bss64.ru

Overview

Learning About Facebook Ads

In summary, here are 10 of our most popular facebook ads courses · How to Set Up a Facebook Ads Campaign: Coursera Project Network · Get Started with Facebook Ads. FACEBOOK ADS8 lectures • 4hr 17min · The Complete Facebook Ad Copy + Creative Guide · Facebook Ads Funnel by Coursenvy · The Ultimate Guide to Creating Facebook. Learn how to create Facebook ads in this step-by-step guide to Meta's powerful advertising tool, Facebook Ads Manager. After logging into Ads Manager, you'll see your dashboard. To create a new campaign, ad set, or ad, click the Create button. Find the best, free online courses and guides to learn how to get your first ad up and running with Facebook Ads Manager. 1. Meta Blueprint · 2. God Tier Facebook Ads · 3. CXL – Facebook Ads · 4. Facebook Ads – Dollar a day course · 5. PHC with Jon Loomer · 6. AdEspresso University · 7. Meta Blueprint helps you learn the digital skills you need to move your business forward. Discover online courses and training to improve your Facebook and. Tools like Facebook Business Insights Suite and Facebook Pixel help create paid targeted ads and gather data for future advertising strategies. Learning. Explore courses from experienced, real-world experts. Most popular. Facebook Ads & Facebook Marketing MASTERY | Coursenvy. Facebook Marketing from. In summary, here are 10 of our most popular facebook ads courses · How to Set Up a Facebook Ads Campaign: Coursera Project Network · Get Started with Facebook Ads. FACEBOOK ADS8 lectures • 4hr 17min · The Complete Facebook Ad Copy + Creative Guide · Facebook Ads Funnel by Coursenvy · The Ultimate Guide to Creating Facebook. Learn how to create Facebook ads in this step-by-step guide to Meta's powerful advertising tool, Facebook Ads Manager. After logging into Ads Manager, you'll see your dashboard. To create a new campaign, ad set, or ad, click the Create button. Find the best, free online courses and guides to learn how to get your first ad up and running with Facebook Ads Manager. 1. Meta Blueprint · 2. God Tier Facebook Ads · 3. CXL – Facebook Ads · 4. Facebook Ads – Dollar a day course · 5. PHC with Jon Loomer · 6. AdEspresso University · 7. Meta Blueprint helps you learn the digital skills you need to move your business forward. Discover online courses and training to improve your Facebook and. Tools like Facebook Business Insights Suite and Facebook Pixel help create paid targeted ads and gather data for future advertising strategies. Learning. Explore courses from experienced, real-world experts. Most popular. Facebook Ads & Facebook Marketing MASTERY | Coursenvy. Facebook Marketing from.

Learning to use Facebook Ads enables you to have control over your spending on Social Media, get clear insights about the performance of your Facebook Ads. Our machine learning models are part of our ads delivery system that learns as it receives new information, without being explicitly programmed. This allows the. Facebook also has analytical tools through the Facebook Business Insights Suite. This can help you create paid targeted ads through Facebook Ads, or you can use. Participants will learn how to craft compelling ad content, choose the right ad formats, and utilize Facebook's extensive targeting capabilities to reach. The learning phase occurs when you create a new ad or ad set or make a significant edit to an existing one. The Delivery column reads "Learning" when an ad set. Free Course – Free Facebook Ads Course with Certificate (Simplilearn) · Free Course – Facebook Advertising for Beginners (Alison) · Free Course – Introduction to. Show ads to people likely to be interested in your business and get more messages, video views or post engagement. right arrow icon Learn about engagement ads. Great Learning brings you an opportunity to learn how to build “Facebook Ads” to put a word across a wider community. You will earn a free Facebook Ads. What you'll learn · Connect with new audiences and lower your ad costs via Facebook Ads! · Mass post quickly to various social media networks! · MASTER Facebook. During the learning phase, the delivery system is exploring the best way to deliver your ad set – actively trying different audiences, placements and more. 1. Create a Facebook Ads Manager account · 2. Start a new campaign · 3. Choose your objective · 4. Set a budget and schedule · 5. Select a target audience · 6. Our Facebook Ads Manager online training courses from LinkedIn Learning (formerly bss64.ru) provide you with the skills you need, from the fundamentals to. Learn how to launch your Facebook Ad campaign and target your ideal Facebook audience in this Facebook Ads for Beginners free online course. This module focuses on Facebook and how the platform's features can be leveraged by digital marketers to develop a successful marketing strategy. The Facebook ads learning phase is really a important part of Facebook's ad set optimization process. It usually lasts until 50 optimization events have been. Make sure you have a Facebook Business Page. Once you create a Page, you'll automatically have an Ads Manager account. View your ad account settings to confirm. Learn why Facebook Ads is an essential marketing tool and how you can become an expert at Facebook Ads and ensure that they reach their target audience. Advertising with Facebook is an influential way to reach your audience. Learn how to create a simple ad campaign for your organization that is in line with. You'll learn more about this in later lessons. Page Module 3 Lesson 2: The Basics. Social Media.

What Information Should Be Included In A Business Plan

Any external professionals, such as lawyers, valuers, architects, and consultants, that the company will need should also be included. If the company intends to. Your business plan should be treated as a birth certificate or formal constitution. This document lays out, in explicit detail, every aspect of what you hope. It covers aspects like market analysis, financial projections, and organizational structure. Ultimately, a business plan serves as a roadmap for business growth. Don't misunderstand me: business plans should include some numbers. But those numbers should appear mainly in the form of a business model that shows the. It may include a table of contents, company background, market opportunity, management overviews, competitive advantages, and financial highlights. It's. What is a business proposal? · Who are you? What does your company do? · What problems are your prospective customers facing? · What solution does your company. Include how much time, effort and resources you've invested in the business so far. “You should get really detailed about what you've accomplished to date,”. trademarks or service marks should be included. The first financial projection within the business plan must be formed utilizing the information. It must contain sound numbers for market size, trends, company goals, spending, return on investment, capital expenditures, and funding required. For new. Any external professionals, such as lawyers, valuers, architects, and consultants, that the company will need should also be included. If the company intends to. Your business plan should be treated as a birth certificate or formal constitution. This document lays out, in explicit detail, every aspect of what you hope. It covers aspects like market analysis, financial projections, and organizational structure. Ultimately, a business plan serves as a roadmap for business growth. Don't misunderstand me: business plans should include some numbers. But those numbers should appear mainly in the form of a business model that shows the. It may include a table of contents, company background, market opportunity, management overviews, competitive advantages, and financial highlights. It's. What is a business proposal? · Who are you? What does your company do? · What problems are your prospective customers facing? · What solution does your company. Include how much time, effort and resources you've invested in the business so far. “You should get really detailed about what you've accomplished to date,”. trademarks or service marks should be included. The first financial projection within the business plan must be formed utilizing the information. It must contain sound numbers for market size, trends, company goals, spending, return on investment, capital expenditures, and funding required. For new.

The financial section should outline: The amount necessary to start or maintain the business; The amount needed over the next two, three, and even five years. This should include a title, your organization name, and accessible contact information (phone/fax/e-mail). The title should reflect the nature of your plan. The company description provides a snapshot of your business. Check out the 11 components to include in this section of your business plan. Financial plans and projections: Established businesses should include financial statements, balance sheets, and other relevant financial information. New. An effective business plan contains 10 key components. Executive summary. The mission statement and highlights of what the plan will cover are included in this. Include how much time, effort and resources you've invested in the business so far. “You should get really detailed about what you've accomplished to date,”. The suggested contents of a business plan are: • executive summary;. • history of the business;. • management and personnel;. • markets and competition;. •. The company description should be written after the executive summary, and it should be brief and concise. Page 6. 5. Section 3: Industry Analysis. An industry. Developing a business plan is the process of putting the key ideas of your business into a concise written document. Business plans vary depending on the. The key sections that need to be included are an executive summary, company description, market analysis, organization and management team. Typically, it should present whatever information an investor or financial institution expects to see before providing financing to a business. Contents of a. The suggested contents of a business plan are: • executive summary;. • history of the business;. • management and personnel;. • markets and competition;. •. A business plan is a written document that describes your business. It covers objectives, strategies, sales, marketing and financial forecasts. Show your financial history from the last five years (if applicable). Include your projections for the next five years. This first year should show projects on. The business plan should be a The analysis should be based on the most current data available, and the sources of information should be referenced. Before you can think about opening the doors to your new enterprise, you'll need to develop a solid business plan. A business plan is a written document. Your company overview is your one-page business plan. It is similar to the executive summary but should be one page. The business description should include. Company information: Include a short statement that covers when your business should not be included with the main body of your business plan. Specific. Basically, it's a thorough description of who your customers are and why they need what you're selling. You'll also include information about the growth of your. What a business plan should include · An executive summary - this is an overview of the business you want to start. · Your vision and business idea - a short.

How To Save Money For Retirement At 40

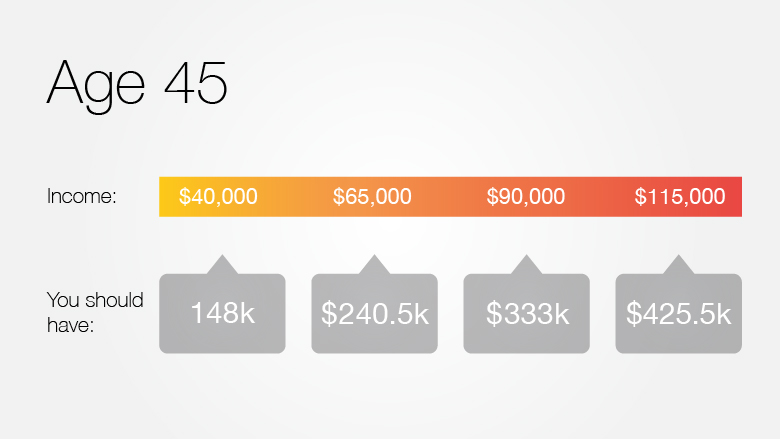

Saving for retirement might be the most important thing you ever do with your money. And the earlier you begin, the less money it will take! 4 minute read. As the saying goes, “The number one tip for retirement savings is to start saving for retirement.” In other words, the first and most effective step you can. Early retirees should aim to save half their income, max out retirement account contributions and invest in dividend-paying stocks. A retirement savings account can supplement your NYSLRS pension and Social Security and help you reach that income-replacement goal. 7. Start saving for your retirement as early as possible. Few people get rich through their wages alone. It's the miracle of compound interest, or earning. Most year-olds have started saving for retirement, but many don't know exactly how much they've saved or how much they'll need at retirement. How to save and build wealth in your 40s · 1. Emergency fund · 2. A debt-free plan · 3. Save for retirement at 40 · 4. Investing in your 40s outside of non-. That means that if you earn $50, a year, you should have $, in retirement savings by the time you're The Thrivent retirement income planning. At age 40 with no retirement savings, you are way behind on retirement savings. But you still have time and having no debt is a plus. Saving for retirement might be the most important thing you ever do with your money. And the earlier you begin, the less money it will take! 4 minute read. As the saying goes, “The number one tip for retirement savings is to start saving for retirement.” In other words, the first and most effective step you can. Early retirees should aim to save half their income, max out retirement account contributions and invest in dividend-paying stocks. A retirement savings account can supplement your NYSLRS pension and Social Security and help you reach that income-replacement goal. 7. Start saving for your retirement as early as possible. Few people get rich through their wages alone. It's the miracle of compound interest, or earning. Most year-olds have started saving for retirement, but many don't know exactly how much they've saved or how much they'll need at retirement. How to save and build wealth in your 40s · 1. Emergency fund · 2. A debt-free plan · 3. Save for retirement at 40 · 4. Investing in your 40s outside of non-. That means that if you earn $50, a year, you should have $, in retirement savings by the time you're The Thrivent retirement income planning. At age 40 with no retirement savings, you are way behind on retirement savings. But you still have time and having no debt is a plus.

Financial Goals for Your 40s · Pay off as much of your credit card and consumer debt as possible · Ensure your emergency fund is ready and available if and when. By age 40, you should have accumulated three times your current income for retirement. So how much money do you need to save for retirement? It's a question. Planning for the future involves setting a retirement goal and saving money. Step one is to figure out how much savings you'll need to live comfortably after. 8 Financial To-Dos in your 40s · 1. Enlist the help of a financial advisor. · 2. Draw up or revisit a will and/or a trust. · 3. Take advantage of retirement catch-. The sooner you start saving, the more time your money has to grow (see the replace 40 percent of pre-retirement income for retirement beneficiaries. By the time you reach your mids, experts recommend that you aim higher—saving twice your annual salary by the time you hit 35 and three times your annual. Things to do: · Within your budget, aim to save 10 – 15% of your income for retirement. If you can't do this, just start by saving what you can. Even saving a. Fidelity's guideline: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by · Factors that will impact your personal savings. Start early and establish good investing habits. If you're under 40, you still have many years to contribute toward your retirement and handle the ups and downs. This assumes an approximately to year working career during which you are actively saving money for your retirement, such as between ages 25 and So. You figure out a way to save $/month, earn more or spend less. At a 4% compounded savings rate, you'll have @$, by age If you buy. One rule of thumb recommends multiplying your desired annual income in retirement by 25 to come up with a savings goal. So, if you want to have $50, a year. Set up an emergency fund — Have enough money in the bank to cover three to six months of your expenses and avoid dipping into your (k) for an emergency. More. For example, you may be planning to retire later or expect your spending to decrease in retirement. A financial advisor can help you develop a more precise goal. A general rule of thumb recommended by many financial advisors is to have about three times your annual salary saved in retirement money by the time you're To retire at 40 and live comfortably on an annual income of $50,, you would need to have saved approximately $ million by the time you end your career. Best Retirement Plans for your 40s · National Pension Scheme. Can't make up your mind what product to invest in? · Mutual Funds. The importance of investing in. Many savers assume they'll need less income in retirement because they'll no longer be saving for retirement. A $2 million portfolio with 60% stocks and 40%. Having a decent emergency savings of three to six months of living expenses could keep you from needing to tap into money from your retirement savings. To retire comfortably, you ultimately need to have at least 25X your annual expenses or 20X your average annual income covered. If you don't save or accumulate.

Secure Cloud For Business

Get powerful and secure cloud storage with Dropbox. Access your files from multiple devices, whether you're at work, at home, or on the road. Learn more. FileCloud supports hyper-secure file sharing internally or externally, on premises or in the cloud. Users within the enterprise can access files directly, with. The intelligent Content Cloud makes it easy to automate workflows, collaborate internally and externally, and protect your sensitive data. Cloud security is the set of strategies and practices for protecting data and applications that are hosted in the cloud. Increase your file sharing security by requiring a special code, delivered via verified mobile device, when signing into Onehub. Business and Enterprise plans. Additionally, organizations can feel secure that our enterprise-grade encrypted cloud security policies of business and international regulations, such. If it's a truly "small" business, Google's services are great, and cheap (unless you need Office). But Google's Workspace equivalent's are pretty good too. Get it now. Start your secure access, sharing, and file storage with OneDrive today. · Talk with sales. Speak with a sales specialist to learn more. · Chat with. You should take a look at Tresorit. Top security, very good collaboration tools and user management and the apps are built very well. Not the. Get powerful and secure cloud storage with Dropbox. Access your files from multiple devices, whether you're at work, at home, or on the road. Learn more. FileCloud supports hyper-secure file sharing internally or externally, on premises or in the cloud. Users within the enterprise can access files directly, with. The intelligent Content Cloud makes it easy to automate workflows, collaborate internally and externally, and protect your sensitive data. Cloud security is the set of strategies and practices for protecting data and applications that are hosted in the cloud. Increase your file sharing security by requiring a special code, delivered via verified mobile device, when signing into Onehub. Business and Enterprise plans. Additionally, organizations can feel secure that our enterprise-grade encrypted cloud security policies of business and international regulations, such. If it's a truly "small" business, Google's services are great, and cheap (unless you need Office). But Google's Workspace equivalent's are pretty good too. Get it now. Start your secure access, sharing, and file storage with OneDrive today. · Talk with sales. Speak with a sales specialist to learn more. · Chat with. You should take a look at Tresorit. Top security, very good collaboration tools and user management and the apps are built very well. Not the.

Secure Cloud Services provides managed cloud hosting for the software solutions you use to manage your business. It's not quite perfect, but it's one of the best in the business. In our review (linked below), we said that “it offers intelligent, reliable, secure file. SailPoint's Identity Security Cloud solution enables organizations to manage and secure real-time access to critical data and applications for every enterprise. Establish a modern workplace for better data sharing, collaboration, flexibility, and remote work. Reduce risks caused by human error and security-related. Take control of your data with Tresorit's ultra-secure encryption for cloud storage, encrypted file sharing & storage, and e-signature solutions. Cloud security is a discipline of cyber security dedicated to securing cloud computing systems. This includes keeping data private and safe across. Use Google Drive for secure business and enterprise online storage. Get unlimited Drive as part of Google Workspace to store, access, and share files. Description. The Secure Cloud Business Applications (SCuBA) project provides guidance and capabilities to secure agencies' cloud business application. 1. pCloud · Zero-knowledge encryption is available · TLS/SSL encryption for file transfers · Choice of 2 server locations (US & EU) · Business and Family plan. Additionally, organizations can feel secure that our enterprise-grade encrypted cloud security policies of business and international regulations, such. Cloud-based storage services for your business, all running on Google Cloud's infrastructure. If you're a consumer looking for file sharing, use Google Drive. Large-scale data breaches are becoming more common, with businesses faced with the disruptive loss of sensitive data. We're not immune at home, either, due to. Free, encrypted, and secure cloud storage · Encrypted cloud storage for all your files · Swiss privacy · Collaborate on documents while protecting your privacy. 1. pCloud · Zero-knowledge encryption is available · TLS/SSL encryption for file transfers · Choice of 2 server locations (US & EU) · Business and Family plan. Enhanced data security. An end-to-end encrypted cloud storage platform, NordLocker Business allows you to securely store, manage, and share your data with. Small companies and medium-sized organizations face the same security and growth challenges that global enterprises do—with fewer resources. Cloud storage services are great in many ways. You can either use it for simply storing your photos and videos or for businesses. Here are some. Cloud services from AT&T Business lets you tap computing, storage, software, development and network resources on demand. Start your Cloud Transformation. Secure file storage and collaboration that helps you stay safe, secure and connected in the cloud Build client trust and set your business apart. Secure. Cloud security is the set of strategies and practices for protecting data and applications that are hosted in the cloud.

Free Market Meaning

A market is free if people can buy and sell whatever they want without any interference from a government, and if prices are set by supply and demand. A free market economy is an · The pursuit of profit drives businesses to operate efficiently and innovate. · The concept of a free market economy emerged from the. A free market is a self-regulated economy that runs on the laws of demand and supply. In a truly free market, a central government agency does not regulate any. Contrary to popular narratives, early market theorists believed that states had an important role in building and maintaining free markets. But in the. The free market is an economic system based on competition, with little or no government interference. What is a free market? A free market economy means one that is mostly driven by supply and demand and has little or no governmental interference. In a free. an economic system based on supply and demand, in which companies manage their own business, prices, profits, etc. without being controlled by government. Free markets are economic systems characterized by limited government intervention. In these markets, prices are subject to the law of supply and demand. an economic system in which prices and wages are determined by unrestricted competition between businesses, without government regulation or fear of monopolies. A market is free if people can buy and sell whatever they want without any interference from a government, and if prices are set by supply and demand. A free market economy is an · The pursuit of profit drives businesses to operate efficiently and innovate. · The concept of a free market economy emerged from the. A free market is a self-regulated economy that runs on the laws of demand and supply. In a truly free market, a central government agency does not regulate any. Contrary to popular narratives, early market theorists believed that states had an important role in building and maintaining free markets. But in the. The free market is an economic system based on competition, with little or no government interference. What is a free market? A free market economy means one that is mostly driven by supply and demand and has little or no governmental interference. In a free. an economic system based on supply and demand, in which companies manage their own business, prices, profits, etc. without being controlled by government. Free markets are economic systems characterized by limited government intervention. In these markets, prices are subject to the law of supply and demand. an economic system in which prices and wages are determined by unrestricted competition between businesses, without government regulation or fear of monopolies.

Considered to be the economic system closest to 'true' capitalism, a free market economy is driven by private ownership and consumer supply and demand. A market economy, however, depends on well-functioning markets. These include competitive product markets with relatively low barriers to new entrants, since. Free market economics is a system in which prices, wages, and profits are determined by the market forces of supply and demand, rather than government. This theory, free market fairness, is committed to both limited government and the material betterment of the poor. Unlike traditional libertarians, Tomasi. Free market” is a summary term for an array of exchanges that take place in society. Each exchange is undertaken as a voluntary agreement between two people. A free market is an economic system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. A market economy, also widely known as a "free market economy," is one in which goods are bought and sold and prices are determined by the free market, with a. Let's remember that the free market, by definition, is the voluntary exchange of goods or services between free individuals. Thus, to be more accurate, we. The cornerstones of economic freedom are (1) personal choice, (2) voluntary exchange coordinated by markets free to use, exchange, or give their property as. "When we call a capitalist society a consumers' democracy we mean that the power to dispose of the means of production, which belongs to the entrepreneurs and. A free market economy is one without government intervention or regulation. In a purely free market, buyers and sellers arrive at prices based only on supply. A free-market economy is one that does not experience government interference. Taxes, tariffs, and regulations either do not exist, or exist but at a minimal. In a Free Market Economy, the production of goods and services is determined by consumer demand, rather than by a central government. A free market is an economic system in which business organizations decide things such as prices and wages, and are not controlled by the government. A free market is one where prices are set by the free flow of supply and demand, rather than government intervention or monopolistic practices. This model is driven by supply and demand where there is perfect competition meaning Like any model, a free market is a simplification of markets in the real. Simply put, laissez-faire translates to “leave us alone” meaning that the government should remain out of the economy and instead allow individuals to freely. Free enterprise is an economic system where market forces determine prices, supply, and demand of goods and services without interference from the government. A market economy is an economic system in which the decisions regarding investment, production, and distribution to the consumers are guided by the price. Most people are generally referring an economy with open competition and only private transactions among buyers and sellers when they talk about the free market.

Hardship Withdrawal From 401k For Home Purchase

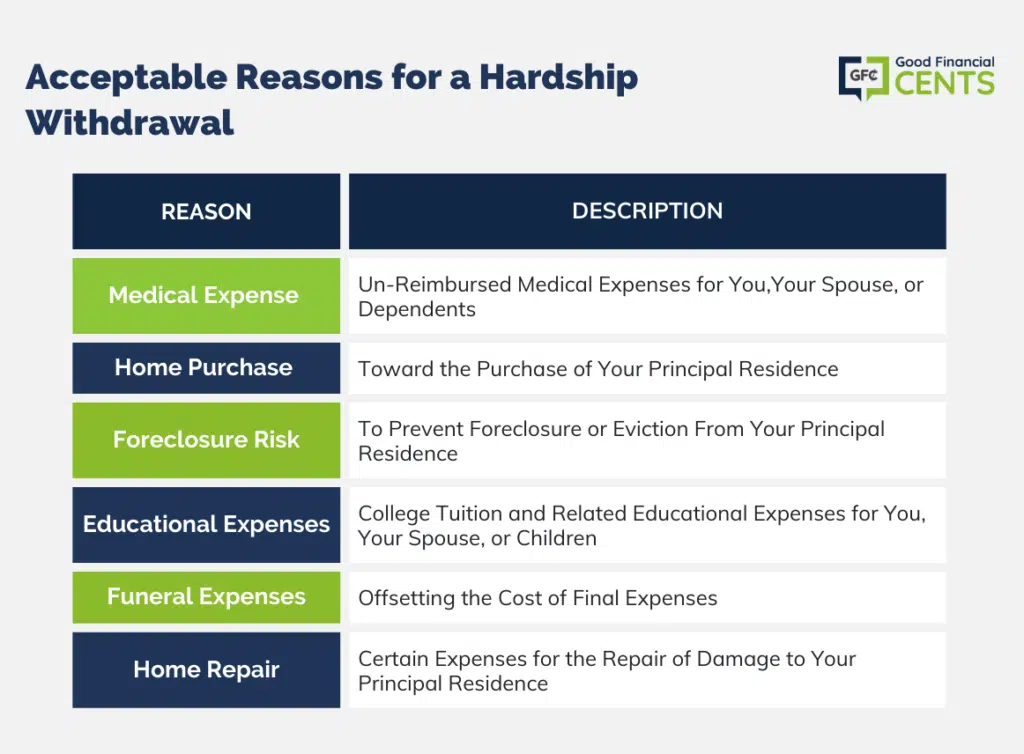

When to consider a loan. Taking a loan against your Merrill Small Business (k) account may seem to have advantages. After all, you'll be paying back. (k) Financial Hardship Withdrawals · pay for non-reimbursed medical expenses; · purchase of your primary residence; · prevent eviction from, or foreclosure on. You should be able to take a hardship withdrawal to purchase a primary residence. This avoids the 10% penalty, but not the tax issue. What is a hardship withdrawal? · Medical expenses incurred by the participant or the participant's spouse, dependents or beneficiaries. · The purchase of a home. When you total up the tax bill and the 10% early withdrawal penalty, the cost of this withdrawal option far outweighs the benefits. If You Have A Roth IRA. You take money directly from your (k) retirement plan under specific conditions known as hardship withdrawals. Fortunately, the IRS considers costs directly. For the hardship withdrawal scenario, a total of $20, is taken from the account so that 25% ($5,) of the withdrawal is set aside for tax withholdings and. Hardship withdrawals do not cover mortgage payments, but using a (k) for a down payment for a first-time home buyer could be allowed. The IRS has very strict. If your employer's plan allows for hardship distributions, the IRS allows individuals to take early withdrawals before age 59½ as a result of an “immediate and. When to consider a loan. Taking a loan against your Merrill Small Business (k) account may seem to have advantages. After all, you'll be paying back. (k) Financial Hardship Withdrawals · pay for non-reimbursed medical expenses; · purchase of your primary residence; · prevent eviction from, or foreclosure on. You should be able to take a hardship withdrawal to purchase a primary residence. This avoids the 10% penalty, but not the tax issue. What is a hardship withdrawal? · Medical expenses incurred by the participant or the participant's spouse, dependents or beneficiaries. · The purchase of a home. When you total up the tax bill and the 10% early withdrawal penalty, the cost of this withdrawal option far outweighs the benefits. If You Have A Roth IRA. You take money directly from your (k) retirement plan under specific conditions known as hardship withdrawals. Fortunately, the IRS considers costs directly. For the hardship withdrawal scenario, a total of $20, is taken from the account so that 25% ($5,) of the withdrawal is set aside for tax withholdings and. Hardship withdrawals do not cover mortgage payments, but using a (k) for a down payment for a first-time home buyer could be allowed. The IRS has very strict. If your employer's plan allows for hardship distributions, the IRS allows individuals to take early withdrawals before age 59½ as a result of an “immediate and.

Removing funds from your (k) before you retire because of an immediate and heavy financial need is called a hardship withdrawal. When taking a hardship withdrawal, the funds will be subject to income tax, and you may also need to pay a 10% early withdrawal penalty if you are under age Limited to two hardship withdrawals per plan year. Supporting documents. A purchase agreement or mortgage contract is needed for the purchase of a primary. Some employers allow (k) loans only in cases of financial hardship, but you may be able to borrow money to buy a car, to improve your home, or to use for. You can withdraw money from a (k) to buy a second house, but you will incur an early withdrawal penalty of 10% as well as taxes. The Bottom Line. The best. If you leave your company, you may be required to pay back the outstanding balance within 60 to 90 days or be forced to take it as a hardship withdrawal. Possible reasons for a (k) hardship withdrawal · Non-mortgage payment costs when you're buying a home that you'll use as your principal residence · Certain. Typically, when you withdraw funds from a (k) before age 59½, you incur a 10% penalty. This rule also applies if you withdrawn funds from your (k) for the. (k) Withdrawals · Costs related to the purchase of your primary residence, payments to prevent eviction from or foreclosure on your primary residence, and. The Pension Protection Act of August expands this option, allowing for similar hardship withdrawals from a retirement plan for any designated beneficiary. A hardship withdrawal isn't a loan and doesn't require you to pay back the amount you withdrew from your account. You'll pay income taxes when making a hardship. (k) Financial Hardship Withdrawals · pay for non-reimbursed medical expenses; · purchase of your primary residence; · prevent eviction from, or foreclosure on. Hardship withdrawals do exist to allow you to borrow money early under extenuating circumstances, but using a (k) hardship withdrawal for a home purchase isn. In addition, if a participant will immediately build a house, a hardship withdrawal can be taken for the purchase of the land on which the house will be built. A hardship withdrawal is basically taking out money from your (k) earlier or before retirement age which is set out by the IRS to be 59 1/2 years old. If you. In addition, if a participant will immediately build a house, a hardship withdrawal can be taken for the purchase of the land on which the house will be built. Even if you are able to avoid the 10% penalty with a “hardship” withdrawal, you will still have to pay the 20% in taxes on any money to take out of your (k). (k) Financial Hardship Withdrawals · pay for non-reimbursed medical expenses; · purchase of your primary residence; · prevent eviction from, or foreclosure on. Generally, you are allowed to borrow up to the lesser of 50% of your vested account balance or $50, Most k loans must be repaid within 5. No, withdrawing funds from your k for a down payment on a house and experiencing a failed home purchase will not typically result in criminal charges. It is.

Send And Receive Money For Free

Share this with your receiver for a fast cash pickup. Follow these steps to send money from a bank account: Log in or register for a free profile. Click 'Send. Send and request money with friends and family easily, no matter where they are in the world. All in a few taps. Check it out. Send money fast. Make your first money online transfer fee-free. Send money online or with our app to your loved ones around the world and back home today. Tell us who you are sending to, how they want to receive the money and how much you want to send. 3. Choose how to pay and send. You can either pay with your. Securely Pay Anyone through Chime in seconds – all they need is a valid debit card to claim their cash. No sign-up needed! Fee-free instant transfers. send or receive money in. Important: Before you can send or receive money in Google Pay, you must add a bank account. Zelle® is a fast, safe and easy way to send and receive money with friends, family and others you trust. Look for Zelle® in your banking app to get started. Join the millions of people who have trusted Remitly since to send money to friends and family overseas. More money makes it home to loved ones with. Use Zelle in the Capital One Mobile app to send and request money from friends and family with no fees from us. Discover how to use Zelle with Capital One. Share this with your receiver for a fast cash pickup. Follow these steps to send money from a bank account: Log in or register for a free profile. Click 'Send. Send and request money with friends and family easily, no matter where they are in the world. All in a few taps. Check it out. Send money fast. Make your first money online transfer fee-free. Send money online or with our app to your loved ones around the world and back home today. Tell us who you are sending to, how they want to receive the money and how much you want to send. 3. Choose how to pay and send. You can either pay with your. Securely Pay Anyone through Chime in seconds – all they need is a valid debit card to claim their cash. No sign-up needed! Fee-free instant transfers. send or receive money in. Important: Before you can send or receive money in Google Pay, you must add a bank account. Zelle® is a fast, safe and easy way to send and receive money with friends, family and others you trust. Look for Zelle® in your banking app to get started. Join the millions of people who have trusted Remitly since to send money to friends and family overseas. More money makes it home to loved ones with. Use Zelle in the Capital One Mobile app to send and request money from friends and family with no fees from us. Discover how to use Zelle with Capital One.

Zelle®: A fast and easy way to send money · There are no fees to send or receive money in our app · Money moves directly to their account in minutes · You only. Enjoy a $0 transfer fee* on your first transfer with Western Union®. Send money fast to Mexico and globally from the US, available 24/7. Send money, track. Send money to people you trust directly from your account to theirs — typically in minutes Easy. Send money using just an email address or US mobile number. Send money in minutes¹ from your account directly to friends, family, or others you trust. Safe. When you use Zelle® within the Schwab mobile app, your. Transfer funds quickly and securely with PayPal. Send money online to friends and family from your bank account or PayPal balance for free. Get started. How to make your online money transfer in five simple steps · Register for your free profile · Enter your money transfer details · Fill in your receiver's details. the incarcerated population received 20 free e-messages per week. As of Aug. 1, CDCR will cease funding 15 free e-messages per week, while ViaPath will. Transfer money internationally to + countries and + currencies with no hidden fees. Receive funds securely using convenient delivery options. Use Zelle® to send and request money · Safely and easily send and receive money with trusted friends and family who have U.S. bank accounts · Send money fast —. Send and request money from friends, family and sellers around the world—quickly and securely. Raise funds and make donations. All in one app Get the. Enjoy a $0 transfer fee* on your first transfer with Western Union®. Send money fast to Mexico and globally from the US, available 24/7. Send money, track. Send and receive money in minutes while keeping your account information private. Easy. All you need is a U.S. bank account and a U.S. mobile number or email. Trusted by millions worldwide, the Remitly app allows you to send fast and secure money transfers to banks and approximately ,+ cash pickup locations. Get the Paysend app today. Download the Paysend app on the App Store or Google Play to send money and track your transfers anytime, anywhere. It allows individuals and businesses to transfer funds electronically from one PayPal account to another. It's free to send money through PayPal, though the. The highly-rated MoneyGram® Money Transfers app is the perfect way to move your money around the globe. Download for free today. 1. Download the free MoneyGram. Send money abroad to your loved ones. Fast and secure international money transfers with the Sendwave app. Trusted by one million users around the world. Zelle® is fast, easy and free with the U.S. Bank Mobile App and online banking. Send and receive money with friends and family using Zelle® Pay. Discover more ways to send and receive money in the United States with MoneyGram With so many options to transfer money internationally - through bank. Our currency converter shows you the exchange rates, and once you select your receive method and delivery partner, you'll see the total amount your receiver.

How To Estimate Solar Panel Production

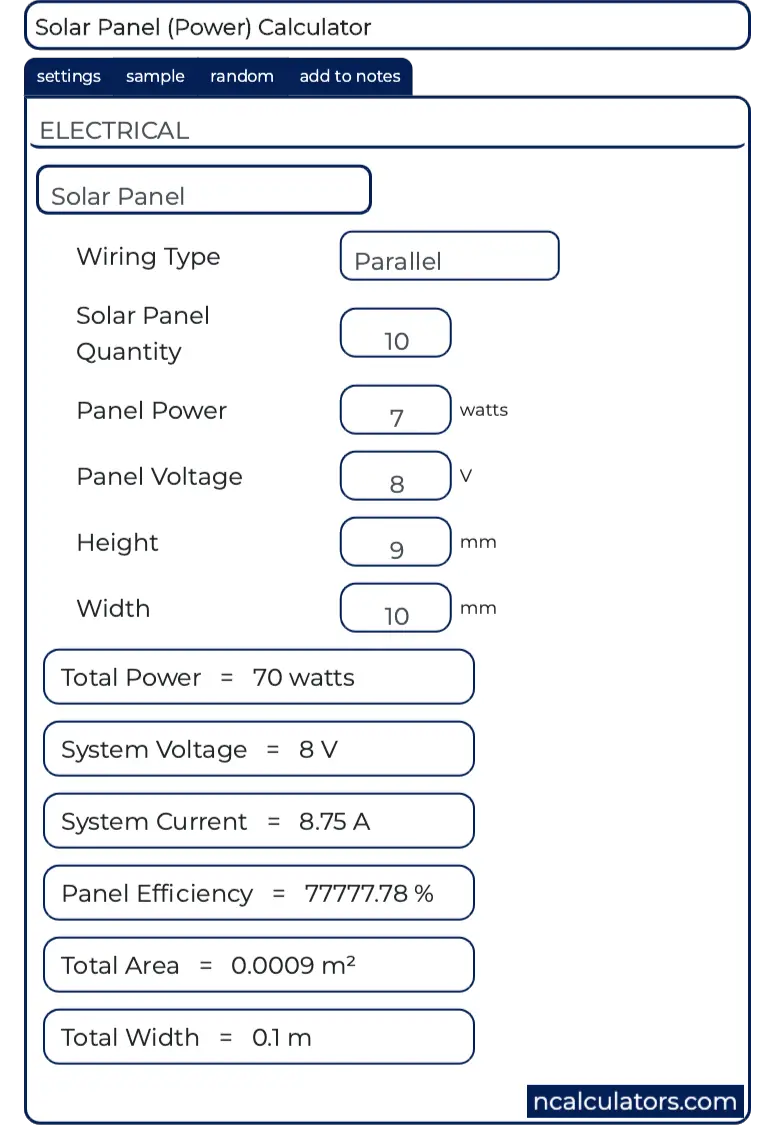

Most residential solar panels on the market today are rated to produce between W and W each. Rated capacity is explained below. Step 1: Determine Your Average Monthly kWh Usage · Step 2: Calculate Your Daily kWh Usage · Step 3: Estimate the Amount of Sunlight Your Solar Panels Will Receive. You can calculate your estimated annual solar energy production by multiplying your solar panel's wattage by your production ratio. This means a watt panel. As a rule of thumb, one can expect a 1kW solar system to generate around 4 units of power every day or units of power annually. The quickest and easiest way is to use an online solar estimator called PVWatts. Here's an example. The global formula to estimate the electricity generated in output of a photovoltaic system is: E = A * r * H * PR. You can calculate how many solar panels you need by multiplying your household's hourly energy requirement by the peak sunlight hours for your area. Solar Panel Output Calculator- Estimate the Real Energy You Can Get From Your Solar Panels · Charge controller losses: 20% for PWM charge controllers(average. Multiply your daily output by the number of days in a month for the monthly output. For annual output, multiply the monthly figure by Continuing. Most residential solar panels on the market today are rated to produce between W and W each. Rated capacity is explained below. Step 1: Determine Your Average Monthly kWh Usage · Step 2: Calculate Your Daily kWh Usage · Step 3: Estimate the Amount of Sunlight Your Solar Panels Will Receive. You can calculate your estimated annual solar energy production by multiplying your solar panel's wattage by your production ratio. This means a watt panel. As a rule of thumb, one can expect a 1kW solar system to generate around 4 units of power every day or units of power annually. The quickest and easiest way is to use an online solar estimator called PVWatts. Here's an example. The global formula to estimate the electricity generated in output of a photovoltaic system is: E = A * r * H * PR. You can calculate how many solar panels you need by multiplying your household's hourly energy requirement by the peak sunlight hours for your area. Solar Panel Output Calculator- Estimate the Real Energy You Can Get From Your Solar Panels · Charge controller losses: 20% for PWM charge controllers(average. Multiply your daily output by the number of days in a month for the monthly output. For annual output, multiply the monthly figure by Continuing.

You can find this information on the utility power bills for 12 months. Add the monthly kilo-watt hours (kWh) for an annual total. If you don't have power bills. Power in watts (W) x Average hours of direct sunlight x = Daily Watt-hours. . Note: Our Solar Panel Tool will. Known to produce about watts of power (in the best conditions). Use this formula to calculate solar output per square meter. Number of panels x Solar system. Our solar energy production during the same time was, on average, 40 kWh per day. In a sense, 75% of our energy used that month came from the. To calculate the kWh produced by a solar panel, we need to know its wattage and the amount of sunlight it receives. Simply use the power calculator to see how much money you could save with a solar installation. Cover the roof of your house with solar panels using the. Example: The panel is square metres ( x 1, = 1,). The panel is 20% efficient: 1, divided by 20% equals multiply by 1, Per day, 1, Calculate your solar panels needs by dividing yearly electricity usage by your area's production ratio, and then by the solar panel's power output. Energy production required = kWh per day / 5 hours, which equals kW. Step 4. Calculate the number of panels: Lastly, you'll need to determine the. The average solar panel produces 2 kWh of energy per day, but the actual amount depends on where you live and the size of the solar panel. 3. Solar panel output per square metre · around square metres (m2) in size · rated to produce roughly watts (W) of power (in ideal conditions). Project Sunroof is a solar calculator from Google that helps you map your roof's solar savings potential. Learn more, get an estimate and connect with. Power in watts (W) x Average hours of direct sunlight x = Daily Watt-hours. . Note: Our Solar Panel Tool will. r is the yield of the solar panel given by the ratio: electrical power (in kWp) of one solar panel divided by the area of one panel. Example: the solar panel. Calculating a solar power system's production ratio means determining its estimated power production over time versus the system size's total wattage. Since the. There are lots of different ways of estimating how much energy your solar panels will, or should be generating. Assuming you have a roof-mounted, unshaded. From the panel manufacturer or solar system installer, you can determine the area of a single panel. Correlate the same with your roof or wall to determine how. Now, we just divide the system size by the panel's output for the number of solar panels needed. 8 kW solar system / kW panel = 20 solar panels. You need to start by figuring out how much wattage of panels you need in your area and on your roof to produce kWh. The best way to do that.

Get Preapproved For Car Loan

Looking to finance a new or used car? See if you pre-qualify for financing in minutes with no impact to your credit score. Preapproval is a quick assessment of your ability to pay off a loan based on your credit history and current financial state. Prequalifying for an auto loan can help you find out how much you can borrow. Save time, estimate payments and be ready to buy with no credit score impact. Pre-approval is a conditional approval given to you from a lender to finance the purchase of a car. For example, if you're pre-qualified or pre-approved, you. Learn how to get preapproved for a car loan in 5 simple steps. Step 1: Gather the following information to submit with your application. You can get your preapproval from any auto loan provider. This includes banks, credit unions and private lenders. Most lenders are more than happy to help you. To get a preapproved auto loan, you'll need to apply online directly with a lender. Your credit score will temporarily drop by a few points when you apply for a. We make it easy — find the right car with the right features for the right budget. Fill out a simple form in a few minutes, with no impact on your credit. Yes, people can be pre-approved for auto loans. However, the process for getting pre-approved for an auto loan won't be the same for everyone. Looking to finance a new or used car? See if you pre-qualify for financing in minutes with no impact to your credit score. Preapproval is a quick assessment of your ability to pay off a loan based on your credit history and current financial state. Prequalifying for an auto loan can help you find out how much you can borrow. Save time, estimate payments and be ready to buy with no credit score impact. Pre-approval is a conditional approval given to you from a lender to finance the purchase of a car. For example, if you're pre-qualified or pre-approved, you. Learn how to get preapproved for a car loan in 5 simple steps. Step 1: Gather the following information to submit with your application. You can get your preapproval from any auto loan provider. This includes banks, credit unions and private lenders. Most lenders are more than happy to help you. To get a preapproved auto loan, you'll need to apply online directly with a lender. Your credit score will temporarily drop by a few points when you apply for a. We make it easy — find the right car with the right features for the right budget. Fill out a simple form in a few minutes, with no impact on your credit. Yes, people can be pre-approved for auto loans. However, the process for getting pre-approved for an auto loan won't be the same for everyone.

A pre-approved loan amount gives you a head start and added negotiating power. New and used auto loans; Pay off your balance at any time without prepayment. Preapproval gives you a set period, usually 30 days, to compare vehicles. It is an essential component of car-buying if you want to negotiate effectively at the. You can also give auto lenders a call to see if their loan offerings would specifically work for your financial needs. Ask them if they do any auto loan pre-. Prequalifying for an auto loan can help you find out how much you can borrow. Save time, estimate payments and be ready to buy with no credit score impact. What do you need to get pre-approved for a car loan? · Be 18 years of age or older · Have a valid Social Security Number · Be a legal resident of the US · Have. To get a preapproved auto loan, you'll need to apply online directly with a lender. Your credit score will temporarily drop by a few points when you apply for a. Whether you are buying a car, truck, or SUV from a car dealer or from a private seller and need to be pre-approved for a loan, we can help you finance your. Auto loan preapproval, however, generally implies a hard inquiry with a lender-initiated credit check. That sounds more official (and in some ways, it is), but. Pre-approval for auto loans makes either route less stressful and more affordable. In essence, pre-approval means that a lender has already reviewed your. We can offer you the best fixed low rate auto loan to fit your needs. You can also view your pre-approved auto and other loan offers by logging into Online. A pre-approval includes a credit check so if you're approved, you'll have a locked-in rate good for 30 days. Save time. Complete your financing application. Once you are pre-qualified, you will have access to view your car financing options with no impact to your credit score. Find vehicles that fit your budget. Generally, a pre-qualification is when a finance company or lender does a basic review of your information and credit history to determine if you're likely to. Generally, a pre-qualification is when a finance company or lender does a basic review of your information and credit history to determine if you're likely to. Yes you should get a pre-approved offer before you buy the car. You don't need to play games about it though. After you settle on a price and go. SCCU makes auto loan pre-approval fast and simple. You can get pre-approved in just minutes, either online or by calling us: Brevard: ; Broward: View the answer to 'Can I get pre-approved for an auto loan?'. When you start by getting a pre-approved auto loan, you add power and ease to your shopping and buying experience. During the early stages of car research, this. Yes you should get a pre-approved offer before you buy the car. You don't need to play games about it though. After you settle on a price and go. Getting pre-approved for an auto loan gives you leverage when negotiating with the dealer, as you can show them that you have a better offer from another lender.

Is Getting Your Mba Worth It

Pursuing an MBA is only an effective career boosting strategy if you know what you want to get out of it, she said, adding that an MBA is not a. Additionally, it provides a greater opportunity to explore career switches while pursuing an MBA at 30 or 40, allowing ample time for understanding your. An MBA course is worth it for numerous reasons. Firstly, it enhances leadership skills, critical for career advancement. The comprehensive. You might be wondering, what is an MBA for? The most generalized of all advanced business options, an MBA degree offers a comprehensive education in business. Online MBAs can be more cost-effective when comparing their fees with traditional MBAs. Completing an MBA online may also offer more flexibility and study. According to the Financial Times' Global MBA Ranking , online MBA graduates can anticipate a 20% increase in salary three years post-graduation. Career flexibility is another strong benefit of holding an MBA. It's a big reason why nearly nine out of 10 graduates say their MBA was worth it, as over half . So, Is It Worth It to Get an MBA? If you're looking to grow as a business professional and you can find a program and institution that feels right for you. You need it to advance your career. Some managerial or higher salaried jobs in business require advanced education, specifically an MBA. If you'. Pursuing an MBA is only an effective career boosting strategy if you know what you want to get out of it, she said, adding that an MBA is not a. Additionally, it provides a greater opportunity to explore career switches while pursuing an MBA at 30 or 40, allowing ample time for understanding your. An MBA course is worth it for numerous reasons. Firstly, it enhances leadership skills, critical for career advancement. The comprehensive. You might be wondering, what is an MBA for? The most generalized of all advanced business options, an MBA degree offers a comprehensive education in business. Online MBAs can be more cost-effective when comparing their fees with traditional MBAs. Completing an MBA online may also offer more flexibility and study. According to the Financial Times' Global MBA Ranking , online MBA graduates can anticipate a 20% increase in salary three years post-graduation. Career flexibility is another strong benefit of holding an MBA. It's a big reason why nearly nine out of 10 graduates say their MBA was worth it, as over half . So, Is It Worth It to Get an MBA? If you're looking to grow as a business professional and you can find a program and institution that feels right for you. You need it to advance your career. Some managerial or higher salaried jobs in business require advanced education, specifically an MBA. If you'.

An MBA degree is a great way to gain business skills & accelerate your career. Learn about the degree requirements, how long it takes to get the degree. Is an MBA worth it after 30? 40? 50? The consensus among educators and students is that an MBA education adds value at any age. For younger students in their. Is an MBA Worth It? · The median starting salary for MBA graduates was $, a year. · MBA graduates continue to be the most sought-after hires among global. Benefits of an MBA · The breadth of the topics that are covered during an MBA program is staggering! · During the first year of the MBA, students learn a core set. An MBA can enhance your marketability as a professional and increase the quality and quantity of job opportunities. Over 98% of Wharton MBA graduates are. Having an MBA puts you in a good position to outshine up the corporate ladder more speedily, increase your pay, and/ or start your own business. An MBA could be. If by “worth it” you mean an MBA helps you find a job, get a promotion, or receive a raise, then yes, an online MBA may be worth the time and money you put into. In short—an MBA delivers a return on investment by setting you up for a continued upward trajectory. JWMI MBA Expenses to consider. HOW LONG WILL IT TAKE TO GET. Job placements and internships aren't typically guaranteed in an online MBA program, but networking opportunities are ample. The most worthwhile online MBA. When is getting an MBA still worth it? An MBA may not be as prestigious as it once was, but that doesn't mean no one should pursue one. Studies still show. The Long-Term Value of an MBA Degree · Win Promotions to Leadership Roles · Build a Great Network · Source Potential Talent · Reduce Your Career Risk · Find the. Is an MBA Worth It? That depends, of course, on your goals, priorities and financial situation, among other considerations, but yes, an MBA can help you gain. An MBA degree can certainly be worth it if you're earning one for the right reasons. You'll need to make your decision based on the personal goals and career. Those with an online MBA often can command higher salaries than those without one. In addition, having an online MBA can give you a competitive edge when. An online MBA helps students build on existing skills, gain critical business knowledge, and increase self-confidence on the job. But the degree doesn't. An MBA can significantly enhance your career potential by opening doors to new job opportunities and increasing your earning potential. Many companies value MBA. Salaries vary based on the job location, industry, the graduate's experience level and the hiring company. While higher pay is a key motivator, an MBA also. Is it worth it to get an MBA right after college? Yes! Graduates of MBA programs command a much higher salary than students with a bachelor's degree, and it. Is an MBA Worth it? Earning your MBA requires an investment of time and resources. It takes focus, dedication, and commitment to succeed. But all that hard work. The pros are well known and I definitely see the merits of business school. There is a lot of value in getting your MBA. If you want to switch careers or if you.