bss64.ru

Community

List Of Recruitment Firms

The 15 Best Professional Recruiting Firms · Toptal · Kelly Services · Robert Half · Randstad · Adecco · Insight Global · Lucas Group. Mondo is one of the largest national staffing agencies specializing exclusively in high-end, niche IT, Tech, and Digital Marketing talent. The company was. Discover, find, & hire from the official Top 50 listing by 50Pros of the highest-ranking Recruiting agencies & firms that our experts vetted. List of Staffing Companies in North Carolina | Top Staffing Firms in North Carolina · Dalerio Consulting · OpenXcell · Need assistance in finding the best match. Top Executive Recruitment Lists Advice. As you research NYC executive recruitment agencies for your company, take care. Some top executive recruiting company. Recruiting firms are external agencies that assist companies in finding qualified talent for open positions in the workforce. The Top 10 Professional Recruiting Firms · Robert Half · Kelly · Korn Ferry · Aerotek · Manpower · Adecco · Randstad · Lucas Group. What Are the Top 11 International Recruitment Agencies? · 1. Near · 2. Hudson · 3. Korn Ferry · 4. Stanton Chase · 5. NPAworldwide · 6. PageGroup · 7. Pedersen &. Connect with the top 50+ Recruiting companies on Upwork. These companies can flex quickly to your business to take it to the next level. The 15 Best Professional Recruiting Firms · Toptal · Kelly Services · Robert Half · Randstad · Adecco · Insight Global · Lucas Group. Mondo is one of the largest national staffing agencies specializing exclusively in high-end, niche IT, Tech, and Digital Marketing talent. The company was. Discover, find, & hire from the official Top 50 listing by 50Pros of the highest-ranking Recruiting agencies & firms that our experts vetted. List of Staffing Companies in North Carolina | Top Staffing Firms in North Carolina · Dalerio Consulting · OpenXcell · Need assistance in finding the best match. Top Executive Recruitment Lists Advice. As you research NYC executive recruitment agencies for your company, take care. Some top executive recruiting company. Recruiting firms are external agencies that assist companies in finding qualified talent for open positions in the workforce. The Top 10 Professional Recruiting Firms · Robert Half · Kelly · Korn Ferry · Aerotek · Manpower · Adecco · Randstad · Lucas Group. What Are the Top 11 International Recruitment Agencies? · 1. Near · 2. Hudson · 3. Korn Ferry · 4. Stanton Chase · 5. NPAworldwide · 6. PageGroup · 7. Pedersen &. Connect with the top 50+ Recruiting companies on Upwork. These companies can flex quickly to your business to take it to the next level.

Best Recruiting Firms · Admios. (6 reviews). Nearshore Software Development Services · Deducto. (no reviews) · NXTThing. (no reviews) · Aerotek. (no reviews). Brainery Llc. Industry: Staffing And Recruiting. Number of employees: Location: Berlin, Connecticut. recruiting firm in the Twin Cities. About Us. Top Industry Partners. With an extensive list of partnerships, we strive to find the best fit for our network of. top Recruitment companies and startups in United States in August Powered by the F6S community. Aug 22, Recruitment companies snapshot. The List · Korn Ferry International · N2Growth · Heidrick & Struggles · Egon Zehnder · Spencer Stuart · Russell Reynolds · Boyden · Stanton Chase International. GRecruiter is a Directory of Recruiting agencies worldwide. Find Top Recruiters in your local area based on social proof and reviews. Palmer Staffing Services is a full-service recruiting firm offering temporary, temp-to-hire and direct-hire placement for administrative, management, legal, and. CoWorx excels in offering cost-effective and highly responsive staffing solutions that help our clients and CoWorke Executive, Light Industrial.. Recruiting. Top 10 Recruitment Research Firms. Research Firms List for Executive Search Support · Recruitment Research Firms List. Corporate Navigators · The Candidate. 50 firms, with top five being: Korn Ferry, Russell Reynolds Associates, Spencer Stuart, Heidrick & Struggles, and Egon Zehnder. This list of recruitment and staffing agencies caters to a wide range of job industries to facilitate job placements. Mid-Level Management Staffing & Recruiting Agencies: · Murray Resources · All Team Staffing · Bulls Eye Recruiting · Certified Employment Group · City Staffing · CSI. Staffing · Staffing Firm Rankings & Lists · Operational Metrics & Best Practices · Talent & Staffing Platforms · Mergers & Acquisitions · Talent Acquisition. Compare and research Staffing Firms that specialize in hiring temporary and contingent workers to supplement your workforce. · VelvetJobs Affordable Outplacement. The 25 Best Staffing Agencies in · 1. Toptal · 2. Robert Half · 3. Adecco · 4. Express Employment Professionals · 5. Manpower · 6. Aerotek · 7. Insight Global · 8. Top Recruitment Firms Directory. Welcome to ClearPointHCO's curated directory of recruiting and staffing firms. Our mission is to assist you in finding. Professional Recruiters Group is an employment agency in Phoenix that operates with integrity, honesty, and thorough industry knowledge. The company uses its. This list of major recruitment companies includes the largest and most profitable recruiting businesses, corporations, agencies, vendors and firms in the world. ALL FIRMS · Korn Ferry · Russell Reynolds Associates · Heidrick & Struggles · Spencer Stuart · Egon Zehnder · True · ZRG Partners · DHR Global.

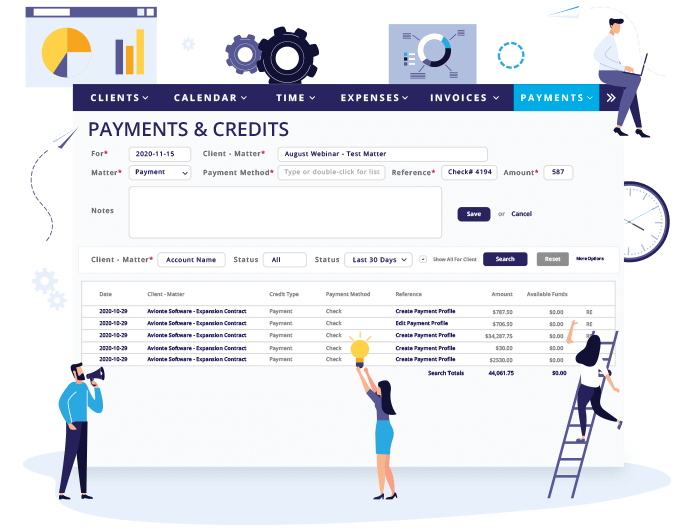

Legal Billing And Accounting Software

LeanLaw: Best overall law firm accounting software · Clio: Best scalable law firm accounting software · PCLaw: Best desktop law firm accounting software. Zoho Invoice is an award-winning cloud app designed to help law firms send, track, and manage their invoices. Legal billing software includes capabilities such as: Time and expense tracking; Bill creation and invoicing; Collections and payment; Trust Accounting. Smokeball's legal billing software is the preferred platform for billing managers at law firms. Streamline your monthly billing process, track time. PCLaw has evolved into leading legal case management software by creating and refining a multitude of features and functions that law firms need, to be their. We use Clio. We have used it for years starting with one attorney up to four (and staff). I like that it can track several bank accounts. Easily track time & expenses, build custom invoices, and see comprehensive insights with PracticePanther's billing software for attorneys & law firms. Bill4Time Firm Manager is an end-to-end mobile-ready legal time billing solution. It provides time tracking, online invoicing and payments, matters management. CaseFox is a legal billing software for modern law firms. CaseFox helps lawyers in managing the timekeeping & billing process more efficient. LeanLaw: Best overall law firm accounting software · Clio: Best scalable law firm accounting software · PCLaw: Best desktop law firm accounting software. Zoho Invoice is an award-winning cloud app designed to help law firms send, track, and manage their invoices. Legal billing software includes capabilities such as: Time and expense tracking; Bill creation and invoicing; Collections and payment; Trust Accounting. Smokeball's legal billing software is the preferred platform for billing managers at law firms. Streamline your monthly billing process, track time. PCLaw has evolved into leading legal case management software by creating and refining a multitude of features and functions that law firms need, to be their. We use Clio. We have used it for years starting with one attorney up to four (and staff). I like that it can track several bank accounts. Easily track time & expenses, build custom invoices, and see comprehensive insights with PracticePanther's billing software for attorneys & law firms. Bill4Time Firm Manager is an end-to-end mobile-ready legal time billing solution. It provides time tracking, online invoicing and payments, matters management. CaseFox is a legal billing software for modern law firms. CaseFox helps lawyers in managing the timekeeping & billing process more efficient.

Legal billing software streamlines and simplifies your billing processes to help you easily track billable hours, send invoices, and collect payments. Advanced legal billing software automates invoicing, strengthens timekeeping, accelerates collections, & improves law firm profitability. Agencies, law firms, freelancers, accountants and other businesses around the world rely on Bilr for time tracking and invoice creation. Try Risk-Free. We're. ALB is a one of a kind Legal billing software for law firms. With ALB accounting software, capture daily activities, easily prepare, cleanse and submit. Clio's legal billing software includes easy expense tracking, billing, LEDES, payments, + more. Industry-leading security & world-class support. IOLTA, which helps raise money for legal aid for those in poverty via interest earned on client funds, entails special accounting. MyCase is a product designed for managing various aspects of a law firm, including case and matter management, calendaring, docketing, trust accounting. Software options · Clio · Soluno · CosmoLex · TeamConnect · Mitratech Managed Bill Review · LawPay · Lexzur · Filevine. Xero is intuitive online accounting software for lawyers, attorneys, and small law firms that helps streamline your admin and bookkeeping. For those with budget at top of mind, LawPay serves as an easy-to-use and affordable billing solution for law firms of all sizes. The software starts at $19 a. Soluno is a powerful and easy-to-use cloud-based legal software that specializes in accounting, billing, trust, time/expense entry, and matter management. Our legal invoicing software provides a complete view of all invoices, accounts receivable, trust account balances, and team productivity. Giving you a clear. My firm currently uses Firm Central (a Thomson Reuters product) for billing, timekeeping and accounting, but it is being discontinued this fall. Tabs3 Financials is an efficient and compliant solution for your law firm's accounting software. This seamless integration between Tabs3 Financials and Tabs3. LeanLaw makes it ridiculously easy for legal teams to efficiently run and grow the firm. LeanLaw is the financial operating system built for law firms that. Streamline billing and accounting processes, track time accurately, and manage client payments easily with our legal billing software suite. FreshBooks is the best accounting software for law firms. Send custom invoices, track expenses, accept credit cards. Start a free day trial today. QuickBooks simplifies legal billing and accounting for lawyers. Track billable hours, record expenses, bill clients, send reports, and more. Legal billing software caters specifically to this need by offering features that enable lawyers to capture every billable moment with accuracy. Whether.

Withdrawing From Ira For Education

Students can withdraw funds early with no penalties to pay for qualified higher education expenses, like tuition and supplies. IRA distributions are generally included in the recipient's gross income and taxed as ordinary income, other than qualified distributions from a Roth IRA. Retirement funds may help your pay for college expenses. You can withdraw funds from your IRA without penalty to pay qualified higher education expenses. Any money taken from a retirement plan is generally subject to a 10% early withdrawal penalty (unless certain conditions are met). How are IRA withdrawals taxed. However, you'll need to carefully consider the income tax consequences if your contributions to a traditional IRA were deductible. The amount you withdraw will. Before age 59½, the IRS considers your withdrawal (also called a "distribution") from these IRA types as an early withdrawal, triggering a possible tax penalty. Funds must be used within days, and there is a pre-tax lifetime limit of $10, Some educational expenses for yourself and your immediate family are. If you use a Roth IRA withdrawal for qualified education expenses, you will avoid the 10% penalty, but you will still pay income tax on the earnings portion. Normally, if you withdraw money from a traditional or Roth IRA before you reach age /2, you would pay a 10% early distribution penalty on the distribution. Students can withdraw funds early with no penalties to pay for qualified higher education expenses, like tuition and supplies. IRA distributions are generally included in the recipient's gross income and taxed as ordinary income, other than qualified distributions from a Roth IRA. Retirement funds may help your pay for college expenses. You can withdraw funds from your IRA without penalty to pay qualified higher education expenses. Any money taken from a retirement plan is generally subject to a 10% early withdrawal penalty (unless certain conditions are met). How are IRA withdrawals taxed. However, you'll need to carefully consider the income tax consequences if your contributions to a traditional IRA were deductible. The amount you withdraw will. Before age 59½, the IRS considers your withdrawal (also called a "distribution") from these IRA types as an early withdrawal, triggering a possible tax penalty. Funds must be used within days, and there is a pre-tax lifetime limit of $10, Some educational expenses for yourself and your immediate family are. If you use a Roth IRA withdrawal for qualified education expenses, you will avoid the 10% penalty, but you will still pay income tax on the earnings portion. Normally, if you withdraw money from a traditional or Roth IRA before you reach age /2, you would pay a 10% early distribution penalty on the distribution.

Some people use a Roth IRA to save for college instead of retirement because withdrawals are exempt from penalties when used to pay for qualified education. Will you pay a penalty for using Roth IRA withdrawals for education? Explore your options today. Get tax answers from H&R Block. Important Withdrawal Processes · Qualified higher education expenses at an eligible educational institution can include: · K Tuition: · Apprenticeship Programs. If you are not yet 59 ½ years old, k withdrawals are also subject to a 10% early withdrawal penalty. While IRAs offer an exception to the early withdrawal. Will you pay a penalty for using Roth IRA withdrawals for education? Explore your options today. Get tax answers from H&R Block. Traditional IRA · Savings grow tax deferred · Investments include stocks, bonds, mutual funds, Exchange-Traded Funds, CDs, and so forth · Withdrawals may begin at. If you are not yet 59 ½ years old, k withdrawals are also subject to a 10% early withdrawal penalty. While IRAs offer an exception to the early withdrawal. I understand that if I need the money for higher education I can move it out of my IRA without having to pay the 10% penalty. Withdrawal rules vary, depending on whether you have a traditional or Roth IRA and, generally, your age. While you must be 59½ to withdraw funds from a. Some people use a Roth IRA to save for college instead of retirement because withdrawals are exempt from penalties when used to pay for qualified education. To qualify for the penalty exemption for education expenses, you must have qualifying college expenses in the year when you take a distribution. If you plan to. The amount you withdraw will be added to your taxable income for the year you withdraw it. This could be enough to put you in a higher tax bracket. Even if your. Early IRA withdrawals—before age 59½—used to pay for student loans are subject to a 10% penalty on top of any income taxes owed. Early withdrawals from a Roth. Restrictions relax at age 59½, and you can withdraw from a Roth or traditional IRA penalty-free. Resources & education. Retirement · Taxes · Investing. You can withdraw from an IRA to pay for educational expenses if you are a parent, spouse, grandparent, or the student him or herself (if the student already has. In addition, qualified education expenses can be used to justify only one education tax benefit. If these expenses are used to justify a penalty-free withdrawal. IRA withdrawal when the IRA funds are invested in obligations A Coverdell education savings account (ESA), formerly known as an education IRA, is not a. There is an exception to the taxability of an IRA withdrawal when the IRA funds are invested in obligations A Coverdell education savings account (ESA). The Roth IRA withdrawals, however, will not attract any income tax. But, there are rules to follow here, as well. In order to draw tax free earnings from a Roth. You can withdraw contributions you made to your Roth IRA anytime, tax- and penalty-free. However, you may have to pay taxes and penalties on earnings in your.

Trustage Term Life Insurance Reviews

This award is based an independent survey of 3,+ companies. TruStage's Permanent Life Product, underwritten by CMFG Life Insurance Company ranked #9 in the. TruStage Life Insurance Company has an A.M. Best rating of “A” (excellent) and has been in the industry for over 80 years. If you are a member of a credit union. While the vast majority of reviews we read were positive, some customers reported communication mix-ups or difficulty understanding their policy options. We work with TruStage™ to offer term and whole life insurance designed to be quick and simple, with no medical exam required. TruStage™ is made available by. TruStage® Life Insurance, TruStage® AD&D Insurance and TruStage® Term Life Insurance are offered by TruStage Insurance Agency, LLC and issued by CMFG Life. TruStage offers term life insurance that covers your family if you pass away during the specified term. TruStage uses simplified underwriting for its term life. TruStage Life Insurance is best for people looking for a small whole life policy with an online quote and application that doesn't require a medical exam. Customer review website Trustpilot lists TruStage with a rating of stars out of five based on more than 5, reviews. TruStage is not accredited by the. It's Annual renewable term. If you're a standard underwriting risk you could buy a level term and likely save money. Talk with a life insurance. This award is based an independent survey of 3,+ companies. TruStage's Permanent Life Product, underwritten by CMFG Life Insurance Company ranked #9 in the. TruStage Life Insurance Company has an A.M. Best rating of “A” (excellent) and has been in the industry for over 80 years. If you are a member of a credit union. While the vast majority of reviews we read were positive, some customers reported communication mix-ups or difficulty understanding their policy options. We work with TruStage™ to offer term and whole life insurance designed to be quick and simple, with no medical exam required. TruStage™ is made available by. TruStage® Life Insurance, TruStage® AD&D Insurance and TruStage® Term Life Insurance are offered by TruStage Insurance Agency, LLC and issued by CMFG Life. TruStage offers term life insurance that covers your family if you pass away during the specified term. TruStage uses simplified underwriting for its term life. TruStage Life Insurance is best for people looking for a small whole life policy with an online quote and application that doesn't require a medical exam. Customer review website Trustpilot lists TruStage with a rating of stars out of five based on more than 5, reviews. TruStage is not accredited by the. It's Annual renewable term. If you're a standard underwriting risk you could buy a level term and likely save money. Talk with a life insurance.

The TruStage term life insurance policy is a five-year increasing term policy. This means that every five years, your policy premium increases, with rates based. Since term insurance covers you for a limited period of time, it generally costs less than whole life. That can make it an affordable choice for people who want. Simplified Issue Term Life: These TruStage and Ameritas policies don't require a medical exam, and underwriting decisions are instantaneously based solely on. TruStage Life Insurance Company has an A.M. Best rating of “A” (excellent) and has been in the industry for over 80 years. If you are a member of a credit union. TruStage Life Insurance Review · Guaranteed acceptance whole life policies available · Applicants may receive same-day approval and coverage. Transamerica offers term life rates up that cost 50% less than average for some applicant profiles. Older applicants might want to consider the company because. What's the difference between whole life & term life insurance? How about AD&D insurance? These questions & more are answered in TruStage's Life Insurance. TruStage™ life insurance policies contain specific limitations, exclusions, termination provisions and requirements for keeping them in force. Please see your. Navy Federal Financial Group offers whole and term life insurance policies to help protect your loved ones and keep you confident in the future. This award is based an independent survey of 3,+ companies. TruStage's Permanent Life Product, underwritten by CMFG Life Insurance Company ranked #9 in the. It can help your family cover financial expenses. It can provide a way to leave money to charity. Whole life policies build some cash value you may be able to. This policy is designed to help financially protect your beneficiaries during the term of the contract, if you are no longer there to do so. The benefits from. Choosing between term life and whole life insurance shouldn't be confusing. We'll help you make the right choice for your family. I do not need life insurance and their mailings are unsolicited. I joined the Navy Federal credit union and since doing so they have continually sent me. Guaranteed acceptance whole life · TruStage™ Simplified Issue Term Life Insurance is issued by CMFG Life Insurance Company. This is a term policy to age 80 that. You could get a Whole Life Insurance policy from TruStage™ after answering only a few health questions online. No physical exams, no invasive tests, no hassle —. TruStageTerm Life Insurance. As a member of our credit union, you may qualify for up to $, of TruStage Term Life Insurance at rates designed to be. Helping you through whatever life brings: Life Insurance, Lon-Term Care, Property & Vehicle, Health/Accident, and Life Insurance Policy Review. This organization is not BBB accredited. Insurance Services Office in Madison, WI. See BBB rating, reviews, complaints, & more. The financial strength rating of life insurance companies scores its ability to pay contracts and life insurance policies. SuperMoney gives TruStage an A or.

Stocks Worth Less Than A Dollar

A penny stock, also known as an OTC or Over-The-Counter stock, typically references a stock that trades for less than $5 per share. Penny stocks are often. Canadian stocks with low prices in one list: available to a wider range of investors, they can potentially bring gains, but can be highly volatile too. Penny stocks are generally stocks that trade at less than five dollars a share. This relatively low price per share can make them attractive to many investors. In addition, they generally have a very small market capitalization, meaning their outstanding shares' value is low. These companies can offer the potential for. Penny stock trading is a riskier, more speculative type of investment where shares of these companies are trading at less than $5 per share. Buying shares of a lower dollar amount also limits your exposure to risk, since Are Stocks Under $10 Worth Buying? The answer to this question is a. A penny stock refers to a small company's stock that typically trades for less than $5 per share. Although some penny stocks trade on large exchanges such as. Penny stocks are shares in companies that trade for less than $5. They are often very illiquid, meaning they don't trade often. As volume declines, fewer. Most penny stocks are considered poor long-term investments. While there are always some hidden gems, most stocks trading under $5 — particularly those trading. A penny stock, also known as an OTC or Over-The-Counter stock, typically references a stock that trades for less than $5 per share. Penny stocks are often. Canadian stocks with low prices in one list: available to a wider range of investors, they can potentially bring gains, but can be highly volatile too. Penny stocks are generally stocks that trade at less than five dollars a share. This relatively low price per share can make them attractive to many investors. In addition, they generally have a very small market capitalization, meaning their outstanding shares' value is low. These companies can offer the potential for. Penny stock trading is a riskier, more speculative type of investment where shares of these companies are trading at less than $5 per share. Buying shares of a lower dollar amount also limits your exposure to risk, since Are Stocks Under $10 Worth Buying? The answer to this question is a. A penny stock refers to a small company's stock that typically trades for less than $5 per share. Although some penny stocks trade on large exchanges such as. Penny stocks are shares in companies that trade for less than $5. They are often very illiquid, meaning they don't trade often. As volume declines, fewer. Most penny stocks are considered poor long-term investments. While there are always some hidden gems, most stocks trading under $5 — particularly those trading.

These stocks, which trade under $5 per share, are usually priced that low for a good reason. For example, a penny stock could belong to a once-thriving company. Penny stocks are generally stocks that trade at less than five dollars a share. This relatively low price per share can make them attractive to many investors. Penny stocks are generally stocks that trade at less than five dollars a share. This relatively low price per share can make them attractive to many investors. Stocks under dollars: Daily Price Predictions of Stocks with Smart Technical Market Analysis. Penny stocks to buy under $1 · $BTC Digital (bss64.ru)$ · $Exela Technologies (bss64.ru)$ · $ProQR Therapeutics (bss64.ru)$ · $Cybin (bss64.ru)$ · $Statera Biopharma . The Best Stocks Under $1 at a Glance. Penny stocks — US stocks ; MTNB · D · USD, −% ; EJH · D · USD, +% ; BNZI · D · USD, −% ; SOBR · D · USD, +%. Get free stock tools, free stock ratings, free stock charts and calculate the value of stocks to buy. Penny stocks are typically issued by small companies and cost less than $5 per share. · They can garner interest from some investors who want to get in close to. Penny stocks are typically issued by small companies and cost less than $5 per share. · They can garner interest from some investors who want to get in close to. A penny stock is a share that trades for $5 or less. While some investors consider penny stocks as trading for amateurs, Wall Street analysts and other. A penny stock, also known as an OTC or Over-The-Counter stock, typically references a stock that trades for less than $5 per share. Penny stocks are often. Buying cheap stocks under $1 doesn't mean it's a bargain. A cheap stock sold at $ may still be overvalued if the business is only worth $, with negative. Penny stocks are common shares of small public companies that trade for less than one dollar per share. The U.S. Securities and Exchange Commission (SEC). stock will begin trading on a split-adjusted basis at the open of trading on Wednesday, August 28, under the new CUSIP number M Exicure's. Penny stocks are shares of small companies that trade for less than $5 a share. In the past, "penny stocks" referred to shares that traded for pennies on the. In the UK, a penny stock is defined as any share worth less than £1 each. In In Australia, many classify penny stocks as those under one Australian dollar. A penny stock is a share that trades for $5 or less. While some investors consider penny stocks as trading for amateurs, Wall Street analysts and other. If a stock's price falls all the way to zero, shareholders end up with worthless holdings. Once a stock falls below a certain threshold, stock exchanges will.

Is Home Equity Mortgage Interest Deductible

When deducting interest paid on a home equity loan or HELOC, be sure to keep all receipts and invoices for labor and materials. You'll need them in case you. And, the interest on a home-equity loan is now deductible only in situations where you use the proceeds to substantially improve the home itself. (Not when you'. You can write off home equity loan interest as long as you used the funds to renovate your home. You'll need to know how to document these expenses. Mortgage Deduction Requirements. Generally, your home mortgage interest is tax deductible up to $, For most taxpayers, this means your entire mortgage. On first and second mortgages and home equity lines of credit (with some limitations) for first and second homes, your mortgage interest deduction is still a. Interest from HELOC and home equity loan interest are both tax-deductible if used to improve a primary residence. Claim this by itemizing with Schedule A. For a home equity loan, you can deduct the interest on up to $, of the loan for married filers, or $, for couples who are married filing separately. Key takeaways · The interest you pay on a home equity loan (HELOC) may be tax deductible · For tax years through there are tax benefits for homeowners. In most cases, you can deduct your interest. How much you can deduct depends on the date of the loan, the amount of the loan, and how you use the loan. When deducting interest paid on a home equity loan or HELOC, be sure to keep all receipts and invoices for labor and materials. You'll need them in case you. And, the interest on a home-equity loan is now deductible only in situations where you use the proceeds to substantially improve the home itself. (Not when you'. You can write off home equity loan interest as long as you used the funds to renovate your home. You'll need to know how to document these expenses. Mortgage Deduction Requirements. Generally, your home mortgage interest is tax deductible up to $, For most taxpayers, this means your entire mortgage. On first and second mortgages and home equity lines of credit (with some limitations) for first and second homes, your mortgage interest deduction is still a. Interest from HELOC and home equity loan interest are both tax-deductible if used to improve a primary residence. Claim this by itemizing with Schedule A. For a home equity loan, you can deduct the interest on up to $, of the loan for married filers, or $, for couples who are married filing separately. Key takeaways · The interest you pay on a home equity loan (HELOC) may be tax deductible · For tax years through there are tax benefits for homeowners. In most cases, you can deduct your interest. How much you can deduct depends on the date of the loan, the amount of the loan, and how you use the loan.

You can't deduct the interest you pay on home equity loans or home equity lines of credit if the debt is used for something other than home improvements. This. Did you know? The interest you pay on a HELOC may be tax-deductible if you use the money to buy, build or substantially improve your home. Energy-efficient. The deductibility of interest on a home equity line of credit (HELOC) as a second mortgage depends on the use of the loan proceeds and the tax year in. Note: For interest paid on home equity loans and lines of credit to be deductible, the loan must be used to buy, build or substantially improve the taxpayer's. An individual may not claim a deduction for interest on a home equity debt for tax years beginning after and before to the extent the loan proceeds. Under the TCJA, all equity debt is non-deductible, even if incurred prior to December 15, However, if the proceeds from home equity debt are used to. HELOC interest is tax deductible only if the borrowed funds are used to buy, build, or substantially improve the taxpayer's home that secures the loan. At. Is Mortgage Interest Tax Deductible? Current IRS rules allow many homeowners to deduct up to the first $, of their home mortgage interest costs from. Home equity indebtedness has a loan limit of $, Home Acquisition Debt. Definition: Home acquisition debt is a mortgage taken out after October 13, Interest on a home equity line of credit (HELOC) or a home equity loan is tax deductible if you use the funds for renovations to your home—the phrase is “buy. Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy, build, or substantially improve the taxpayer's home. Regardless of whether your property is a house, co-op, condo, apartment, mobile home, houseboat, or something completely different, if you reside in the US, you. So beginning in , interest on home equity loans will be deductible again, and the limit on qualifying acquisition debt will be raised back to $1 million. Interest is still deductible on home equity loans (or second mortgages) if the proceeds are used to substantially improve the residence. Interest remains. As you're planning to stay in your current home and use the loan to buy an investment property, which will be used to produce income then the interest would be. If the home equity loan is used for business purposes, however, the interest remains a deductible business expense. Farmers must be careful to trace and. Fully deductible interest. In most cases, you can deduct all of your home mortgage interest. How much you can deduct depends on the date of the mortgage, the. After the TCJA, home equity loans are now included within the mortgage's principal limit, and interest is only deductible if used to build or improve a. Under the pre-Act rules, you could deduct interest on up to a total of $1 million of mortgage debt used to acquire your principal residence and a second.

Top Rated Roadside Assistance

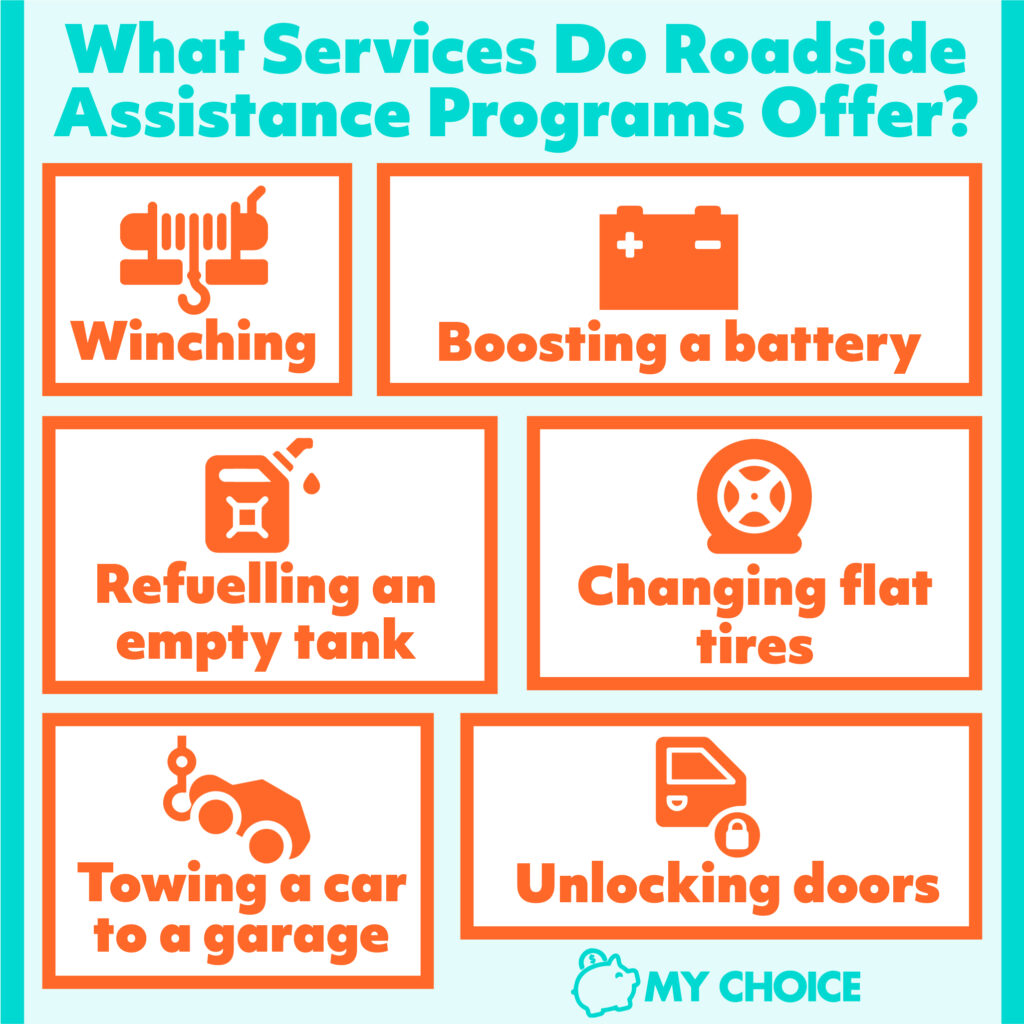

Their best plan for the budget is the Plus plan. 4 service calls per year (any tow, tire change, fuel delivery, jump start, lockout and winching. Call ; a flat $ charge for towing up to 5 miles, tire changing, jump starting, locksmith service, fuel delivery and standard winching;. Best Roadside Assistance Plans for · Best for RVs: Good Sam Roadside Assistance · Best for Road Trips: AAA · Best for Motorcycles: Motorcycle Towing. Lots of cards offer some type of road side assistance. You're covered for towing, flat tire service, battery boost, and fuel delivery. AAA Roadside Assistance. Geico. State. Farm. Progressive. Allstate. 24/7 Roadside Assistance Service. We offer hour Roadside. Get the peace of mind that comes with Good Sam Roadside Assistance. Auto and RV roadside assistance plans with premium coverage, towing, and roadside. AAA Classic starts at $68 per year including five miles of towing, fuel delivery, and $50 locksmith service. Higher tiered AAA Plus costs $ and includes Top 10 Best Roadside Assistance in Philadelphia, PA - August - Yelp - Easy To Plug Roadside, South Philly Towing, Xpress Roadside Assistance. Comparing the best roadside assistance plans of ; COMPANY. AAA. OUR RATING. LOWEST COST PLAN, $ LEARN MORE. Compare Rates. Compare rates offered by. Their best plan for the budget is the Plus plan. 4 service calls per year (any tow, tire change, fuel delivery, jump start, lockout and winching. Call ; a flat $ charge for towing up to 5 miles, tire changing, jump starting, locksmith service, fuel delivery and standard winching;. Best Roadside Assistance Plans for · Best for RVs: Good Sam Roadside Assistance · Best for Road Trips: AAA · Best for Motorcycles: Motorcycle Towing. Lots of cards offer some type of road side assistance. You're covered for towing, flat tire service, battery boost, and fuel delivery. AAA Roadside Assistance. Geico. State. Farm. Progressive. Allstate. 24/7 Roadside Assistance Service. We offer hour Roadside. Get the peace of mind that comes with Good Sam Roadside Assistance. Auto and RV roadside assistance plans with premium coverage, towing, and roadside. AAA Classic starts at $68 per year including five miles of towing, fuel delivery, and $50 locksmith service. Higher tiered AAA Plus costs $ and includes Top 10 Best Roadside Assistance in Philadelphia, PA - August - Yelp - Easy To Plug Roadside, South Philly Towing, Xpress Roadside Assistance. Comparing the best roadside assistance plans of ; COMPANY. AAA. OUR RATING. LOWEST COST PLAN, $ LEARN MORE. Compare Rates. Compare rates offered by.

Roadside Assistance Plans · Titan Warranty Administration · Beanstalk Benefits · AAA · Information Not Provided · Alpha Roadside Services · Information Not. DRIVE Roadside mobile long-distance roadside assistance is designed to provide the best and quickest help, ensuring you are never alone on the road. With a. From flat tires to breakdowns, it's best to be prepared for it all. At Weiss Insurance Agency, we're proud to offer the following packages of Roadside. Breakdown Inc. is a reputable option, offering comprehensive services such as towing, jump-starts, tire changes, and fuel delivery. Their. You can get roadside assistance coverage from auto insurers, motor clubs, and more. Allstate, Farmers, and GEICO offer some of the best coverage options. For the best towing Aurora CO has to offer, call for the fastest & most reliable fleet of tow trucks, 24 Hr roadside assistance & towing. However, Expedite Towing has a large inventory of tow trucks to handle all major and minor emergencies with ease, 24 hour towing at its best! From heavy towing. Best Roadside Service offer commercial fleet roadside assistance you can rely on and insure fleets of all sizes. We're always with you/7 and days a. Top 10 Roadside Assistance Apps · Waze · Verizon Roadside Assistance · AAA Mobile · AARP Roadside from Allstate · Roadside Assistance 24 · HONK - Towing & Roadside. There is a fee of $ for roadside assistance, and the cardholder is only responsible for uncovered services. Chase, All Chase Visa and Master cards. The Best Roadside Assistance You've Never Heard Of · Motor Club of America · The Good Sam Club · Auto Insurance Roadside Services · Credit Card Companies · Citations. We're confident that we offer the best emergency roadside service deals in North America. See for yourself and sign up today for a premium roadside assistance. Get the peace of mind that comes with Good Sam Roadside Assistance. Auto and RV roadside assistance plans with premium coverage, towing, and roadside. With years of experience, bss64.ru has grown its business as being the best commercial vehicle membership for Emergency Roadside Assistance in the. With our legendary hour Roadside Assistance, if you lock your keys in your car, get a flat tire, need a jump start, or break down on the side of the road. Drive customer loyalty with the highest rated customer satisfaction scores in the industry. Lots of companies make promises. We've built the technology to. Best Overall: Allstate. Best Value: Progressive. Best Eco Pick: Better World Club. Best Add-On: Travelers. Best for Local Service: AAA. At U.S. News & World Report, we rank the Best Hospitals, Best Colleges, and Best Cars to guide readers through some of life's most complicated decisions. Our. Central is partnering with top-rated service provider Agero to ensure exceptional service when you need help on the road. The program provides access to a. We help recover your vehicle from an accident site and use the best techniques to prevent further damage. You can trust us with our junk car removal services.

Ishares Msci Brazil

The iShares MSCI Brazil UCITS ETF (Dist) seeks to track the MSCI Brazil index. The MSCI Brazil index tracks the largest and most liquid Brazilian stocks. iShares MSCI Brazil ETF (EWZ) Dividend History. Ex-Dividend Date 06/11/ Ex/EFF Date. Type Cash Amount. Declaration Date. Record Date. Payment Date. The Fund seeks to track the investment results of the MSCI Brazil 25/50 Index composed of Brazilian equities. The Fund invests, under normal circumstances, at. The MSCI Brazil Index is designed to measure the performance of the large and mid cap segments of the Brazilian market. With 48 constituents, the index covers. What is EWZ? EWZ is a Global Ex. US Equities ETF. The iShares MSCI Brazil ETF seeks to provide investment results that correspond generally to the price and. View iShares MSCI Brazil ETF (EWZ) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Find the latest quotes for iShares MSCI Brazil ETF (EWZ) as well as ETF details, charts and news at bss64.ru Learn everything you need to know about iShares MSCI Brazil ETF (EWZ) and how it ranks compared to other funds. Research performance, expense ratio. EWZ Portfolio - Learn more about the iShares MSCI Brazil ETF investment portfolio including asset allocation, stock style, stock holdings and more. The iShares MSCI Brazil UCITS ETF (Dist) seeks to track the MSCI Brazil index. The MSCI Brazil index tracks the largest and most liquid Brazilian stocks. iShares MSCI Brazil ETF (EWZ) Dividend History. Ex-Dividend Date 06/11/ Ex/EFF Date. Type Cash Amount. Declaration Date. Record Date. Payment Date. The Fund seeks to track the investment results of the MSCI Brazil 25/50 Index composed of Brazilian equities. The Fund invests, under normal circumstances, at. The MSCI Brazil Index is designed to measure the performance of the large and mid cap segments of the Brazilian market. With 48 constituents, the index covers. What is EWZ? EWZ is a Global Ex. US Equities ETF. The iShares MSCI Brazil ETF seeks to provide investment results that correspond generally to the price and. View iShares MSCI Brazil ETF (EWZ) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Find the latest quotes for iShares MSCI Brazil ETF (EWZ) as well as ETF details, charts and news at bss64.ru Learn everything you need to know about iShares MSCI Brazil ETF (EWZ) and how it ranks compared to other funds. Research performance, expense ratio. EWZ Portfolio - Learn more about the iShares MSCI Brazil ETF investment portfolio including asset allocation, stock style, stock holdings and more.

iShares MSCI Brazil ETF ARCA. Morningstar Medalist Rating™. Performance; Analysis; Sustainability; Risk; Price; Portfolio; Parent. Add To Portfolio. Related. Learn everything about iShares MSCI Brazil ETF (EWZ). News, analyses, holdings, benchmarks, and quotes. iShares MSCI Brazil UCITS ETF (DE) (Acc) price in real-time (A0Q4R8 / DEA0Q4R85) charts and analyses, news, key data, turnovers, company data. The latest iShares plc (IBZL) MSCI Brazil UCITS ETF (Dist) share price (IBZL). View recent trades and share price information for iShares plc (IBZL) MSCI. The iShares MSCI Brazil Small-Cap ETF seeks to track the investment results of an index composed of small-capitalization Brazilian equities. EWZ iShares MSCI Brazil ETF is an ETF fund investing in shares of Brazilian companies included in the MSCI family index (Morgan Stanley Capital. Get the latest iShares MSCI Brazil Small-Cap ETF (EWZS) real-time quote, historical performance, charts, and other financial information to help you make. Description. The iShares MSCI Brazil UCITS ETF (Dist) seeks to track the MSCI Brazil index. The MSCI Brazil index tracks the largest and most liquid Brazilian. EWZ - iShares, Inc. - iShares MSCI Brazil ETF Stock - Stock Price, Institutional Ownership, Shareholders (ARCA). The latest iShares plc (IBZL) MSCI Brazil UCITS ETF (Dist) share price (IBZL). View recent trades and share price information for iShares plc (IBZL) MSCI. Discover historical prices for EWZ stock on Yahoo Finance. View daily, weekly or monthly format back to when iShares MSCI Brazil ETF stock was issued. Complete iShares MSCI Brazil ETF funds overview by Barron's. View the EWZ funds market news. Get the latest Ishares Msci Brazil ETF (EWZ) real-time quote, historical performance, charts, and other financial information to help you make more informed. iShares Inc iShares MSCI Brazil ETF (ARCA: EWZ) stock price, news, charts, stock research, profile. The iShares MSCI Brazil ETF seeks to track the investment results of an index composed of Brazilian equities. WHY EWZ? 1 Exposure to large and mid-sized. The Fund seeks to track the performance of an index composed of Brazilian companies. The Fund seeks to track the investment results of the MSCI Brazil 25/50 Index (the “Underlying Index”), which is a free float-adjusted market. EWZ iShares MSCI Brazil ETF is an ETF fund investing in shares of Brazilian companies included in the MSCI family index (Morgan Stanley Capital. Get iShares MSCI Brazil ETF (EWZ:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. Latest iShares MSCI Brazil ETF (EWZ) stock price, holdings, dividend yield, charts and performance.