bss64.ru

Gainers & Losers

Best Loan For Tesla Model 3

5-Year Auto Loan · Up to 7 years loan repayment: Model S, Model 3, Model X and other Tesla models · New Tesla financing: % financing** (purchase price plus tax. Finance your Tesla, Fisker, Rivian, Lucid Motors, or legacy brand EV with Logix and enjoy! Competitive rates. as low as % APR* for 24 months! Up to The best Tesla financing rates on their website are at a starting purchase loan APR of % for those with the highest credit scores. There is no minimum. Financing your Tesla · Step 1: Shop for Your Vehicle · Step 2: Become a Member of Clean Energy Credit Union · Step 3: Review and Complete Your Loan Documents · Step. Credit unions usually have better rates than the banks as they are non-profit to serve their members. Here's a good site for finding one. Loans for Advanced Technologies to Ford Motor Company, Nissan Motors and Tesla Motors. PROJECT PHOTOS. Office of. Loan Programs Office. Loan Guarantee Program. Tesla Loan Features · Excellent competitive rates · Terms up to 84 months for new and used Teslas · Quick online application with same-day approval in most cases. Get great loan rates on a new or certified pre-owned Tesla. And with Tech CU, you're banking with a credit union that has your best interests at heart. Tesla financing is more affordable with no payments for 90 days. OneAZ's new auto rates put you in the driver's seat of a luxury electric vehicle. 5-Year Auto Loan · Up to 7 years loan repayment: Model S, Model 3, Model X and other Tesla models · New Tesla financing: % financing** (purchase price plus tax. Finance your Tesla, Fisker, Rivian, Lucid Motors, or legacy brand EV with Logix and enjoy! Competitive rates. as low as % APR* for 24 months! Up to The best Tesla financing rates on their website are at a starting purchase loan APR of % for those with the highest credit scores. There is no minimum. Financing your Tesla · Step 1: Shop for Your Vehicle · Step 2: Become a Member of Clean Energy Credit Union · Step 3: Review and Complete Your Loan Documents · Step. Credit unions usually have better rates than the banks as they are non-profit to serve their members. Here's a good site for finding one. Loans for Advanced Technologies to Ford Motor Company, Nissan Motors and Tesla Motors. PROJECT PHOTOS. Office of. Loan Programs Office. Loan Guarantee Program. Tesla Loan Features · Excellent competitive rates · Terms up to 84 months for new and used Teslas · Quick online application with same-day approval in most cases. Get great loan rates on a new or certified pre-owned Tesla. And with Tech CU, you're banking with a credit union that has your best interests at heart. Tesla financing is more affordable with no payments for 90 days. OneAZ's new auto rates put you in the driver's seat of a luxury electric vehicle.

Tesla loan rates as low as % bss64.ru to disclosure. Get the lowest Tesla loan rates and financing up to $, Your monthly installment payments with Tesla Finance LLC for your vehicle loan can be made conveniently in the Tesla app or your Tesla Account Model 3. Model. $25, minimum loan amount for 84 month financing. 6Vehicle must be 4 model years or newer with less than 60, miles. All loans require Tech CU membership. I purchased my Model 3 with an auto loan from my credit union. You could also get a loan from a bank or from Tesla. Enjoy your Model 3. Start your order and design your Tesla vehicle. The Tesla financing calculator is available in the Design Studio to help you determine the right payment. We provide multiple financing options for your vehicle. The Tesla financing calculator is available in the Design Studio to help estimate your payments. Best Tesla finance rates compared ; Vehicle. Model 3 Long Range ; Estimated cost. $71, ; Monthly repayments (6% p.a. interest). $1, ; Monthly repayments (8%. Find out how you can finance your vehicle through Tesla. article. Ordering and Delivery. Tesla Account. Model S. Model 3 For the best experience, we recommend. Starting today, Tesla is offering a special loan rate of % APR for all new Model Y finance orders in the U.S. This promotional rate. Contract Purchase · Down Payment. Flexible, starting as low as 0%. ; Contract Hire · Monthly Payments. Set over a fixed term of 36 to 48 months. ; Tesla Loan · Down. Financing a Tesla Model Y Performance with a purchase price of $58, and a loan amount of $52, with an Annual Percentage rate (“APR”) of % with a A new Tesla may be $43, at the low end, and more than $, when fully equipped. Even used models are in high demand, which means higher prices. Getting. Because you've paid for part of the car with it, it lowers the amount of money you need to borrow and thus lowers your monthly loan payment. As a general rule. Tesla Financing · Up to 7 years loan repayment: Model S, Model 3, Model X and other Tesla models · New Tesla financing: % financing** (purchase price plus tax. loan. Any delinquent registered in the U.S. New Tesla Model 3 $ per $1, borrowed. loan terms of 36, enough income or assets when. Tesla Model 3 Monthly Payment ; Loan Term, 72 Months ; APR, % ; Paid in Full, Aug, ; Total Principal, $38, ; Total Interest, $8, best auto loan for tesla model 3 lt | 6 followers on LinkedIn. Welcome to best auto loan for tesla model 3 We offer help for: Credit Cards, Auto Loans. Best Tesla finance rates compared ; Vehicle. Model 3 Long Range ; Estimated cost. $71, ; Monthly repayments (6% p.a. interest). $1, ; Monthly repayments (8%. To make that choice easier, Mountain America provides competitive financing and favorable terms for all current Tesla models—3, S, X and Y. Tesla loans feature. Tesla's lender partners provide new and used car loans with APRs ranging from % to 72 months and loan periods ranging from 36 to 72 months. We recommend.

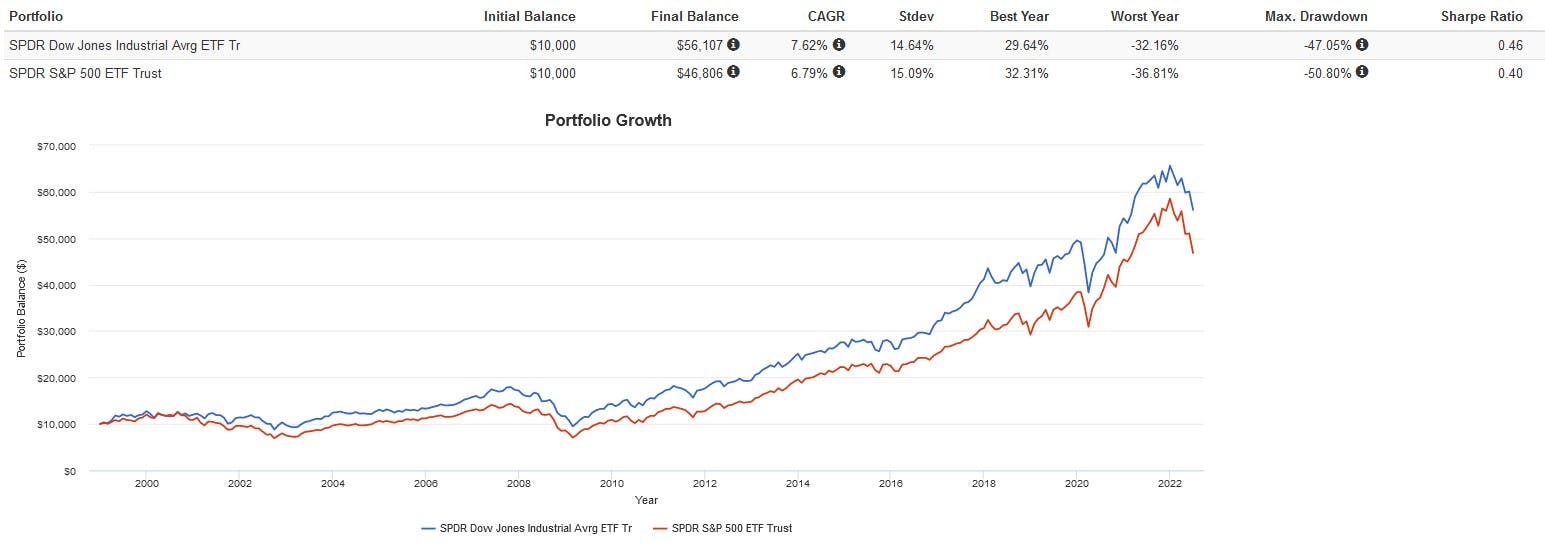

Etf Based On Dow Jones Index

Find the latest SPDR Dow Jones Industrial Average ETF Trust (DIA) stock quote, history, news and other vital information to help you with your stock trading. Complete SPDR Dow Jones Industrial Average ETF Trust funds overview by Barron's. View the DIA funds market news. The SPDR® Dow Jones® Industrial AverageSM ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield. Find the latest BMO Dow Jones Industrial Average Hedged to CAD Index ETF (bss64.ru) stock quote, history, news and other vital information to help you with. Find the latest BMO Dow Jones Industrial Average Hedged to CAD Index ETF (bss64.ru) stock quote, history, news and other vital information to help you with. Get the LIVE share price of Dow Jones Industrial Average ETF SPDR(DIA) and stock performance in one place to strengthen your trading strategy in US stocks. The Global X Dow 30 Covered Call ETF (DJIA) seeks to provide investment results that correspond generally to the price and yield performance, before fees and. Top 25 ETFs ; 1, SPY · SPDR S&P ETF Trust ; 2, IVV · iShares Core S&P ETF ; 3, VOO · Vanguard S&P ETF ; 4, VTI · Vanguard Total Stock Market ETF. The Invesco Dow Jones Industrial Average Dividend ETF (Fund) is based on the Dow Jones Industrial Average Yield Weighted (Index). The Fund will invest at. Find the latest SPDR Dow Jones Industrial Average ETF Trust (DIA) stock quote, history, news and other vital information to help you with your stock trading. Complete SPDR Dow Jones Industrial Average ETF Trust funds overview by Barron's. View the DIA funds market news. The SPDR® Dow Jones® Industrial AverageSM ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield. Find the latest BMO Dow Jones Industrial Average Hedged to CAD Index ETF (bss64.ru) stock quote, history, news and other vital information to help you with. Find the latest BMO Dow Jones Industrial Average Hedged to CAD Index ETF (bss64.ru) stock quote, history, news and other vital information to help you with. Get the LIVE share price of Dow Jones Industrial Average ETF SPDR(DIA) and stock performance in one place to strengthen your trading strategy in US stocks. The Global X Dow 30 Covered Call ETF (DJIA) seeks to provide investment results that correspond generally to the price and yield performance, before fees and. Top 25 ETFs ; 1, SPY · SPDR S&P ETF Trust ; 2, IVV · iShares Core S&P ETF ; 3, VOO · Vanguard S&P ETF ; 4, VTI · Vanguard Total Stock Market ETF. The Invesco Dow Jones Industrial Average Dividend ETF (Fund) is based on the Dow Jones Industrial Average Yield Weighted (Index). The Fund will invest at.

In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange. ZDJ - BMO Dow Jones Industrial Average Hedged to CAD Index ETF (Hedged Units) ETF or any index on which such ETF is based. The ETF's prospectus contains a. SPDR® Dow Jones Industrial Average ETF Trust (DIA) ; Volume: 3,, ; Average Vol. (3m): 3,, ; 1-Year Change: % ; Day's Range: ; 52 wk Range. SPDR Dow Jones Industrial Average ETF Trust DIA:NYSE Arca · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/. See all ETFs tracking the Dow Jones Industrial Average, including the cheapest and the most popular among them. Compare their price, performance, expens. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. The Fund seeks to track the performance of an index composed of 30 large US companies, covering all industries except transportation and utilities. ProShares based on The Dow 30 are not sponsored, endorsed, sold or promoted by CME Indexes or Dow Jones, and they make no representation regarding the. S&P TR USD. Broad-Based Index. + + + + + + + + Best Fit Index. -. -. -. -. -. -. -. -. Standardized Quarterly Total. The iShares Dow Jones Industrial Average UCITS ETF (Acc) is a very large ETF with 1,m Euro assets under management. The ETF was launched on 26 January Learn everything you need to know about SPDR® Dow Jones Industrial Avrg ETF Tr (DIA) and how it ranks compared to other funds. Research performance, expense. Key Takeaways · The SPY is the SPDR S&P ETF, which tracks the companies in the S&P index. · The DIA is the SPDR Dow Jones Industrial Average ETF Trust. Amundi PEA Dow Jones Industrial Avg ETF, ETF, Germany ; BMO Dow Jones Ind Avg Hdgd to CAD ETF, ETF, Canada ; Cathay DJIA ETF, ETF, Taiwan ; DJIA Index (UDF). distributions made by the ETF in the periods shown were used to purchase additional units of the ETF and is based on the net asset value of the ETF. The. Just buy VTI for US stocks - it holds all the stocks in the US, including all the stocks in the S&P and all the stocks in the Dow Jones. The Best (And Only) Dow Jones ETF The Dow Jones Industrial Average ETF Trust (DIA %) is the only game in town when it comes to mirroring the performance. The Index is a product of S&P Dow Jones Indices LLC or its affiliates ETF or any index on which such ETF is based. The ETF's prospectus contains a. The First Trust ETF provides exposure to its new index by investing all or substantially all of its assets in an underlying US index fund. The Invesco Dow Jones Industrial Average Dividend ETF. (Fund) is based on the Dow Jones Industrial Average Yield. Weighted (Index). The Fund will invest at. DIA | A complete SPDR Dow Jones Industrial Average ETF Trust exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better.

Ivw Dividend

Why IVW? 1. Exposure to large U.S. companies whose earnings are Understanding Dividends. Record Date, Ex-Date, Payable Date, Total Distribution. IVW is listed Real estate investment trust, or REIT, ETFs are a great choice for investors looking for high dividend income and good growth potential. See the dividend history dates, yield, and payout ratio for iShares S&P Growth ETF (IVW). Latest iShares S&P Growth ETF (IVW) stock price, holdings, dividend yield, charts and performance. Key Stats · Expense Ratio % · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change · 1 Year % Change The Dividend Yield is the latest annualized dividends / share divided by the share price. Higher numbers are better. The dividend yield for IVW / iShares. IVW Dividend Payout History ; , , Regular, Quarterly ; , , Special, Other. View Top Holdings and Key Holding Information for iShares S&P Growth ETF (IVW) SDVY First Trust SMID Cap Rising Dividend Achievers ETF. +%. ISMD. It shows how much a company, fund, or portfolio has paid out in dividends each year relative to its price, NAV (Net Asset Value) or level (for portfolios). Why IVW? 1. Exposure to large U.S. companies whose earnings are Understanding Dividends. Record Date, Ex-Date, Payable Date, Total Distribution. IVW is listed Real estate investment trust, or REIT, ETFs are a great choice for investors looking for high dividend income and good growth potential. See the dividend history dates, yield, and payout ratio for iShares S&P Growth ETF (IVW). Latest iShares S&P Growth ETF (IVW) stock price, holdings, dividend yield, charts and performance. Key Stats · Expense Ratio % · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change · 1 Year % Change The Dividend Yield is the latest annualized dividends / share divided by the share price. Higher numbers are better. The dividend yield for IVW / iShares. IVW Dividend Payout History ; , , Regular, Quarterly ; , , Special, Other. View Top Holdings and Key Holding Information for iShares S&P Growth ETF (IVW) SDVY First Trust SMID Cap Rising Dividend Achievers ETF. +%. ISMD. It shows how much a company, fund, or portfolio has paid out in dividends each year relative to its price, NAV (Net Asset Value) or level (for portfolios).

Backtested results are adjusted to reflect the reinvestment of dividends and other income and, except where otherwise indicated, are presented gross-of fees and. The Dividend Yield is the latest annualized dividends / share divided by the share price. Higher numbers are better. The dividend yield for IVW / iShares. ByDividend ChannelContributor. Aug 17, How The Pieces Add Up: IVW Headed For $ Looking at the underlying holdings of the ETFs in our coverage. IVW's dividend yield currently ranks #60 of 65 vs. its peers in the Large Cap Growth ETFs category. Rank, Symbol, Name, Dividend Yield. Dividend: Sep $ (Est.) Div Yield: %. IVW Dividend Information. Next Dividend: Sep Dividend Amount: Increased Dividend: No. Forward. The fund normally distributes its dividend income quarterly and its capital gains annually. It's natural to seek the best-performing investments, but you must. Get the latest iShares S&P Growth ETF (IVW) real-time quote Schwab US Dividend Equity ETF. $ %. add_circle_outline. XLK. Technology. An easy way to get iShares S&P Growth ETF real-time prices. View live IVW stock fund chart, financials, and market news Dividend yield (indicated). %. IVW:US. Following Follow Follow. Nyse Arca (USD)· Market closed. Dividend Indicated Gross Yield %. Front Load Fee %. Back Load Fee The last dividend was announced on June 10, Q. Why is iShares S&P Growth ETF (IVW) dividend considered low? A. There is not enough data to provide an. IVW's dividend yield, history, payout ratio & much more! bss64.ru: The #1 Source For Dividend Investing. Dividend $; Ex-Dividend Date Mar 21, ; Average Volume M. Lipper Leader. YTD Lipper Ranking:Quintile 1 (11th percentile). 4 Total Returns; 3. Learn everything about iShares S&P Growth ETF (IVW). News, analyses, holdings, benchmarks, and quotes Dividend Yield · Russell Index ETFs · Dividend. The fund normally distributes its dividend income quarterly and its capital gains annually. It's natural to seek the best-performing investments, but you must. Stock Price and Dividend Data for iShares S&P Growth ETF/iShares Trust (IVW), including dividend dates, dividend yield, company news, and key financial. Get the latest iShares S&P Growth ETF (IVW) real-time quote Schwab US Dividend Equity ETF. $ %. add_circle_outline. XLK. Technology. View iShares S&P Growth ETF's distribution of profits in the form of dividends. Get the full history of dividend payments, including declaration date. Last dividend for iShares S&P Growth ETF (IVW) as of July 22, is USD. The forward dividend yield for IVW as of July 22, is %. Average. Latest Dividend. $ (03/27/24). Beta. N/A. Holdings Details. Avg P/E Ratio. Avg Price/Book Ratio. ? Short Interest: The total number of. An easy way to get iShares S&P Growth ETF real-time prices. View live IVW stock fund chart, financials, and market news Dividend yield (indicated). %.

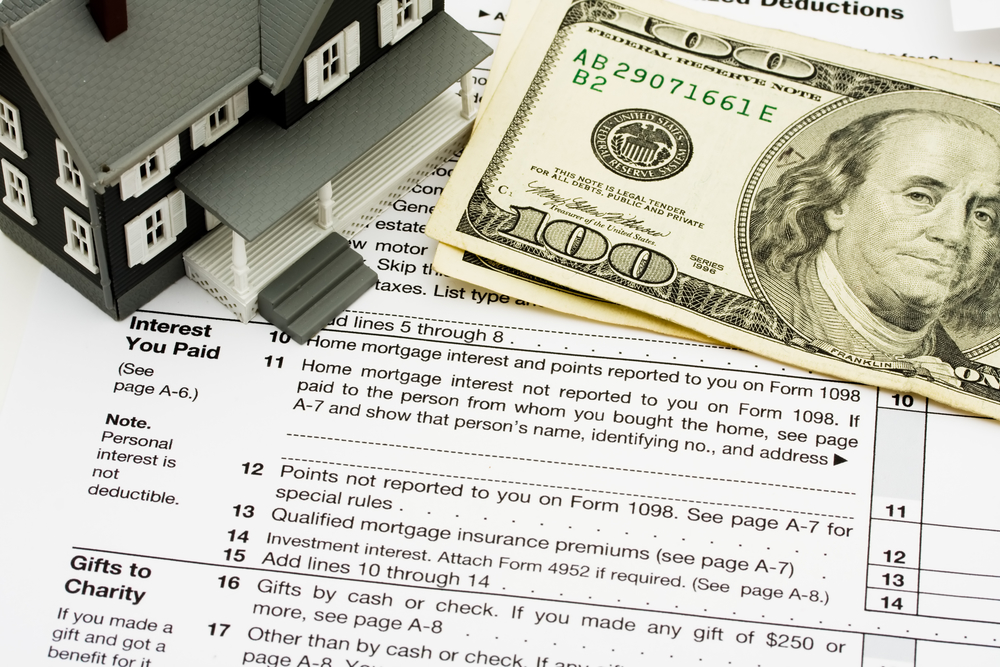

Is A Home Equity Loan Tax Deductible

Under the TCJA, for tax years beginning after December 31, and before January 1, , the limit on acquisition debt is reduced to $, ($, for a. But if the taxpayer used the home equity loan proceeds for personal expenses, such as paying off student loans and credit cards, then the interest on the home. For a home equity loan, you can deduct the interest on up to $, of the loan for married filers, or $, for couples who are married filing separately. Most times, the interest paid on a home equity loan or home equity line of credit is tax deductible. This is a primary reason that people often choose to. Most times, the interest paid on a home equity loan or home equity line of credit is tax deductible. This is a primary reason that people often choose to. You can only deduct interest on HELOC debt if the money you borrow is used for renovations to your home. In other words, if you “buy, build, or substantially. When deducting interest paid on a home equity loan or HELOC, be sure to keep all receipts and invoices for labor and materials. You'll need them in case you. The Tax Cuts and Jobs Act of affected the tax deduction for interest paid on home equity debt as of Under prior law, you could deduct interest on. The interest paid on home equity loans in New Jersey could still be tax-deductible, if the funds are used to “buy, build or substantially improve” the property. Under the TCJA, for tax years beginning after December 31, and before January 1, , the limit on acquisition debt is reduced to $, ($, for a. But if the taxpayer used the home equity loan proceeds for personal expenses, such as paying off student loans and credit cards, then the interest on the home. For a home equity loan, you can deduct the interest on up to $, of the loan for married filers, or $, for couples who are married filing separately. Most times, the interest paid on a home equity loan or home equity line of credit is tax deductible. This is a primary reason that people often choose to. Most times, the interest paid on a home equity loan or home equity line of credit is tax deductible. This is a primary reason that people often choose to. You can only deduct interest on HELOC debt if the money you borrow is used for renovations to your home. In other words, if you “buy, build, or substantially. When deducting interest paid on a home equity loan or HELOC, be sure to keep all receipts and invoices for labor and materials. You'll need them in case you. The Tax Cuts and Jobs Act of affected the tax deduction for interest paid on home equity debt as of Under prior law, you could deduct interest on. The interest paid on home equity loans in New Jersey could still be tax-deductible, if the funds are used to “buy, build or substantially improve” the property.

The interest you pay on a home equity loan may be tax-deductible, but it's essential to adhere to IRS guidelines to qualify for this benefit. Interest on home equity debt is no longer tax-deductible. Under the old tax rules, you could deduct the interest on up to $, of home equity debt, as long. The interest rate is often lower than other forms of credit, and the interest you pay may be tax deductible, but you should consult a tax advisor. On screen. The deduction only applies if you utilize the loan proceeds to buy, build, or substantially improve the rental property. This provision allows real estate. The interest you pay on a home equity loan (HELOC) may be tax deductible; For tax years through there are tax benefits for homeowners; A HELOC can. Potential tax benefits. You may be able to deduct a portion of your home equity loan interest — but only if the loan funds certain home improvements, such as an. Interest on a home equity line of credit (HELOC) or a home equity loan is tax deductible if you use the funds for renovations to your home. Home Equity Loans: Interest paid on home equity loans not used to improve a first or second residence is no longer deductible until the tax year. Home. If the home equity loan is used for business purposes, however, the interest remains a deductible business expense. Farmers must be careful to trace and. If you have a home equity loan or a home equity line of credit (HELOC), you may be eligible for a tax break on the interest you pay. Key takeaways · The interest you pay on a home equity loan (HELOC) may be tax deductible · For tax years through there are tax benefits for homeowners. If a home equity loan or home equity line of credit (HELOC) is used to substantially renovate or improve a home, the interest paid is typically. Most helpful response Hi @nikki,. For loan interest to be a tax deduction the funds from the loan must be used to produce income. As you're planning to. The interest you pay on a HELOC may be tax-deductible if you use the money to buy, build or substantially improve your home. Energy-efficient upgrades could. How you use the money—The first point to consider is how you're planning on using the money. The funds acquired from home equity loans, HELOC tax deductions and. Is interest in a home equity line of credit tax deductible? Interest on a home equity line of credit may be tax deductible. Consult with your tax advisor Under the Tax Cuts and Jobs Act, interest on a HELOC is no longer deductible, regardless of when it was put in place. The lone exception to this. According to the IRS, interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy, build, or substantially. Home Equity Loan Tax Deductions Eliminated In the past, most homeowners with home equity loans were able to deduct the interest paid on those loans, up to.

Can You Use Your Carecredit For Someone Else

You are not permitted to allow anyone else to use your credit card, but if you do, you will be responsible for such use. You will destroy all the credit card(s). You can use your CareCredit card just like you use any other credit card. As I don't trust my dogs to anyone else! Dr. Kleinpeter and Dr. Latkovich. CareCredit provides financing for a wide range of out-of-pocket expenses not covered by insurance, including co-pays. Learn how CareCredit works today. Clients can use their CareCredit credit card to pay any expense they choose, whether for themselves, their pet, or someone else. However, the one presenting. your financial situation. With special financing options*, you can use your CareCredit card again and again for your cosmetic needs, as well as at , Generally, you may not take this credit if your filing status is married filing separately. However, see What's Your Filing Status? in Publication , Child. You can use your account for anyone (i.e., spouse, family member, children, etc. �) However, you should remember that you should be present to use your card. You can use your CareCredit credit card multiple times for a wide range of health and wellness expenses for you and your entire family. To apply by phone call. Use your card in the CareCredit network for costs including doctor visits, veterinary care, dentistry, specialists, retail locations, and more. You are not permitted to allow anyone else to use your credit card, but if you do, you will be responsible for such use. You will destroy all the credit card(s). You can use your CareCredit card just like you use any other credit card. As I don't trust my dogs to anyone else! Dr. Kleinpeter and Dr. Latkovich. CareCredit provides financing for a wide range of out-of-pocket expenses not covered by insurance, including co-pays. Learn how CareCredit works today. Clients can use their CareCredit credit card to pay any expense they choose, whether for themselves, their pet, or someone else. However, the one presenting. your financial situation. With special financing options*, you can use your CareCredit card again and again for your cosmetic needs, as well as at , Generally, you may not take this credit if your filing status is married filing separately. However, see What's Your Filing Status? in Publication , Child. You can use your account for anyone (i.e., spouse, family member, children, etc. �) However, you should remember that you should be present to use your card. You can use your CareCredit credit card multiple times for a wide range of health and wellness expenses for you and your entire family. To apply by phone call. Use your card in the CareCredit network for costs including doctor visits, veterinary care, dentistry, specialists, retail locations, and more.

Your Responsibility. Each accountholder will receive a card. You may not allow anyone else to use your account. If you do, or if you ask us to send. Authorizing Others to Use Your CareCredit Account What can you do if a child, sibling, or someone else dear to you is unable to cover the costs of rehab? With special financing options* you can use your CareCredit card again and Invisalign and the Invisalign logo, among others, are trademarks of. Your security is important. · Sign new credit cards immediately — before someone else does. · Memorize your Social Security Number and passwords. · Don't use your. CareCredit helps you pay for out-of-pocket healthcare expenses for you, your family, and even your pets! Once you are approved, you can use it again and again. you or your family that may not be covered by insurance. With special financing options* You can use your CareCredit card again and again for your dental. Use for Various Services: Your CareCredit card isn't limited to one procedure. You can use it for various treatments and procedures for both you and your family. Can CareCredit be used for someone else? Yes, but with limitations. As stated on its website, you can use CareCredit for “you, your family, and even your pets. With special financing options*, you can use your CareCredit card again and Her passion is assisting others with feeling confident and beautiful in their. It might be a good choice for someone but I would much rather You can use your CareCredit credit card at Sam's Club, Walmart and. You are not permitted to allow anyone else to use your credit card, but if you do, you will be responsible for such use. You will destroy all the credit card(s). Your CareCredit credit card can be used to pay for health, wellness and personal care items. This means you can use your card in the following departments. Authorizing Others to Use Your CareCredit Account If a child, sibling, or someone else dear to you is unable to afford the costs of rehab, CareCredit offers a. This option can be used if someone else with a CareCredit card wants to pay your bill, or if you need to order some medicines or prescription food from us over. You may not allow anyone else to use your account. If you do, or if When you use your CareCredit Rewards Mastercard, you will automatically earn. If you disclose your Card Account number, user ID, password or any other security credentials to any person(s) or entity, you assume all liability associated. CareCredit works just like a credit card, but is exclusive for healthcare services. With low monthly payments every time you use it, you can use your card over. We are pleased to accept the CareCredit healthcare, credit card. CareCredit lets you say "Yes" to recommended surgical and non-surgical dental procedures. With special financing options,* you can use your CareCredit card again and anyone else we tried initially. We had gotten dental insurance and had. Once you've applied, you can use it again and again at any location that accepts CareCredit. You can call the same number 24 hours a day, 7 days a week.

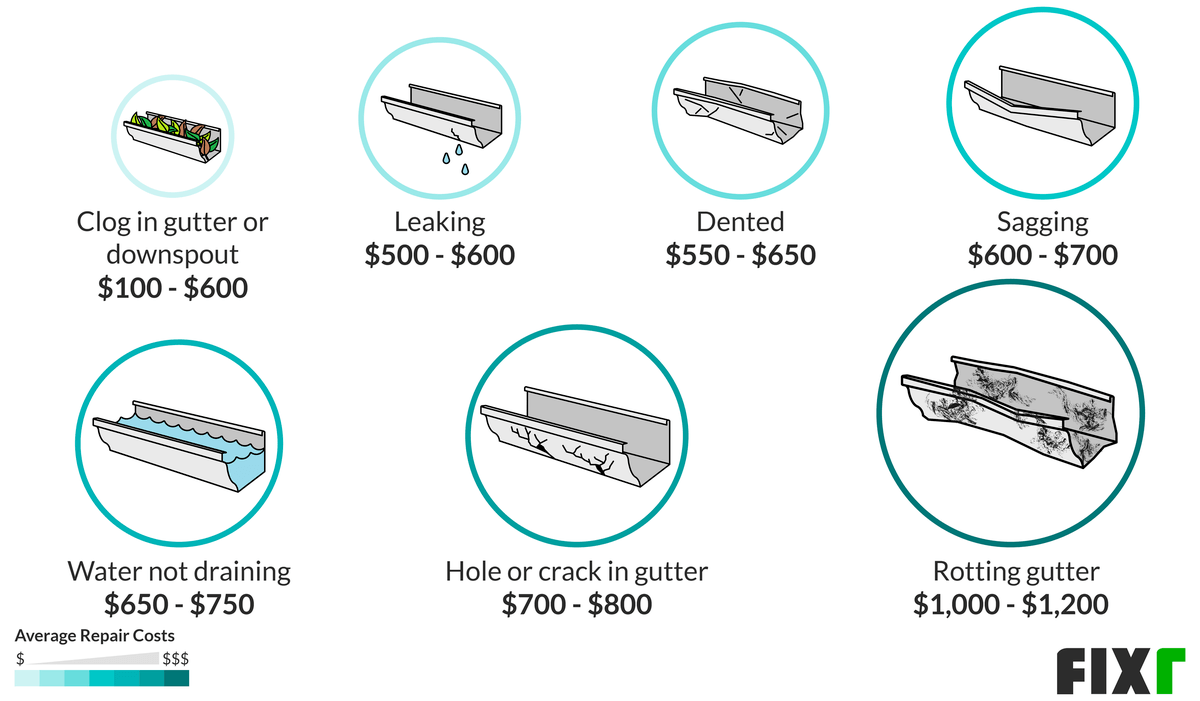

Gutter Replacement Cost Per Foot

For aluminum it should be 5–10 usd per running foot depending on where you live and the degree of difficulty of the job. The metals used for. Vinyl Gutters: Vinyl gutters are the most affordable option, with costs ranging from $3 to $5 per linear foot, including installation. A typical home. It costs an average of $4 to $40 per linear foot to install gutters, depending on factors like material and type. You can estimate your costs by measuring the. Types Of Gutters · Vinyl – This is an economical option costing just $3 to $5 per foot on average. · Copper – Copper rain gutters are very durable and can last. It will cost $1, – $2, to have seamless gutters installed on the average size home in Central Florida. The average cost is $7 – $9 per linear foot. In general, however, your standard 5″ K style gutter will cost anywhere from approximately $$10 per foot (one story) while 6″ K style gutter will run. The basic cost to Install Gutters is $ - $ per linear foot in April , but can vary significantly with site conditions and options. You can expect to pay between $ to $ per linear foot for installation. This would be the cost for the installation only – the cost of materials varies. For one-story homes, you'll pay around $4 to $10 per linear foot to hire a pro for installation, but if your home is two stories or more, it'll be $5 to $17 per. For aluminum it should be 5–10 usd per running foot depending on where you live and the degree of difficulty of the job. The metals used for. Vinyl Gutters: Vinyl gutters are the most affordable option, with costs ranging from $3 to $5 per linear foot, including installation. A typical home. It costs an average of $4 to $40 per linear foot to install gutters, depending on factors like material and type. You can estimate your costs by measuring the. Types Of Gutters · Vinyl – This is an economical option costing just $3 to $5 per foot on average. · Copper – Copper rain gutters are very durable and can last. It will cost $1, – $2, to have seamless gutters installed on the average size home in Central Florida. The average cost is $7 – $9 per linear foot. In general, however, your standard 5″ K style gutter will cost anywhere from approximately $$10 per foot (one story) while 6″ K style gutter will run. The basic cost to Install Gutters is $ - $ per linear foot in April , but can vary significantly with site conditions and options. You can expect to pay between $ to $ per linear foot for installation. This would be the cost for the installation only – the cost of materials varies. For one-story homes, you'll pay around $4 to $10 per linear foot to hire a pro for installation, but if your home is two stories or more, it'll be $5 to $17 per.

Normal k-style gutters should run at most $12 a foot. Guards usually a foot.

The cost of replacing your home's gutter system in Pittsburgh ranges from $ to $ This pricing is mainly dependent on the size of your home. The average installation cost for aluminum gutters is $23 per linear foot. Vinyl gutters are the least expensive option, while zinc gutters generally cost the. Understanding the Influence of Home Size on Gutter Installation Costs · linear feet of gutters: $ to $1, · linear feet of gutters: $ to $1, How Much Does Gutter Installation Cost in New Jersey? Most homeowners in New Jersey pay an average of around $1, to have a full gutter system installed. The basic cost to Install Gutters is $ - $ per linear foot in April , but can vary significantly with site conditions and options. Typically, you can expect to pay around $ to $ per linear foot for a set of new gutters in the San Antonio area. At Best Choice Roofing, our gutters are priced at around $ per linear foot, ensuring quality and affordability. A new gutter system's price is largely determined by what material the gutters are made from. High-end metal gutters cost $10 to $20 more per linear foot than. The average cost per linear foot of seamless gutters, according to Homewyse, is between $ and $ So for the average 2,square-foot home, which. A new gutter system's price is largely determined by what material the gutters are made from. High-end metal gutters cost $10 to $20 more per linear foot than. You can generally expect to pay between $5 and $12 per linear foot for new gutters in Nashville. The average cost of a gutter replacement in Nashville is $1, On average, sectional gutters cost between $3 and $20 per linear foot, although it depends on the material you choose. The problem with sectional gutters is. For a typical house with linear feet of gutter, your total costs would then range from $75 to $ for gutter guard materials. Costs will vary for larger. Seamless aluminum gutter installation cost ranges from $ to $ per linear foot. · When calculating the number of linear feet, don't forget to measure the. Some companies simply measure the number of linear feet and multiply that by a dollar amount. In Austin, that range normally runs about $8-$15 per foot. The. Each downspout is about 15 feet. On average, 5” aluminum gutter cost $8-$ per foot installed. 5” gutter system with 2 downspouts: Feet = 15 x 2. On average, sectional gutters cost between $3 and $20 per linear foot, although it depends on the material you choose. The problem with sectional gutters is. Typically, you can expect to pay around $ per linear foot for a new gutter installation in the Omaha area. In April the cost to Install Seamless Gutters starts at $ - $ per linear foot. Use our Cost Calculator for cost estimate examples customized to. Sectional gutters range from about $5 per linear foot for vinyl to $20 per linear foot for a high-quality material like steel. Sectional gutters are versatile.

Who Are Internet Providers

Our picks for the best internet providers · Xfinity · Spectrum · Verizon Fios · AT&T · T-Mobile 5G · Astound · Optimum. Logo for Other providers. Current Internet Service Providers in Carroll County ; CABLE, Comcast, ; FIXED WIRELESS, Towerstream (Formerly Freedom Broadband), Your Internet Service Provider (ISP) is the company that provides your internet access. Visit bss64.ru to look for your ISP. Current options for Internet service in Gatesville are: Brightspeed, HughesNet, Viasat, NextLink. Upcoming Events. How much is Spectrum Internet only? Spectrum Internet only is $/mo for 12 months, delivering speeds up to Mbps. Learn more about Spectrum Internet only. We are thrilled to deliver our high-speed Internet services to homes and businesses within the Municipality of Whitestone and Township of McKellar. Canada's Top Five High-Speed Internet Providers · 1. VMedia · 2. TELUS · 3. Primus Internet Services · 4. Bell Canada · 5. Cogeco Internet. For specific information on serviceability of your home or business and for details on speeds and pricing, please contact the internet service providers. Among Canada's biggest internet service providers (ISP) are Bell, Rogers, Telus, and Shaw—with the former two being the largest in Ontario, and the latter two. Our picks for the best internet providers · Xfinity · Spectrum · Verizon Fios · AT&T · T-Mobile 5G · Astound · Optimum. Logo for Other providers. Current Internet Service Providers in Carroll County ; CABLE, Comcast, ; FIXED WIRELESS, Towerstream (Formerly Freedom Broadband), Your Internet Service Provider (ISP) is the company that provides your internet access. Visit bss64.ru to look for your ISP. Current options for Internet service in Gatesville are: Brightspeed, HughesNet, Viasat, NextLink. Upcoming Events. How much is Spectrum Internet only? Spectrum Internet only is $/mo for 12 months, delivering speeds up to Mbps. Learn more about Spectrum Internet only. We are thrilled to deliver our high-speed Internet services to homes and businesses within the Municipality of Whitestone and Township of McKellar. Canada's Top Five High-Speed Internet Providers · 1. VMedia · 2. TELUS · 3. Primus Internet Services · 4. Bell Canada · 5. Cogeco Internet. For specific information on serviceability of your home or business and for details on speeds and pricing, please contact the internet service providers. Among Canada's biggest internet service providers (ISP) are Bell, Rogers, Telus, and Shaw—with the former two being the largest in Ontario, and the latter two.

The Town of Erin is making a concerted effort to bring High Speed Internet to our community. The following programs and providers are helping us do that. YorkNet high-speed Internet YorkNet, a corporation of York Region and Their Internet Service Provider partner, Galaxy Fibre are preparing to connect homes. Find out which internet providers are available in your area of Green. Make sure you get the best satellite internet experience from the best satellite internet providers. An internet service provider is a company that provides internet access for homes and businesses. Learn more about what ISPs offer and how to choose one. Top Internet Providers in Lillian, AL: 1. Brightspeed covers 90% | 2. Viasat covers % | 3. CenturyLink covers % | 4. Xtream by Mediacom covers. Internet service providers of the United States. Subcategories This category has the following 9 subcategories, out of 9 total. Wake County would like to help get you connected by providing some options for local and low-cost internet service providers. Want better internet service? We've crunched a year's worth of data to show you the top Canadian providers based on speed, price, coverage, and customer. Our PureFibre Internet Service Promise: day money-back guarantee. BroadbandNow: The easiest place to research, compare, and shop for internet service in your neighborhood. Internet connection types · Fiber · Cable · 5G home internet/Fixed wireless · DSL · Satellite. E-vergent is a high-speed Internet service provider for the entire Gurnee area. We provide point-to-point wireless connections with scalable, dedicated. About Us. Founded in small-town Canada, Xplore is dedicated to bringing fast, reliable Internet to Canadians in rural communities. With our world. Outside of urban areas, this is accomplished primarily through Fixed Wireless Access (FWA). there are more than 45 Wireless Internet Service Providers (WISPs). Get reliable, fast, and safe Internet service from AT&T, your local Internet Service Provider (ISP). View Internet plans, prices and offers in your area! Find the best satellite internet providers and plans for high-speed connectivity in Rural Areas. We compare satellite internet costs, speeds. Spectrum provides television, internet and phone services to Lakeville residents and businesses. For more information on residential installation and customer. Available Providers in Middlesex Centre: Ilderton N0M 2A0, Arva N0M 1C0, Kilworth/Komoka- N0L 1R0, Delaware N0L 1E0. CIK Telecom is the top notch internet service provider in Canada. Enjoy unlimited high speed internet, digital TV, cable and phone services for your home.

Never Received My 3rd Stimulus Check

3rd stimulus payment (approved March ) cannot be garnished to pay I did not receive my stimulus payments from the IRS and am expecting to receive. To check the status of your Economic Impact Payment, please visit the IRS Get my Payment page · To check if you qualify for the Economic Impact Payment this. You will generally receive a response 6 weeks after the IRS has received your request for a payment trace, but there may be delays due to limited staffing. NOTE: If you did not receive an Economic Impact Payment in or , or you have questions about the payments, please visit the Internal Revenue Service for. This means that if you do not receive your third stimulus check, you will have to claim it on your Tax Return as the IRS is no longer issuing these advance. If you did not get the Child Tax Credit or the third stimulus payment benefit, it's not too late! Apply by November 15 and you could get up to $3, per. The IRS will send payments by direct deposit, paper check, and prepaid debit cards. They will likely deliver your third stimulus the same way you received the. The payments continue to be sent out. If you haven't gotten your payment yet, the best way to check the status is on the Get My Payment tool on the IRS website. You'll need to request a payment trace. This can be done with Form (again, don't know why that was so quickly dismissed), but my recommendation is that. 3rd stimulus payment (approved March ) cannot be garnished to pay I did not receive my stimulus payments from the IRS and am expecting to receive. To check the status of your Economic Impact Payment, please visit the IRS Get my Payment page · To check if you qualify for the Economic Impact Payment this. You will generally receive a response 6 weeks after the IRS has received your request for a payment trace, but there may be delays due to limited staffing. NOTE: If you did not receive an Economic Impact Payment in or , or you have questions about the payments, please visit the Internal Revenue Service for. This means that if you do not receive your third stimulus check, you will have to claim it on your Tax Return as the IRS is no longer issuing these advance. If you did not get the Child Tax Credit or the third stimulus payment benefit, it's not too late! Apply by November 15 and you could get up to $3, per. The IRS will send payments by direct deposit, paper check, and prepaid debit cards. They will likely deliver your third stimulus the same way you received the. The payments continue to be sent out. If you haven't gotten your payment yet, the best way to check the status is on the Get My Payment tool on the IRS website. You'll need to request a payment trace. This can be done with Form (again, don't know why that was so quickly dismissed), but my recommendation is that.

CLEVELAND (WJW) — The third stimulus check was sent out to eligible American families starting back in March as part of the American Rescue Plan Act. And. The IRS also launched a new hotline to help answer FAQs about stimulus payments, which you can reach at How do I get the Third Economic Impact. If you did not receive the third stimulus payment ($ issued in March ), you will need to file a tax return and claim the Recovery Rebate Credit. Tax Tip If you still haven't received the previous April stimulus payment or only got part of it, you can claim what is known as a “recovery rebate. This can be done with Form (again, don't know why that was so quickly dismissed), but my recommendation is that you call the IRS. This is. Use the IRS "Get My Payment" tool to check on the status of your Economic Impact Payment. It will let you know when the IRS is depositing your payment or. If you do not have prior tax returns on file, you will need to file a income tax return to receive the third stimulus check – even if you have no income to. "Like the other two stimulus payments, you can track the status of yours using the IRS's Get My Payment tool. However, the tool is not available yet for the. without an income; without a bank account. If you're eligible and didn't receive a first or second Economic Impact Payment, or received less than the full. You can claim the 3rd stimulus payment ($1,) by claiming the Recovery Rebate Credit on your tax return. The deadline to file a tax return for Check the status of your stimulus check on the IRS Get My Payment website. Call the Economic Impact Payment Helpline with questions: +1 () As the IRS sends out its third batch of stimulus payments, many people wonder where their second stimulus payments are. · Check the Get My Payment Tool · My. Check the status of your stimulus check on the IRS Get My Payment website. Call the Economic Impact Payment Helpline with questions: +1 () If you file a payment trace (and let me emphasize that if it has been at least 4 weeks since your mailing date in Get My Payment, you need to do. If the IRS did not have an individual's direct deposit information, the individual should have received payments via physical checks or Economic Impact Payment. 3rd stimulus payment (approved March ) cannot be garnished to pay I did not receive my stimulus payments from the IRS and am expecting to receive. For information on the third EIP, see the IRS EIP webpage. To check on the status of your EIP, go to the IRS Get my Payment webpage. What are the differences. Those with questions can call the stimulus check hotline at IRS Get My Payment Tool. Get your payment status. See your payment type. Provide. Call the IRS. They will help you locate the whereabouts of your money. My friend did not get her Stimulus. I urged her to call IRS. Being the. The payments continue to be sent out. If you haven't gotten your payment yet, the best way to check the status is on the Get My Payment tool on the IRS website.

Where Is The Best Place To Retire On A Budget

She's asking for my help to find a house to buy in a cheaper place. The problem is, she told me she's open to pretty much anything in Georgia or Alabama. It came in as the most affordable retirement spot in our study based on a combination of low average home prices and rent combined with a decent median income. For retirees looking to live in a big city on a small budget, Des Moines is a good choice. Affordability is just one reason the Milken Institute ranked the. This affordable retirement community places you conveniently close to big cities. Whether you want to hop on a plane or have a nearby adventure, Raleigh and. Peru is one of the least expensive destinations to retire to in the world, with low living costs (31), low rent and cheap restaurant prices. It's a welcoming. El Paso is often ranked as the cheapest place to retire in Texas, but it also gets high marks for the overall happiness rating of its residents. You'll get. Below are some of the best and most affordable places to retire in California if you are on a budget. Where you live during retirement can significantly impact your spending abilities and how long your savings last. Based on our analysis, Las Vegas, NV, was the. Consider some of the many Florida communities that boast affordability and access to the retirement lifestyle you are dreaming of. Here are 25 budget-friendly. She's asking for my help to find a house to buy in a cheaper place. The problem is, she told me she's open to pretty much anything in Georgia or Alabama. It came in as the most affordable retirement spot in our study based on a combination of low average home prices and rent combined with a decent median income. For retirees looking to live in a big city on a small budget, Des Moines is a good choice. Affordability is just one reason the Milken Institute ranked the. This affordable retirement community places you conveniently close to big cities. Whether you want to hop on a plane or have a nearby adventure, Raleigh and. Peru is one of the least expensive destinations to retire to in the world, with low living costs (31), low rent and cheap restaurant prices. It's a welcoming. El Paso is often ranked as the cheapest place to retire in Texas, but it also gets high marks for the overall happiness rating of its residents. You'll get. Below are some of the best and most affordable places to retire in California if you are on a budget. Where you live during retirement can significantly impact your spending abilities and how long your savings last. Based on our analysis, Las Vegas, NV, was the. Consider some of the many Florida communities that boast affordability and access to the retirement lifestyle you are dreaming of. Here are 25 budget-friendly.

First on our list: Wenatchee. Topping both MoneyWise's list of inexpensive places to retire and Forbes' list of the best places to retire in the West, Wenatchee. Check out our list of the cheapest places to retire in the world. There is a place for every budget! Panama Panama beckons retirees to come live and spend. Most expats will consider the cost of living in Honduras as relatively cheap and this means retirees can stretch their retirement savings further. From housing. Australia: Known for its laid-back lifestyle, certain areas offer a more budget-friendly retirement experience. Retirement spots with great well-being. Here Are the 11 Best Places to Retire on a Budget · 1. St. George, Utah · 2. Palm Coast, Florida · 3. Loveland, Colorado · 4. Cape Coral, Florida · 5. Surprise. The 10 Most Affordable Places to Retire in Florida · 1. Boynton Beach · 2. Sarasota · 3. St. Petersburg · 4. Delray Beach · 5. Ocala · 6. Lakeland · 7. Fort Myers · 8. If you prefer a small town beach retirement, Astoria might be the right fit. This coastal city, which is located on the Columbia River (close to the Pacific. The state of Maryland is a popular choice when it comes to selecting a prime locale for retirement. First and foremost is the centralized location, surrounded. Ranking of America's best places for retirees based on weather, livability for the retirement population, and access to healthcare. Browse these options for some of the most affordable places to live in California with median home sales and two-bedroom rental averages provided via Trulia. The largest city in Maine, Portland offers a lively downtown and plenty of urban-esque amenities amidst the great outdoors of the Pine Tree State. You can enjoy. That said, you can still get a lot of bang for your buck as the median household price is still affordable and new homes are being developed in popular cities. First, the state makes for an attractive retirement home thanks to its low cost of living and the lack of state income taxes. Out of the top 10 most affordable states for retirement, Wyoming stands out for its excellent quality of life, also taking WalletHub's No. 7 ranking in that. Check out our list of the cheapest places to retire in the world. There is a place for every budget! Panama Panama beckons retirees to come live and spend. Olympia, Washington's capital, is another one of the best cities to retire in. The city only hosts a few retirement communities because older adults comprise. That said, you can still get a lot of bang for your buck as the median household price is still affordable and new homes are being developed in popular cities. Western NC used to be the affordable, mild weather retirement paradise. Now it is the rich people's mild weather retirement paradise. Newer. Best for Year-Round Outdoor Recreation: Reno, Nevada · Best for Sunshine and Warm Weather: Orlando, Florida · Best for Affordable Big-City Living: Minneapolis. Sierra Foothills: As an alternative to pricey coastal communities, the Sierra Foothills region is more reasonably priced. Places like Placerville and Grass.

Cost Of Hospital Birth

Correcting a birth certificate can cost money or even require a trip to court. There is no fee for changes made by the hospital if sent within 12 months of. Medicaid payments for all maternal and newborn care were $ for vaginal birth and $13, for cesarean birth. The authors noted that both commercial and. It costs about $18, to have a baby in the United States if you have health insurance. This includes the cost of pregnancy, childbirth, and postpartum. Baby was small and required a bit of extra care, but never went to the NICU, and we only spent 1 more night than usual in the hospital. I still. Preparing for a new baby is exciting, but handling hospital delivery costs can be overwhelming. Learn about common maternity billing expenses you can. Here are the median costs by birth type: Vaginal with no complications: $10, Vaginal with complications: $13, $ for an unmedicated birth in hospital with a midwife and no emergencies. I was on Medicaid at the time, and delivered in a “crappy”. This line chart compares the median cost vs. median charge for vaginal deliveries with a minor severity of illness by hospital. I'm a state government employee and my wife was on my insurance. The insurance plan is pretty good. Notwithstanding that, a hospital admission. Correcting a birth certificate can cost money or even require a trip to court. There is no fee for changes made by the hospital if sent within 12 months of. Medicaid payments for all maternal and newborn care were $ for vaginal birth and $13, for cesarean birth. The authors noted that both commercial and. It costs about $18, to have a baby in the United States if you have health insurance. This includes the cost of pregnancy, childbirth, and postpartum. Baby was small and required a bit of extra care, but never went to the NICU, and we only spent 1 more night than usual in the hospital. I still. Preparing for a new baby is exciting, but handling hospital delivery costs can be overwhelming. Learn about common maternity billing expenses you can. Here are the median costs by birth type: Vaginal with no complications: $10, Vaginal with complications: $13, $ for an unmedicated birth in hospital with a midwife and no emergencies. I was on Medicaid at the time, and delivered in a “crappy”. This line chart compares the median cost vs. median charge for vaginal deliveries with a minor severity of illness by hospital. I'm a state government employee and my wife was on my insurance. The insurance plan is pretty good. Notwithstanding that, a hospital admission.

Vaginal birth with insurance will cost $8, in Connecticut and $15, if you do not have an insurance cover. For a C-section, it costs $10, with. This line chart compares the median cost vs. median charge for vaginal deliveries with a minor severity of illness by hospital. Hospital (Vaginal Birth $K for mom, $K for the newborn care, C/Section $k additional cost); Pathologist (for reading your labs); Anesthesiologist . In the end, though estimates vary, a normal vaginal birth costs an average of nearly $11, in the United States. Insurance—if you have it—covers most of that. You will pay a deposit of $10, for labour and childbirth. This deposit is applied towards your needs at the hospital. For example, support during labour and. University Of Maryland Medical Center · $11, · $ ; Johns Hopkins Hospital · $11, · $77 ; Johns Hopkins Bayview Medical Center · $10, · $ ; Mercy Medical. $ for an unmedicated birth in hospital with a midwife and no emergencies. I was on Medicaid at the time, and delivered in a “crappy”. In the end, though estimates vary, a normal vaginal birth costs an average of nearly $11, in the United States. Insurance—if you have it—covers most of that. (No insurance) Total average hospital bill with a c-section: $50, (With insurance) Total average hospital bill for a regular birth: $3, (With insurance. Giving birth; Preparing a room for the baby; Buying diapers; Buying formula; Buying A vaginal birth will cost $10, and a C-section will cost $16, A study published in the journal Health Affairs on the out-of-pocket spending for maternity care among women with employer-sponsored health plans found that the. Hospital (Vaginal Birth $K for mom, $K for the newborn care, C/Section $k additional cost); Pathologist (for reading your labs); Anesthesiologist . The average cost of childbirth can vary widely and there can be significant cost differences between giving birth at the hospital and birthing in the. In fact, most delivery types that are performed in-network at a hospital or birthing center are covered, to some extent, by insurance – this includes methods. How much will your hospital stay cost? Get a personalized estimate based on Planning an out-of-hospital birth? If you're a Kaiser Permanente member. Preparing for a new baby is exciting, but handling hospital delivery costs can be overwhelming. Learn about common maternity billing expenses you can. University Of Maryland Medical Center · $11, · $ ; Johns Hopkins Hospital · $11, · $77 ; Johns Hopkins Bayview Medical Center · $10, · $ ; Mercy Medical. Correcting a birth certificate can cost money or even require a trip to court. There is no fee for changes made by the hospital if sent within 12 months of. For patients not covered by health insurance, the typical cost of a vaginal delivery without complications ranges from about $9, to $17, It costs about $18, to have a baby in the United States if you have health insurance. This includes the cost of pregnancy, childbirth, and postpartum.