which is that flags signify that the program will due something when the flag is entered, but how do I actually. This flag is enabled by default for -std=c++ -fchar8_t ¶; -fno-char8_t. Enable support for char8_t as adopted for C++ Flag UnlimitTrussLengthDM referenced from Lua isn't ; Creatoriom (Creatoriom) September 1, , am #1 · 7 Likes. VokiDoki_YT (Voki) September 1,

creates flags inside c++ class. GitHub Gist: instantly share code, notes, and snippets. If an optimization flag (-x0[1|2|3|4|5] or an equivalent flag) is used with the -misalign option, the additional instructions required for alignment of. This flag must be used to compile and when linking. Compile times are very long with this flag, however depending on the application there may be appreciable. [SOLVED] Window resize flag. photo. By bss64.ru March 1, in C++ Programming. The format flags of a stream affect the way data is interpreted in certain input functions and how these are written by certain output functions. See ios_base. A flag, or sentinel, is any variable that's sole purpose is to indicate when a key point in the processing has been reached. This include things. The -Wall and -Wextra compiler flags enable pre-defined sets of compile-time warnings. The warnings in the –Wall set are generally easy to avoid or can be. C/C++ Reference Syntax: #include fmtflags flags(); fmtflags flags(fmtflags f);. The flags() function either returns the io stream format flags for. C++ Program to Demonstrate Use of Formatting Flags on Integer Output. This C++ program demonstrates the use of formatting flags on integer output. The. Returns true if any flag set in flags is also set in this flags object, otherwise false. If flags has no flags set, the return will always be false. This. It is used to get/set format flags. The format flags of a stream affect the way data is interpreted in certain input functions and how these are written by. This article aims to spotlight the potency of compiler optimizations, focusing on the Intel C++ compilers — renowned for their popularity and widespread usage. GetName. const char *GetName() · Returns the flag's name. ; GetValue. int GetValue(Context *context = nullptr) · Returns the feature flag's current value, or the. ILE C/C++ Compiler Reference. FLAG. Specifies the level of messages that are to be displayed in the listing. Only the first-level text of the message is. Options of the form -f flag specify machine-independent flags. Most flags The C++ ABI requires multiple entry points for constructors and. Write is one of them. So, when you use cout, the output is buffered, that is, collected together to be printed in a batch. The standard behaviour of C++ is to. Language standard compilation flag guide for C++ language. If an optimization flag (-x0[1|2|3|4|5] or an equivalent flag) is used with the -misalign option, the additional instructions required for alignment of. Normally, when you compile c++ programs, you'll ask for all warnings with the -Wall flag. After the compiler checks for these errors, it will build your program. CC: C compiler to use · CFLAGS: Compile flags to pass to the C compiler · CPPFLAGS: Preprocessor flags to pass to the C compiler · CXX: C++ compiler to use.

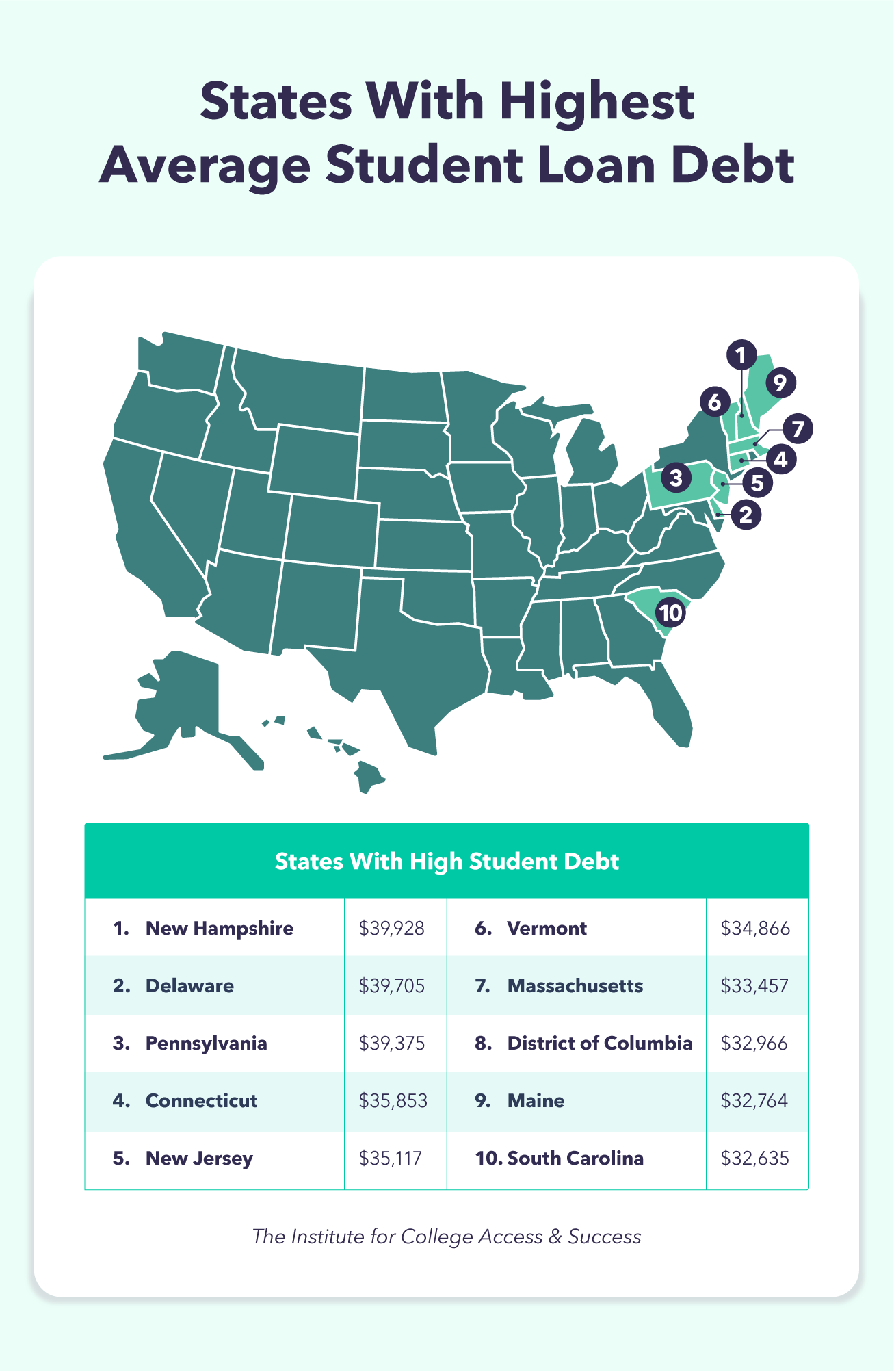

Student Loan Table

Income-Based Repayment Calculator. Estimate your monthly payment amount under the income-based repayment plan for various federal student loans. What is the average interest rate on a loan? · Average interest rates for personal loans · Average interest rates for student loans. This student loan calculator compares the SAVE plan to other income-driven repayment plans, such as new and old IBR, PAYE, and refinancing. This calculator is for students living in England starting a new undergraduate course in academic years. loan as a way to tackle your debt. Private Student Loan. A private student loan is a financing option that can fill the gap when federal student loans fall. Use our student loan payoff calculator to see how making additional payments on your student loans can save you money and time over the life of your loan. IBR (Any loans disbursed before July 1, ): Payments are calculated at 15% of Discretionary Income, where Discretionary Income = AGI minus % of FPL. Any remaining loan balance is forgiven if your federal student loans are not repaid in full at the end of the repayment period. Again, note that IDR is the. Student Loan Calculator Based on your loans and income, you qualify for 7 repayment plans. Choose a plan below to see how it compares to all the others. Income-Based Repayment Calculator. Estimate your monthly payment amount under the income-based repayment plan for various federal student loans. What is the average interest rate on a loan? · Average interest rates for personal loans · Average interest rates for student loans. This student loan calculator compares the SAVE plan to other income-driven repayment plans, such as new and old IBR, PAYE, and refinancing. This calculator is for students living in England starting a new undergraduate course in academic years. loan as a way to tackle your debt. Private Student Loan. A private student loan is a financing option that can fill the gap when federal student loans fall. Use our student loan payoff calculator to see how making additional payments on your student loans can save you money and time over the life of your loan. IBR (Any loans disbursed before July 1, ): Payments are calculated at 15% of Discretionary Income, where Discretionary Income = AGI minus % of FPL. Any remaining loan balance is forgiven if your federal student loans are not repaid in full at the end of the repayment period. Again, note that IDR is the. Student Loan Calculator Based on your loans and income, you qualify for 7 repayment plans. Choose a plan below to see how it compares to all the others.

Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans. Student Loan Repayment Calculator. Estimate your student loan payments under a standard repayment plan. Students watching big screen in university atrium, back. Use this calculator to find out your potential student loan debt, repayment costs and how long it could take to pay off. original loan amount). The monthly payment calculations in this chart are based on standard principal and interest payments and do not include fees or repayment. Use the Citizens student loan rate and repayment table to estimate your monthly student loan payments. Discover interest rates and payoff term lengths to. Loan Calculator. A, B, C, D, E, F, G, H, I. 1, Student Loan Calculator. 3. 5. 6. 7, Loan Data, Disclaimers: 8, Loan Amount, $ 4,, This loan calculator is. Undergraduate students ; Federal Direct Subsidized Undergraduate Stafford Loan ; Lender, Federal government ; Interest Rate, % – loans disbursed between 7/1/. Use our student loan calculator to estimate your student loan. Select a Different Calculator Student Loan Calculator Student Loan Refinance Calculator. Are you thinking about financing a college degree? A student loan calculator can help you estimate your monthly payments. Learn more at Citizens. Using the student loan calculator is a simple way to estimate how much you owe on your student loans. To use the calculator, you'll need the following. Loan. Use our student loan calculator to help you estimate your payments and interest. Create a repayment plan to ensure you repay your student loans on time. Use this amortization schedule calculator to see your monthly loan payment, interest and principal on a monthly basis as well as the lifetime interest. Use this tool to figure out your estimated monthly student loan payment and to get an idea of how much interest you'll pay over the life of your loan. Required fields are marked with an asterisk (*). Footer. Federal Student Loan Management. Find out how long it will take to pay off your student loans—and how you can save yourself time (and interest) by boosting your monthly payment. (The loan calculator can be used to calculate student loan payments, auto loans or to calculate your mortgage payments.) Jump to Calculator. Calculating. Even track and calculate charitable gifts and donations, investments, net worth, or student loans. These stylish Microsoft Excel calculator templates are easy. Use this calculator to estimate what your payment could be, how much you would pay in total on the loan, and how much forgiveness you might receive. loan directly to confirm your final graduated repayment schedule. Federal Student Aid Estimator · MAP Estimator · Loan Repayment Calculator · Monthly Payment. Are private student loans eligible for Income-Driven Repayment plans?

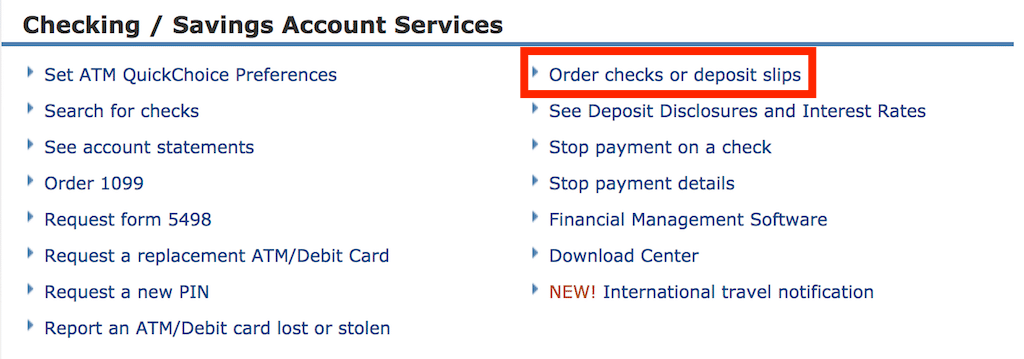

Como Solicitar Cheques En Chase

Paperless statements allow you to access your statement virtually anytime, from anywhere with Chase Online or the Chase Mobile app. Description como hacer un cheque de chase Direct deposit is a process where someone who is going to be paid on a recurring basis, such as an employee, or a. Chase no te aceptará ❌ ninguna nueva tarjeta de crédito personal, si has sacado mas de 5 tarjetas de crédito personales dentro de un periodo de 2 años (con. Chase for Business, Constant Contact, and NerdWallet. Interactive Exhibits Solicitar ayuda. Siempre estamos aquí para ayudar. Complete este. For example, traffic violations, defamation, or issuing unfunded cheques (unless there was a fraudulent or malicious intent at the time the cheque was issued). Descubra cómo configurar un depósito directo para que sus cheques y pagos se depositen automáticamente en su cuenta Solicitar una tarjeta de débito. cheque al solicitar la nueva tarjeta de credito de Chase: La Chase Freedom Rise Como Abrir Una Cuenta De Cheques Con Chase Paso A Paso · Mejor Tarjeta De. Cuentas de cheques. Escoge la cuenta de cheques que más te convenga. · Cuentas de ahorros y CD. Nunca es demasiado temprano para empezar a ahorrar. · Tarjetas de. Adicionalmente existe JPMorgan Chase Bank, National Association Oficina de Representación establecida en Colombia desde Nuestro compromiso de ayudar a. Paperless statements allow you to access your statement virtually anytime, from anywhere with Chase Online or the Chase Mobile app. Description como hacer un cheque de chase Direct deposit is a process where someone who is going to be paid on a recurring basis, such as an employee, or a. Chase no te aceptará ❌ ninguna nueva tarjeta de crédito personal, si has sacado mas de 5 tarjetas de crédito personales dentro de un periodo de 2 años (con. Chase for Business, Constant Contact, and NerdWallet. Interactive Exhibits Solicitar ayuda. Siempre estamos aquí para ayudar. Complete este. For example, traffic violations, defamation, or issuing unfunded cheques (unless there was a fraudulent or malicious intent at the time the cheque was issued). Descubra cómo configurar un depósito directo para que sus cheques y pagos se depositen automáticamente en su cuenta Solicitar una tarjeta de débito. cheque al solicitar la nueva tarjeta de credito de Chase: La Chase Freedom Rise Como Abrir Una Cuenta De Cheques Con Chase Paso A Paso · Mejor Tarjeta De. Cuentas de cheques. Escoge la cuenta de cheques que más te convenga. · Cuentas de ahorros y CD. Nunca es demasiado temprano para empezar a ahorrar. · Tarjetas de. Adicionalmente existe JPMorgan Chase Bank, National Association Oficina de Representación establecida en Colombia desde Nuestro compromiso de ayudar a.

Bono de la cuenta de cheques de Chase: Obtén un bono de $ al abrir una - Si llamas para solicitar un aumento en las tarjetas personales, se realizará una. Terri Chase. Houston. Office: NMLS#: Visit Profile Tarjetas perdidas/robadasVolver a pedir chequesDías festivos que observa el banco. cheques, tarjeta de débito Visa, capacidad de seguimiento [ ] de gastos y [ ] will pay you by TWC UI Visa® debit card from Chase Bank, [ ]. cuando solicitar pagos de beneficios. Puede solicitar pagos cada dos [ Llame a Chase o vaya a bss64.ru si tiene preguntas sobre la. How to deposit a cheque online with your mobile device on TD app · 1. Go to the Deposit Cheque page · 2. Register for Mobile Deposit · 3. Enter deposit information. Las peticiones para solicitar una reservación deberán ser enviadas a escolar Please write “VBG” for “Vallarta Botanical Gardens” on your cheques. How to Redeem Travelers Cheques · Travel Help Center · Global Assist Hotline. Rewards & Benefits. Rewards. Membership Rewards® Program · Cash back · Refer a. Las soluciones de cuentas de cheques para negocios de Chase están diseñadas para ayudarte a administrar el flujo de efectivo, ahorrar tiempo y obtener el apoyo. Noticed Suspicious Fraud Activity? Ahorros y Cuenta de Cheque · Cuentas de Cheques According to results taken in by the American Costumer Satisfaction. Solicitar cita; RUTA #; Sobre Nosotros · Visión general · Carreras Hunters Chase Dr. Austin, TX bss64.ru · In some cases, competitors assess and/or waive fees if certain criteria are met. The non-Discover Bank service marks for Chase, Bank of America, Wells Fargo. Por ejemplo,usted tenía una tarjeta de crédito de Chase, pero luego Chase vendió Cualquiera de las partes en un caso de reclamo de deuda puede solicitar un. Encuentra herramientas y guías por Internet para ayudarte a pagar la factura de tu tarjeta de crédito de Chase, verificar tu nueva tarjeta, hacer cambios en. Pedir cheques · Zelle®. Servicios de Cuenta. Tarjetas de débito · Encuentra un ATM Chase and Wells Fargo combined. Welcome, Fresno County. We Are Excited. Tome en cuenta que algunas tesorerías del condado, así como la oficina estatal de licencias de conducir en los condados Douglas y Sarpy, no aceptan cheques. Ve a bss64.ru o la aplicación Chase Mobile® para ver las limitaciones, los términos, las condiciones y los detalles. La aplicación Chase Mobile®. Cheques regalo Activar una suscripción Blog Ayuda y asistencia. ES. 0 Cesta Editores Información de venta Solicitar vender Iniciar sesión. La empresa. Accounts Cuentas Pay & Transfer Pago & Transferencias Deposit Checks Deposite cheques Trade Comercio Solicitar otro código de autorización. Security. Chase ofrece una gran variedad de cuentas de cheques para negocios pequeños, medianos y grandes. Compara nuestras soluciones de cuentas de cheques para negocios. Por qué los padres deben solicitar los servicios a través del Programa de Pensión Infantil de NJ · Sitúe su oficina de condado. Formas Application · Formulario.

How Much Do You Need To Purchase A House

How Much Should I Have Saved When Buying a Home? Lenders generally want to house, you have plenty of time to do so without missing any payments. The minimum is 3% down, but if you have bad or little credit or a high debt-to-income ratio, be prepared to put down more than this. These loans are often used. Conventional mortgages require a 20 percent down payment to avoid extra fees like private mortgage insurance. If you are looking to buy a $, home in El. GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an. Ideally, your living cost should not be more than 30% of your gross monthly income. That includes paying interest, homeowners insurance, property taxes. Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. This rule says your mortgage should not cost you more than 28% of your gross monthly earnings, while your total debt payments should equal no more than 36% of. The average home buyer in Texas spends between $24, and $86, when purchasing a $, home — the state median value. Keep in mind, this is just the. Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying. How Much Should I Have Saved When Buying a Home? Lenders generally want to house, you have plenty of time to do so without missing any payments. The minimum is 3% down, but if you have bad or little credit or a high debt-to-income ratio, be prepared to put down more than this. These loans are often used. Conventional mortgages require a 20 percent down payment to avoid extra fees like private mortgage insurance. If you are looking to buy a $, home in El. GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an. Ideally, your living cost should not be more than 30% of your gross monthly income. That includes paying interest, homeowners insurance, property taxes. Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. This rule says your mortgage should not cost you more than 28% of your gross monthly earnings, while your total debt payments should equal no more than 36% of. The average home buyer in Texas spends between $24, and $86, when purchasing a $, home — the state median value. Keep in mind, this is just the. Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying.

The 28% and 36% ratios are standard in the mortgage world, but lenders may have other combinations available, such as 33%/38%. Generally, making a down payment of 20% or more can help you avoid having to buy private mortgage insurance. The average home buyer in California spends between $58, and $, when purchasing a $, home — the state median value. For example, if you are purchasing a $, home you would typically need a deposit of $80, to avoid paying LMI. The LMI for a $, home at a 90% loan. Well, you want to save at least 20% for a down payment, so that would be 40K. You want money to cover other things like the appraisal. Conventional mortgages require a 20 percent down payment to avoid extra fees like private mortgage insurance. If you are looking to buy a $, home in El. The amount of your down payment on a house depends upon multiple variables, including your personal financial situation, your income, your credit health and. If you're buying a $, house, a 20 percent down payment would translate to $32, — which is a lot more than most first-time homebuyers can afford. Most real-estate experts will tell you to have at least 5% of the cost of a house on hand in savings to account for the down payment. However, it's essential to understand that home buyers can secure an affordable mortgage with as little as 3 percent down. Mortgage Interest: To buy a single-. If your lender requires you to make a minimum down payment of 10%, then you will need to make a $25, down payment to buy a $, house and a $50, down. That depends on the purchase price of your home and your loan program. Different loan programs require different percentages, usually ranging from 5% to 20%. Generally, a credit score of a borrower should range from – It reveals whether or not you qualify and are responsible for getting a mortgage. The. Generally, conventional loans require a minimum down payment of 3% to 5% of the home's purchase price. However, keep in mind that a higher down payment may be. In most cases, you'll need to have cash on hand to cover the earnest money, down payment, taxes and all the various closing costs. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. Paying cash for a home means you won't have to pay interest on a loan. You will also save money on closing costs by using cash instead of taking out a mortgage. There are no hard rules for how much money you should have available to cover these issues, but a good rule of thumb would be to put around 1 or 2 percent of. This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income. Do you need to put 20% down on a house? While making a 20% down payment on a home is considered the gold standard, rising home prices have made this benchmark.

Company Options Vs Shares

We've outlined the main distinctions between RSUs and stock options to help you decide which type of equity offering is best for your startup. Strike price: One of the main differences between founder shares and options is the price at which the equity can be purchased. With options, the holders are. A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the “exercise” or “strike price.”. Typically, your options will expire 10 years after your Vesting Calculation Date as long as you remain employed. The moment you leave the company (whether. Founders find this best accomplished by sticking to an "everyone gets stock options" principle, so that the only negotiation is about how many shares are. Pricing takes into account an option's hedged value so dividends from stock and interest paid or received for stock positions used to hedge options are a factor. The fundamental difference between shares and options comes down to timing. Someone who purchases shares becomes a shareholder and an investor in the company. Employee stock options are commonly viewed as an internal agreement providing the possibility to participate in the share capital of a company, granted by the. Share options are more likely to be used in the UK, and stock options are more common in the US. Share options are a way of saying to staff, “When the company. We've outlined the main distinctions between RSUs and stock options to help you decide which type of equity offering is best for your startup. Strike price: One of the main differences between founder shares and options is the price at which the equity can be purchased. With options, the holders are. A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the “exercise” or “strike price.”. Typically, your options will expire 10 years after your Vesting Calculation Date as long as you remain employed. The moment you leave the company (whether. Founders find this best accomplished by sticking to an "everyone gets stock options" principle, so that the only negotiation is about how many shares are. Pricing takes into account an option's hedged value so dividends from stock and interest paid or received for stock positions used to hedge options are a factor. The fundamental difference between shares and options comes down to timing. Someone who purchases shares becomes a shareholder and an investor in the company. Employee stock options are commonly viewed as an internal agreement providing the possibility to participate in the share capital of a company, granted by the. Share options are more likely to be used in the UK, and stock options are more common in the US. Share options are a way of saying to staff, “When the company.

What is a Stock Option? · Stock Option Types. There are two types of stock options: · Strike Price. Stock options come with a pre-determined price, called a. When a corporation grants someone the right to buy shares later, such as granting a stock option to an employee, those shares are not yet issued and outstanding. Both Sweat Equity Shares and ESOPs are valuable tools to attract and retain top talent. However, choosing the right one depends on your company's goals and. When a corporation grants someone the right to buy shares later, such as granting a stock option to an employee, those shares are not yet issued and outstanding. The difference between shares and share options lies in the ownership of the company and the vesting method. Ownership in the company. Once shares have been. Employee Stock Option Plan is an employee equity sharing program that startups use to give their employees option to purchase shares in the company. In other. Founders find this best accomplished by sticking to an "everyone gets stock options" principle, so that the only negotiation is about how many shares are. Exercise your stock options to buy shares of your company stock, then sell just enough of the company shares (at the same time) to cover the stock option cost. Both Sweat Equity Shares and ESOPs are valuable tools to attract and retain top talent. However, choosing the right one depends on your company's goals and. Company Share Option Plan. This gives you the option to buy up to £60, worth of shares from 6 April (or £30, if the options were granted. Shares are easier to purchase/sell and don't have a “theata decay” where you could possibly lose your entire premium. An option loses its entire value after a certain date, whereas stocks tend to retain value indefinitely. Options. Stock. They're often part of an Employee Stock Ownership Plan (ESOP). When the time comes for employees to exercise their share options, they own shares in the company. The difference? Stock options give the employee an opportunity to buy and own the shares, but restricted stock awards are automatically owned by the employee. Granting options vs. issuing restricted stock Restricted stock is almost always issued to founders when the company is formed. Most early stage companies. Generally, the gains from exercising non-qualified stock options are treated as ordinary income, whereas gains from an incentive stock option can be treated. *When private, a company's FMV is based on the company's valuation; when public, it is based on the stock price. 1. 2. 3. 4. 5. GRANT. Stock options award-. NSOs: What's the Difference? When a company issues options to US employees, there are two types it can choose from: incentive stock options (ISOs), which. The service or vesting period is the difference between the grant date and exercise date. For example, if a company issued stock options to an employee, but. The price at which you can purchase the stock is called the exercise price, or strike price. So if your employer grants you options, you do not own

Selling Rental Home Capital Gains

Capital gains on a rental property are the profits made from selling real estate assets. When these transactions are not profitable, they'. Deferring Capital Gains Tax: Buying another home after selling an investment property within days can defer capital gains taxes. Although reinvesting. Long-term capital gains tax rates for are 0%, 15%, or 20%, depending on your taxable income. Let's look at two scenarios to see the difference between. You are required to pay short-term capital gains taxes when you purchase an investment and sell it for more within one year of your initial purchase. In other. On top of that, California will charge another 1% to % when you sell. So, if you're a millionaire, your total capital gains taxes will be %. The math. This means you will be required to pay tax anywhere between 10% to 37%. On the other hand, if you owned the property for more than a year, the profits will then. Gains on the sale of personal or investment property held for more than one year are taxed at favorable capital gains rates of 0%, 15%, or 20%, plus a %. Another option for reducing the capital gains tax when you sell a rental property is to turn the house into your primary residence before you sell. Once every. Yes. Regarding capital gains rental property, you are liable for rental capital gains. You can only exclude capital gains from the sale of your main home. Capital gains on a rental property are the profits made from selling real estate assets. When these transactions are not profitable, they'. Deferring Capital Gains Tax: Buying another home after selling an investment property within days can defer capital gains taxes. Although reinvesting. Long-term capital gains tax rates for are 0%, 15%, or 20%, depending on your taxable income. Let's look at two scenarios to see the difference between. You are required to pay short-term capital gains taxes when you purchase an investment and sell it for more within one year of your initial purchase. In other. On top of that, California will charge another 1% to % when you sell. So, if you're a millionaire, your total capital gains taxes will be %. The math. This means you will be required to pay tax anywhere between 10% to 37%. On the other hand, if you owned the property for more than a year, the profits will then. Gains on the sale of personal or investment property held for more than one year are taxed at favorable capital gains rates of 0%, 15%, or 20%, plus a %. Another option for reducing the capital gains tax when you sell a rental property is to turn the house into your primary residence before you sell. Once every. Yes. Regarding capital gains rental property, you are liable for rental capital gains. You can only exclude capital gains from the sale of your main home.

You may owe taxes on the profit (gain) you make from selling your property. This applies whether you held the property short-term (less than 1 year) or long-. Capital gains taxes are based on any profit made on the sale of your rental property, as determined by subtracting the purchase price and any improvements. Capital gains tax on rental property in California · Those who earn no more than $44, pay no capital gains tax. · Those who earn from $44, to $, pay. As mentioned above, holding on to real estate investment for more than one year creates a long-term capital gain with a maximum tax rate of 20%. Otherwise, it's. Report the gain or loss on the sale of rental property on Form , Sales of Business Property or on Form , Sales and Other Dispositions of Capital Assets. When a primary residence is sold, it remains tax-free up to a certain monetary threshold. Beyond that threshold, taxes are assessed. This becomes a little more. The tax consequences of gifting of rental properties are more complex since the recipient of the gift receives the property at the adjusted cost basis of the. You can sell your primary residence and be exempt from capital gains taxes on the first $, if you are single and $, if married filing jointly. · This. On top of that, California will charge another 1% to % when you sell. So, if you're a millionaire, your total capital gains taxes will be %. The math. If you are selling a home that used to be your primary residence, as long as you lived in the home for 2 of the last 5 years before selling, you. Property owners can exclude up to $, in capital gains from the sale of their primary residence if the filing status is single, and up to $, in. Compared to the sale of a personal-use property, the sale of a rental property results in much higher rates of capital gains taxation. Additionally, any. In the last section, we established that profits made from selling rental properties are taxable. Generally, the profit from the sale of a rental real property. Capital gains tax on rental property in California · Those who earn no more than $44, pay no capital gains tax. · Those who earn from $44, to $, pay. 1. Exchanges. The first strategy you can use to lower capital gains tax involves exchanges. You can use section to sell a rental property while. You've held the property for 4–5 years, so the gain on sale will be at the long-term capital gains tax rate of 20% (it would be only 15% if. Capital gains tax applies to home sales, but an IRS rule allows individuals who have owned and lived in the home being sold for at least two of the previous. If you are selling a rental or investment property and purchasing another, you may be able to avoid paying capital gains tax entirely by using the exchange. If the property is sold at a profit then it would be taxed as short-term capital gains. Usually, this is taxed at the standard income tax rate. Property held. Although profit on selling a rental property might have to be reported as capital gains, losses when selling rental property are deductible from your ordinary.

Coinbase Loan Management

Users may experience: Some loan balances on Coinbase are reported accurately, while others are inaccurate or not flagged correctly in CoinTracker. Community-built interfaces integrating the protocol. Institutions Earn Manage Tools Coinbase Custody Secure custody for COMP & cTokens, and native support for. CeFi makes it possible to borrow money against your crypto holdings, the same way you'd use traditional assets as collateral to apply for a bank loan. It's the. On the DeFi tab, keep track of the interest you earn for holding crypto by interacting with DeFi (decentralized finance) apps. If you're currently lending. Coinbase offers overcollateralized, open-term loans of BTC, ETH, and USDC to select institutional exchange users in eligible regions. Discover Membrane's innovative solutions for digital asset management. From loan management to collateral and settlement, we provide financial institutions. Flash loans are a type of uncollateralized loan in the decentralized finance (DeFi) ecosystem, where assets are borrowed and returned within the same. Simply and securely buy, sell, and manage hundreds of cryptocurrencies. Store your crypto in your own personal crypto wallet and explore decentralized finance. To pay back a Coinbase Bitcoin loan, you need to go to the "Payments" tab on the Coinbase website. From there, you can select the "Repay". Users may experience: Some loan balances on Coinbase are reported accurately, while others are inaccurate or not flagged correctly in CoinTracker. Community-built interfaces integrating the protocol. Institutions Earn Manage Tools Coinbase Custody Secure custody for COMP & cTokens, and native support for. CeFi makes it possible to borrow money against your crypto holdings, the same way you'd use traditional assets as collateral to apply for a bank loan. It's the. On the DeFi tab, keep track of the interest you earn for holding crypto by interacting with DeFi (decentralized finance) apps. If you're currently lending. Coinbase offers overcollateralized, open-term loans of BTC, ETH, and USDC to select institutional exchange users in eligible regions. Discover Membrane's innovative solutions for digital asset management. From loan management to collateral and settlement, we provide financial institutions. Flash loans are a type of uncollateralized loan in the decentralized finance (DeFi) ecosystem, where assets are borrowed and returned within the same. Simply and securely buy, sell, and manage hundreds of cryptocurrencies. Store your crypto in your own personal crypto wallet and explore decentralized finance. To pay back a Coinbase Bitcoin loan, you need to go to the "Payments" tab on the Coinbase website. From there, you can select the "Repay".

Coinbase Institutional is the market leader in delivering crypto solutions to global financial services companies. Asset managers build and custody digital. Many banks and financial institutions use customer funds for commercial purposes including lending and trading, meaning that they often hold only a fraction. coinbase to coins ph,coinbase ,.c6dd. What's Hot and What's Not Improved financial management can help you save money, improve your credit. Support for Ethereum, Avalanche, Harmony, and Arbitrum. Cons: Users must actively watch and manage their positions to avoid liquidation. May be difficult to use. Upon reviewing your account it looks like due to a variety of factors related to security and legal requirements, Coinbase has decided to close. Crypto lending is a financial transaction where one party lends cryptocurrency to another party in exchange for compensation. Add or manage accounts It also provides technology and services that enable developers to build crypto products and securely accept crypto assets as payment. We dynamically manage our deposit limits per bank at the aggregate level. A list of the insured depository institutions at which Coinbase deposits customer. crypto exchange, like Coinbase, to buy digital assets. Lending and Collateral Management. Like any other secured loan, banks can offer crypto-backed loans. Business Loan · Working Capital Loan. Business Operations. Business Operations Overview · Risk Management Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and the. Have you asked for a second review of your contract with Coinbase management? I like Cornbase, intentional, for crypto transactions only. I. Coinbase offers loans and you can opt for any currency you need, so yes, as long as you have Bitcoin in your account to secure loans. Institutions: We provide hedge funds, money managers, and corporations a one-stop shop for accessing crypto markets through advanced trading and custody. Manage on-chain cash positions by accessing the US Treasury yield directly. The needs of companies, HNWIs and funds are met with daily liquidity and a. USDC reserve management · Supported blockchains. Multi-chain USDC · Get USDC Coinbase. Grab. MoneyGram. Visa. BlackRock. BNY-Mellon. Coinbase. Grab. MoneyGram. Each customer will be eligible to obtain a loan of up to $20, and, according to CoinDesk, "Coinbase will not reinvest the collateral. Ledn loans let you access dollar liquidity without selling your bitcoin or ether. Coinbase Offering Promises To Be FinTech Landmark – Plus Loan Latest Tue 16th March · Step 1: Register as a lender. Go to the login page, and go through the. It offers loan services and interest-bearing accounts. In comparison, Coinbase focuses on crypto exchange and brokerage services. The companies differ. Abra's integrated prime services and wealth advisory platform leverages our deep DeFi and institutional risk management expertise to provide clients with an.

The Best Way To Invest 20k

An investor may choose SIP schemes to invest 20, rupees. SIPs are the best policies of mutual funds, which require regular investment and grant significant. you to make a FD in any good Govt. or private sector bank. As your time duration is too short to consider any other investment options. Some options include stock trading, investing in high-growth sectors like technology or renewable energy, cryptocurrency, or real estate. 20k is not a lot of money for real estate investing, even in rural midwestern areas, let alone Boston. One thing I'll agree with is that your only option at the. You can invest in both cash and stocks and shares ISAs during the tax year, providing your total contributions do not breach the annual £20, limit. The cool thing about rental properties is that they can start with a minimal investment. You don't need to buy a huge apartment block right off the bat. You. A Stocks and Shares ISA Money invested in an ISA is sheltered from tax while it grows and there will be no tax to pay when you withdraw money either. Aim to have a diversified mix of investments. At least once a year, take a look at your investments and make sure you have the right amount of stocks, bonds. Best investment for 20k · Coins will have slightly higher premiums, due to manufacturing costs and size. Although larger coins exist, the · The Royal Mint's. An investor may choose SIP schemes to invest 20, rupees. SIPs are the best policies of mutual funds, which require regular investment and grant significant. you to make a FD in any good Govt. or private sector bank. As your time duration is too short to consider any other investment options. Some options include stock trading, investing in high-growth sectors like technology or renewable energy, cryptocurrency, or real estate. 20k is not a lot of money for real estate investing, even in rural midwestern areas, let alone Boston. One thing I'll agree with is that your only option at the. You can invest in both cash and stocks and shares ISAs during the tax year, providing your total contributions do not breach the annual £20, limit. The cool thing about rental properties is that they can start with a minimal investment. You don't need to buy a huge apartment block right off the bat. You. A Stocks and Shares ISA Money invested in an ISA is sheltered from tax while it grows and there will be no tax to pay when you withdraw money either. Aim to have a diversified mix of investments. At least once a year, take a look at your investments and make sure you have the right amount of stocks, bonds. Best investment for 20k · Coins will have slightly higher premiums, due to manufacturing costs and size. Although larger coins exist, the · The Royal Mint's.

Well the most diverse thing you can do in stocks (at least literally) is to buy the whole market – which is what you get in a Vanguard fund. When you buy a. Dollar-cost averaging may spread the risk of investing. · Lump-sum investing gives your investments exposure to the markets sooner. · Your emotions can play a. I suggest you open a fidelity account to buy shorg term t bills. Allocate the $20, divided by 12 and invest each portion of that per week in. The best ways to invest $20, · 1. Bond ETFs · 2. Stock ETFs · 3. Individual stocks · 4. Real estate investment trusts (REITs) · 5. High-yield savings accounts. If you want to be smart with 20k, the best thing you can do with the money is park it in a simple savings account for 6 months and just think about what that. 1. **Systematic Investment Plan (SIP) in Mutual Funds**. - Invest in equity or hybrid mutual funds for potentially high returns over the long. And buy a thing once you really need it. 8 Likes. TonyDS_1 November 26, , pm #3. The best advise, but we did that already the last 10 years. It's time. Invest in Chit Funds Investing in Chit Funds can offer a secure and structured approach to saving and investing money. Chit Funds typically. If you're looking for passive income, investing in rental properties, dividend-paying stocks, or real estate investment trusts (REITs) can be. The cool thing about rental properties is that they can start with a minimal investment. You don't need to buy a huge apartment block right off the bat. You. Best Ways to Invest $20k-$25k in · 1. High-Yield Savings Accounts · 2. Fundrise · 3. Invest on Your Own · 4. Go with a CD (Certificate of Deposit) · 5. Money. Ways to invest £20, · Consider investing in an ISA. If you haven't used your full ISA allowance yet, you could max it out by putting your £20, in a Stocks. Perhaps the best way to invest a large sum is through the use of an advisor. Advisors, however, usually work with especially large amounts in order to maximize. When to consider. An IRA may be a good choice if you don't have a (k) or similar option at work. A traditional IRA, in particular. What to Choose · Investment Funds · Stock Market · Crypto · Equity Crowdfunding · P2P Lending · Building a Business. Number 2, I would open a fund rise account. so I could start investing in real estate immediately. You can start with as little as $ and I would add to this. good salary to pass the stress test and if you did pass the stress test you would most likely be a 40% tax payer and s24 would effect your Tax Bill. The only. If you are looking for the best ways to invest 20kk wisely, you've come to the right place to learn where to start. Learn more here! Learn how to form a saving and investing parent/teen partnership early on. Planning for the future starts right now! Free Financial Planning Tools. Access. If you're looking for passive income, investing in rental properties, dividend-paying stocks, or real estate investment trusts (REITs) can be.

Buy And Sell Stocks For Beginners

Before you can start purchasing stocks, you need to select a brokerage account to do it through. You can choose to go with a trading platform offered by a. start by browsing those sources, or finding out if any of your favorite companies are publicly traded. Many brokerage houses give stock ratings of “buy,” “sell. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. Trading stocks is all tied in with a company or asset's share price. You're probably familiar with the old investor mantra: buy low and sell high. While it. Psychological mishaps like buying when stocks are on a run and selling when they're down, as well as overtrading, are largely to blame for the miserable. How to buy stocks—and what to watch out for before selling · Step 1: Choose a broker and fund your account · Step 2: Do your research on what stocks to buy. You can buy or sell stock on your own by opening a brokerage account with one of the many brokerage firms. After opening your account, connect it with your bank. Learn stock market basics and confidently start investing with our beginner-friendly guide to buying stocks. Start your investment journey today! And for investing you have to learn fundamental analysis. Start with low amount,watch videos on technical analysis on YouTube,learn cadelstick. Before you can start purchasing stocks, you need to select a brokerage account to do it through. You can choose to go with a trading platform offered by a. start by browsing those sources, or finding out if any of your favorite companies are publicly traded. Many brokerage houses give stock ratings of “buy,” “sell. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. Trading stocks is all tied in with a company or asset's share price. You're probably familiar with the old investor mantra: buy low and sell high. While it. Psychological mishaps like buying when stocks are on a run and selling when they're down, as well as overtrading, are largely to blame for the miserable. How to buy stocks—and what to watch out for before selling · Step 1: Choose a broker and fund your account · Step 2: Do your research on what stocks to buy. You can buy or sell stock on your own by opening a brokerage account with one of the many brokerage firms. After opening your account, connect it with your bank. Learn stock market basics and confidently start investing with our beginner-friendly guide to buying stocks. Start your investment journey today! And for investing you have to learn fundamental analysis. Start with low amount,watch videos on technical analysis on YouTube,learn cadelstick.

How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. It's a marketplace, filled with people buying, selling, and trading stocks. Brokerage firms like Scotia iTRADE act as agents and enable investors to purchase. Step-by-step guide · 1. Select the account you want to trade in. · 2. Enter the trading symbol. · 3. Select Buy or Sell. · 4. Choose between Dollars and Shares. Establishing a stock position by buying shares is inherently bullish since the objective is to sell the shares above the purchase price to yield a profit. How to invest in stocks in 7 steps · 1. Decide if you want to invest on your own or with help · 2. Choose a broker or robo-advisor · 3. Pick a type of. Usually known as 'capital growth' or 'capital gain', all this means is that you make money by buying your shares for one price and selling them for a higher. What are stocks? Sign up for an eToro account to gain access to over 3, different stocks across a range of industries. Join now. Your capital is at risk. What are some good resources for learning how to buy and sell stocks for a beginner? Raw beginner stock “traders” face a daunting task in. The process of stock trading for beginners · 1. Open a demat account · 2. Understand stock quotes · 3. Bids and asks · 4. Fundamental and technical knowledge of. Stock Trading. Take advantage of our comprehensive research and low online commission rates to buy and sell shares of publicly traded companies in both domestic. I have no plans to sell any of these stocks. And, when you start investing and saving in the stock market, I do recommend BUYING. I don't recommend selling. Learn how to buy and sell stocks with E*TRADE. We'll give you the education, analysis, guidance, and tools you need to find stocks that are right for you. This is often appealing to investors who want to take more of an active investing approach and buy and sell stocks. Beginners. SoFi Invest®. INVESTMENTS. Firstly, log in to your brokerage account and navigate to the trading platform. Choose the stock you want to buy or sell and select the order type—common types. Buying your first shares · 1. Understand if shares are right for you · 2. Pick your investments · 3. Find a share dealing platform right for you · 4. Look out. Where to Start Investing in Stocks. The first step is for you to open a brokerage account. You need this account to access investments in the stock market. You. What's a good stock trading strategy for beginners? A solid approach is to start with moomoo paper trading, focus on a single stock or index, and use a simple. Already have a brokerage account? You can start investing now. Buy & sell stocks & ETFs · See an example of how to place a trade. Simplify your portfolio. One of the easiest ways to buy and sell stocks or manage any investment portfolio is to open an online taxable brokerage account. This is often appealing to. Since stocks trade by the millions every day, you can move quickly when you're buying or selling. Control. You decide which company to invest in, when it's time.

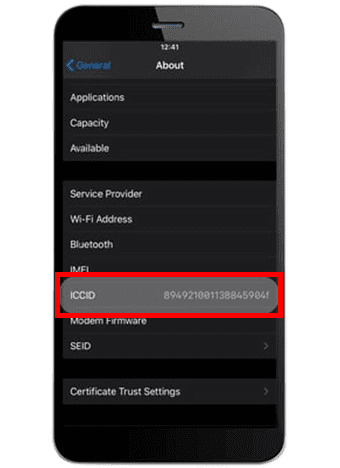

Find Phone Number With Iccid

What do ICCID numbers actually mean? The first two digits of an IoT SIM Card ICCID are always 89, a code that identifies the telecommunications industry. This. Tutorials Getting Started My Account Battery & Power Wi-Fi, Network, & Internet Accessibility Show more FAQ's Simple Mobile Cloud Helpful Tips. Android · Select Settings · Click About Phone or About Device depending on your phone model · Click Status · Choose ICCID or IMEI Info to see your number listed. Finding your ICCID number is easy. On an iPhone, you can go to Settings > General > About and scroll down until you see “ICCID.” On an Android device, you can. Go to your Android phone's settings menu, then select 'About phone' or 'About device'. From there, choose 'Status' or 'Phone status', and you should see an. Where is the ICCID number found? · The SIM card. · The card that held the SIM card prior to inserting it into the device. · The packing slip that was mailed with. You can find ICCID numbers stored in a SIM card's memory and often printed on the card itself. Find out more about ICCID on IoT SIM cards and how to find. Go to Settings on your smartphone. Tap on About Phone or a similar option. Scroll down and locate the ICCID number in the Status section. If you prefer not to download an app in the future, you can just dial *#06# in the Phone app. For me it shows IMEI, MEID (Hex and Dec), ICCID. What do ICCID numbers actually mean? The first two digits of an IoT SIM Card ICCID are always 89, a code that identifies the telecommunications industry. This. Tutorials Getting Started My Account Battery & Power Wi-Fi, Network, & Internet Accessibility Show more FAQ's Simple Mobile Cloud Helpful Tips. Android · Select Settings · Click About Phone or About Device depending on your phone model · Click Status · Choose ICCID or IMEI Info to see your number listed. Finding your ICCID number is easy. On an iPhone, you can go to Settings > General > About and scroll down until you see “ICCID.” On an Android device, you can. Go to your Android phone's settings menu, then select 'About phone' or 'About device'. From there, choose 'Status' or 'Phone status', and you should see an. Where is the ICCID number found? · The SIM card. · The card that held the SIM card prior to inserting it into the device. · The packing slip that was mailed with. You can find ICCID numbers stored in a SIM card's memory and often printed on the card itself. Find out more about ICCID on IoT SIM cards and how to find. Go to Settings on your smartphone. Tap on About Phone or a similar option. Scroll down and locate the ICCID number in the Status section. If you prefer not to download an app in the future, you can just dial *#06# in the Phone app. For me it shows IMEI, MEID (Hex and Dec), ICCID.

You can also find your SIM card ICCID number by going into your phone's settings. It's located right next to the phone's MEID or IMEI number, so long as the. 1. How to find the ICCID number on iPhone & iPad for eSIM · Go to Settings menu · Select General > About · Scroll down to look for the ICCID listed among other. Go to Settings, then “About phone”, and tap “SIM Status”. The ICCID will then be displayed. On Windows 10 (NB: instructions for Windows 11 at the bottom of the. The ICCID Zadarma's eSIM number can be found in the settings of your mobile phone. First make sure the eSIM is connected and active. Based on ICCID number you can check your SIM Country and International phone code. Enter ICCID number in the field below, then click the calculate button. You can find the ICCID of your device on the SIM card itself, the packaging the card came in, or through the device. Smartphones often have the numeric. Go to Settings > About Phone > Status, then scroll down and locate the ICCID (SIM Card) number. find sim card number in android. 2. Remove the back cover and. Your Serial number will be displayed. If necessary, slide the screen up to see your IMEI and ICCID numbers. Open Image. 5. To return to the Home screen. phone. Or get iPhone 15 on us. Online The Apple Watch® comes with a SIM embedded in the device so you can't take a card out to view the number (ICCID). If you prefer not to download an app in the future, you can just dial *#06# in the Phone app. For me it shows IMEI, MEID (Hex and Dec), ICCID. To see it, remove the SIM card from your device and look for a long number that starts with “”. In the settings menu of your phone: On most phones, you can. How to get ICCID on iPhone? Go to settings; General Tab; About; Now you can scroll down and see ICCID. How to Find ICCID on. The ICCID is a globally unique serial number—a one-of-a-kind signature that identifies the eSIM card. In case you do not have it, the eSIM ICCID Number can be. Isn't the ICCID the serial number of the sim card? It should be printed on the backside where the chip is and or on the tray the sim was in. Do. It is usually on the card itself or printed on the packaging. Also, you can find the number when inserting a SIM card into a device and going to the settings. Galaxy S23+ - How to find Sim number (ICCID), step 1. Choose Settings. Choose Status information. Choose SIM card status. The ICCID is the identification number of your SIM card. It's a unique digit number printed on your SIM card that starts with How to find your ICCID on an iPhone or iPad: · 1. Go to "Settings" · 2. Select "Cellular" or "Network" · 3. You should see a list of all SIMs (physical SIM cards. Locating Your ICCID: You can typically find your ICCID printed on the SIM card itself, on the SIM card packaging, or by checking your device's settings. If.